Jan 2024

When it comes to investing, there is such an assortment of options, strategies and conflicting ideas to choose from…that if you’re a beginner, it can make starting out seem like an absolute minefield!

Why can’t there just be one, simple and painlessly straightforward way to invest? Well, that would make things a little too easy — wouldn’t it? Everyone would be stuffing their savings into stocks and bonds left right and centre.

The old adage coined by industrialist Andrew Carnegie, reminds us that ‘anything in life worth having, is worth working for.’

Thankfully, we’re not saying you’ll need to work quite as hard as Carnegie, but there may involve a dash of work, and a pinch of risk to create that investment-worthy concoction.

We can show you many ways to achieve such goals here at Fat Tail, but in this guide, we will explore just one of the smart and simpler ways to invest— Exchange Traded Funds (ETFs).

ETF investing is a popular choice among investors who are starting out in the world of stocks and creating passive income. But what exactly is an ETF, and how can it be used as part of one’s investment strategy?

In this post, we’ll take a look at ETFs for beginners, diving into what they are and how you can use them to grow your portfolio.

So, if you’re new to the world of investing or just want to learn more about ETFs, then please read on!

What is an ETF and how does it differ from a stock or mutual fund?

ETFs, aka Exchange Traded Funds, are a type of investment that allows people to gain access to the stock market without the challenges of sourcing, researching and choosing individual stocks.

That’s because a company has already done that hard work. An investment company selects a group of assets to track. They then bundle these assets together and create shares of the ETF.

That is what you buy when you purchase an ETF — shares of something tracking the underlying group of assets. So, the fund directly owns the assets, while you get a share that tracks that fund’s performance.

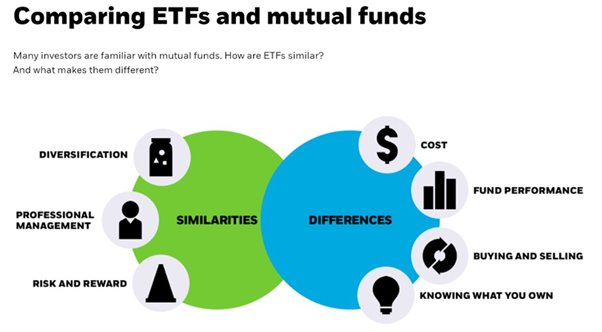

ETFs are similar to mutual funds in that they allow investors to purchase a basket of investments — all at once!

This is a great hack, as it enables the buyer to gain instantaneous diversification that only a mixed bag of multiple holdings could possibly provide.

Source: iShares

Some ETFs even pay dividends like regular stocks or reinvestments for the stocks that make up the index.

They also happen to offer lower fees than mutual funds, which makes them more attractive to moderate and small-scale investors who don’t have vast amounts of capital for individual stock market investments.

But there’s another hidden benefit — ETFs typically have the benefit of tracking indices and baskets of assets. This is a special way of aiming for consistent returns over time and makes ETFs themselves a powerful strategy for those looking for stable long-term returns in the stock market.

Why ETFs are becoming more popular among investors

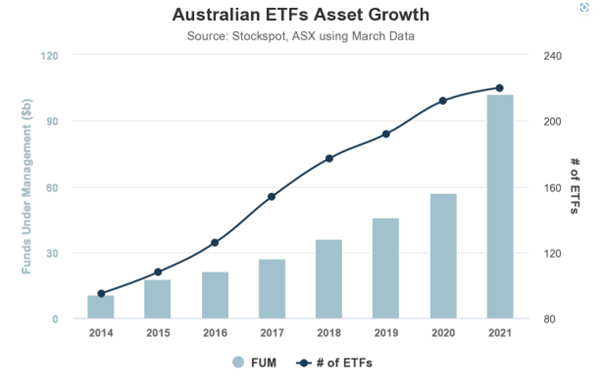

Here’s the thing, ETFs are quickly growing in popularity among savvy investors, as they offer a variety of advantages over traditional mutual funds.

ETFs allow investors to diversify their portfolio with a relatively small investment while opening up access to niche markets or desired strategies that can’t be tapped through traditional funds. This, in turn, allows for more control over timing, cost and decisions.

And don’t forget, the EFT investments also offer the added benefit of lower operating costs over equivalent mutual funds, providing the investor with even greater value.

As markets evolve and technology adds new options to investing portfolios, ETFs will likely continue being an attractive option for investors.

Source: Stockspot

The benefits of investing in ETFs

Investing in ETFs has grown increasingly popular in recent years thanks to three main attributes: low cost, flexibility, and convenience.

The fact that ETFs provide access to a wide range of securities that replicate an index like the S&P500 appeals to the seasoned investor, but not only that, they also tend to be well-diversified and offer greater liquidity than traditional investments tend to do.

ETFs are also more transparent than mutual funds. This is because ETFs are required to disclose their holdings on a daily basis, letting you know what you’re investing in.

Furthermore, since ETFs are traded on exchanges just like stocks, investors can take advantage of commission-free trading on many online brokerage platforms.

ETFs can also be a cost-saving option due to their tax savings over mutual funds. This is because a mutual fund will incur capital gains every time it wants to sell something in its portfolio to adjust its holdings. In most ETFs, you’ll only be charged capital gains when you sell your ETF shares.

So it’s really not so hard to see why, as a result of these characteristics, investors are rewarded two-fold by taking this investment approach as:

They get the benefit of an efficient and straightforward means to diversify their portfolios with some of the largest companies in the world. They can transparently balance risk and watch performance potential grow over time.

How to get started with ETF investing

You’ll be happy to know that starting a foray into ETF investing doesn’t have to be intimidating or overwhelming. In fact, it is an exciting and great way to diversify your investments while keeping fees in check.

First and foremost— as we often tell you here at Fat Tail— it’s important to conduct thorough research on the investment products available.

You’d be wise to take a look at the fees associated with each product as well as knowing what kind of trade-offs you’re making. This is for things like minimum investments, certain platform features and any other restrictions you might encounter. As well as any risks associated with investing in ETFs, such as volatility from changes in the market and currency risks if ETFs are exposed to overseas markets. Remember, the higher the reward, the higher the risk.

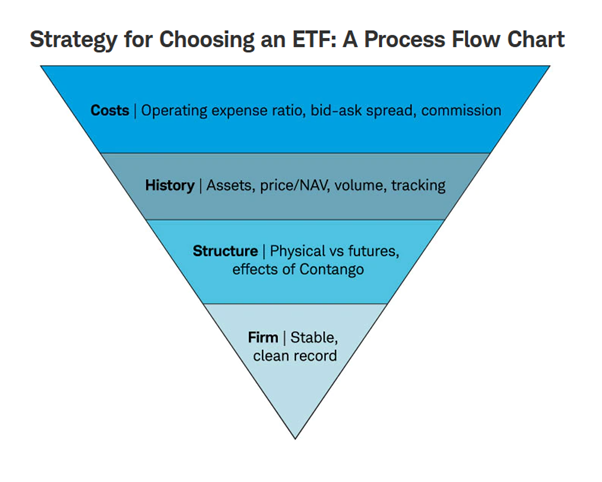

Here is what a typical process flow chart looks like for choosing the right ETF, starting at the top.

Source: Schwab

Once you get a feel for this process and you’re adequately informed, then you can look at opening a brokerage account and begin establishing your portfolio.

It might be a good idea to consider investing in multiple ETFs that track different asset classes. Looking at ETFs that cover stocks, bonds, commodities and currencies allows you to diversify, which may reduce risk and spread potential rewards over many sources.

With an effective plan in place, you can start building towards your financial goals through smart ETF investing.

The different types of ETFs available

Generally, there are three main types of ETFs.

First you have the index-based ETFs which track indices like the S&P 500.

Then there’s commodity ETFs that include precious metals or other assets like oil and gas.

And lastly, currency ETFs. These types of ETFs can include any type of currency, from US dollars to Bitcoin.

No matter what kind of investor you are or what investment strategies you prefer, ETFs provide ample opportunities to get started with your portfolio that suits your preferences.

To make things interesting, investors also have the option of selecting between Passive and Active ETFs.

Where passive funds focus on replicating the performance of a chosen index, such as the S&P 500 or gold mining stocks, active ETFs take things one step further by including securities that are hand-picked by portfolio managers — though buyers beware, this method comes at an additional cost to investors.

Let’s look a little closer at different types of EFTs, or sub-genres if you will:

Bond ETFs

Investors looking for regular income can consider bond ETFs. These are Exchange Traded Funds that are based on a variety of bonds across genres such as government, corporate, and municipal sectors.

Bond ETFs fluctuate in price due to the performance of their underlying instruments, but they tend not to expire.

Rather than having a fixed maturity date, these ETFs usually trade with either premiums or discounts as compared to the actual value of the bonds themselves.

Industry and sector ETFs

Investing in industry or sector ETFs can be a great way to take advantage of the upside that comes with monitoring and tracking companies within a specific area.

Technology is one particular sector which has been brimming with attention quite recently, you just need to look at the breakthroughs in AI, smart cars, cryptocurrency and drones to get the idea.

That said, well-researched industry-specific ETFs can provide protection from downside risks like stock market volatility, although that is never guaranteed, any investing comes with risk and volatility can play a part in that.

Not only this, but having an idea about when certain sectors are likely to perform better than others allows investors to rotate into other industries during upswings in profitability for greater potential in return on their investments.

Leveraged ETFs

If you’re looking to take on more risk to amp up the potential gains of your investments, leveraged ETFs may be right for you.

These products use derivatives such as options or futures contracts to multiply returns on underlying investments — so if the S&P 500 goes up 1%, a 2x leveraged fund could return twice that!

It’s important to remember that the opposite could be true if the S&P 500 goes down, your losses could also be amplified so it’s very high risk, high reward and should be considered with caution.

If you want to try pick downward movements in the market there are ‘inverse’ funds designed specifically with to try benefit from that movement also.

Currency ETFs

Currency ETFs provide investors with a unique way to diversify their portfolios by speculating on the value of international currencies, while also protecting against wild fluctuations in exchange rates caused by factors such as political and economic developments.

In addition, you can even opt for Bitcoin-backed funds if they feel that’s an appropriate hedge — not just against unpredictable foreign exchanges but inflation too!

Again, remember these ETFs can be a great way to hedge against exchange rate risks that might affect other parts of your portfolio, but in general these ETFs are considered very high risk.

Stock ETFs

One of the types that might be more familiar to most people are stock ETFs. These ETFs offer a unique way to invest in an entire sector without having to pick individual stocks.

Imagine the opportunities available if one could gain exposure from both established leaders and new players — all with growth potential harnessed within a single industry!

It’s an economical choice too, as stock ETF fees are much lower than those of traditional stock mutual funds — there’s also the added plus of there being no ownership stake as a requirement for trading success.

Commodity ETFs

Have you considered investing in commodities? With commodity ETFs, investors can enjoy the benefits of diversifying their portfolio while avoiding expensive storage and insurance costs.

Plus, when stock markets hit a downturn, these types of investments can provide an extra cushion to protect your assets. Commodity ETFs trade based on movements in the indices and make trading in commodity stocks easier since they bundle options like other ETFs.

Investing in commodity ETFs can be risky and complex, but they can help form a balanced portfolio, as they often offer diversification benefits given the historically low correlation of commodities to other assets like equities, cash and fixed income.

Gold, for example, is often called a ‘safe haven’ due to it being a commodity historically less affected by market downtrends caused by things like inflation or political turmoil.

Inverse ETFs

Inverse ETFs can be beneficial in uncertain market conditions, allowing investors to capitalise on stock declines. This ETF strategy involves ‘shorting stocks’; selling them when their value is expected to drop and buying them back at a lower price.

This is a complicated endeavour for newer investors as it involves derivatives and particular market knowledge. Inverse ETF funds or exchange traded note (ETN) can make this process easier for investors who want to try capture profits on a group of assets falling in value.

ETNs may offer more flexibility than traditional true ETF investments due to issuer backing from banks; however it’s important for prospective investors to speak with an adviser before making such decisions about their portfolio.

Buyer beware, inverse ETFs carry a high risk rating, so they’re not the best idea for risk-adverse investors and may be better suited to more risk-tolerant people with a bit more experience.

All ETF investing carries risks. Market volatility as well as changes to the Aussie dollar. Please familiarise yourself with the risks investors face when considering an ETF or a particular investment.

Tips for choosing the right ETF

With such a wide selection of ETFs, it can be overwhelming to figure out which one is right for you. To get the most out of your investments, take some time to research and compare different ETFs before selecting one that meets your goals.

When selecting an ETF, consider its performance and diversification characteristics as well as its risk ratings. Review past performance and look at the current top holdings in order to better understand what you are investing in.

Take the time to look into account expenses associated with each ETF and assess whether or not they fit within the bounds of your financial goals.

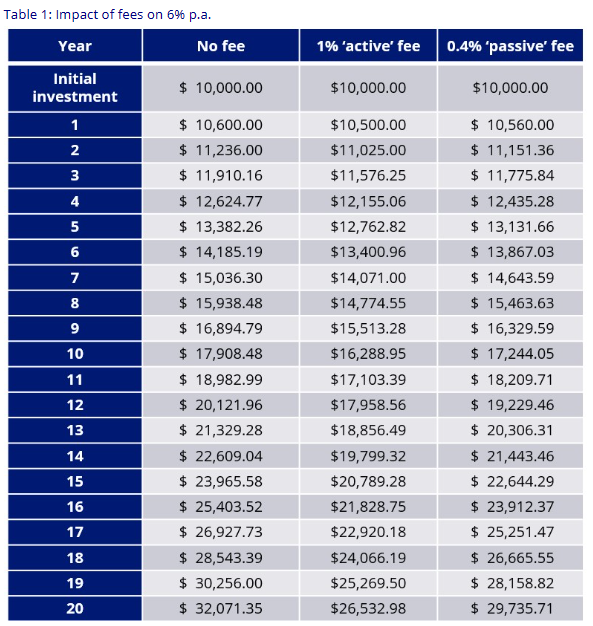

The difference between fees can make all the difference to your underlying performance. Here is a handy calculator to help understand the impact of those fees on your investments.

Here is what the difference between fees can mean for a fund that makes 6% per year:

Source: VanEck

If possible, speak with a financial advisor who can provide an objective point of view and help you determine which ETF is best suited for your portfolio.

Exchange Traded Funds have a lot to offer investors — from low costs to flexibility and simplicity. If you’re thinking of adding ETFs to your portfolio, be sure to do your homework first so you can choose the right ones for your investment goals.

With over 2,000 ETFs available today, there’s no shortage of options to consider. But with a little help from an advisor or online resources, you should be able to find ETFs that fit well in your overall investing strategy.

Examples of ETFs

If you are interested in investing in ETFs, we thought we might list a few examples of to start you on your journey. Note, these are not recommendations. Check them out below:

Vanguard ETFs

Vanguard has at least three top-performing EFTs to choose from; the Vanguard 500 Index Fund, Vanguard Growth Fund and Vanguard Total Stock Market.

- The Vanguard 500 Index Fund [NYSE:VOO], like its name suggests, tracks the S&P 500 index. It is a well-diversified ETF heavily focused on tech, health and consumer discretionary sectors, has a net asset value of $851.8 billion, and expense ratio of 0.03%.

- The Vanguard Growth Fund [NYSE:VUG] invests in large cap US growth stocks, and has a net asset value of $170.7 billion and an expense ratio of 0.04%. This fund has been around since 1992, falls under Morningstar’s category for large growth, and mostly focuses on large cap stocks.

- Lastly, there’s the Vanguard Total Stock Market ETF [NYSE:VTI] which has a net asset value of $1.3 trillion, an expense ratio of 0.03% and holds around 4,000 US stocks of varying types, sectors and sizes. So far in 2023, VTI has returned just over 9% in investment value. It’s considered to be a fund of high efficiency, without having such an outlandish expense ratio.

Invesco Trust

Invesco QQQ Trust [NASDAQ:QQQ] is an ETF that tracks the Nasdaq 100, which is the top 100 of the largest domestic and nonfinancial companies that are found on the Nasdaq Stock Market according to their market capitalisation.

The fund is recognised in its industry for its performance in corporate governance and is also part of the S&P 500 Index. It has a net asset value of $223 billion and expense ratio of 0.2%.

Avantis

Avantis Small-Cap US Value ETF [NYSE:AVUV] has a net asset value of $7.3 billion and expense rate of 0.25%. This is an ETF that invests in a wide range of different US small-cap stocks, and performed very well when markets were rocked by inflation last year.

Avantis’ Small-Cap fund is packed with diversified holdings at fairly cheap valuations, and has a sound track record for performance. Focused on smaller capitalisations, it may not make the big bucks, but it’s a good choice for growth and solid earnings.

iShares Core MSCI

iShares Core MSCI Total International Stock ETF [NASDAQ:IXUS] works to track the MSCI ACWI index, which is made up of over 4,500 large, mid, and small-cap companies and non US equities including the likes of Nestle and Louis Vuitton.

This fund uses a free float-adjusted market capitalisation index which measures the combined equity market performance of both established and emerging markets outside the United States.

It boasts a net asset value of $32 billion, and has a net expense ratio of 0.07%. The fund has had mixed performance in downturns but has managed 9.10% gains in 2023 so far.

If you’d prefer some more Australian focused ETFs then here is a good list of options for you to look over — just beware of the higher management fees!

We leave you with some high-performance ETFs

We hope you have found this introduction to ETFs useful, and perhaps you’re ready to start your own foray into this investment style.

Don’t forget to do your research, and ask the help of a qualified professional before wading in too deep. You could start by looking into some of the top-performing ETFs in Australia over the past year.

First there is top yearly performer, SPDR S&PASX 200 Resources Fund [ASX:OZR] which has returned 15.57% so far this year.

Next is Betashares Resources Sector ETF [ASX:QRE] which made a one-year return rate of 15.47% in the past year, and a 18.30% three-year return.

Or the BetaShares S&P/ASX Australian Technology ETF [ASX:ATEC], which touts an return rate of 11.16% this year (although its longer performance isn’t as strong).

These ETFs with sound annual and three-yearly returns appear both lucrative and safe bets. But remember, you can’t rely on historical data to give you the best options for the future.

As always, any investing comes with risk. ETFs can carry volatility, especially if investing in funds focusing on the smaller end of the marker. And if you choose an ETF that invests overseas, you could face currency risk, as fluctuations to the Aussie dollar can impact returns. It is always best to do your own research and consider your circumstances and tolerance for risk.

So look around, experiment a little, and try and have a little fun with your next investing adventure! If you’d like to hear more from us, don’t hesitate to sign up to our free newsletter Fat Tail Daily where you can get all the latest news and some sound nuggets of advice — for free!