Hi! Kiryll here.

I’ll be writing to you for the next few weeks while Selva goes off on a hard-earned break.

Part of my aim with these pieces will be to relay some of our editors’ best ideas on commodities to you — a ‘peak behind the curtain’ of sorts.

So, stay tuned for that.

Earlier this week, Evolution Mining [ASX:EVN] released an investor presentation and one slide in particular caught my eye.

This one here:

|

|

| Source: Evolution Mining |

According to the miner, the key investment drivers for gold and copper converge under financial stresses and geopolitical issues.

That got me thinking — is that really true?

What are the long-term investment drivers for gold and copper?

Copper demand

I won’t bore you with the obvious.

Commodity prices have slumped in recent weeks. You’ve seen it, I’ve seen it, everyone’s seen it.

Copper is no exception.

Tight monetary policy, slowing economies, and disappointing numbers from China are being baked into lower prices for key industrial inputs — like copper, oil, and iron ore.

China is a big factor, too.

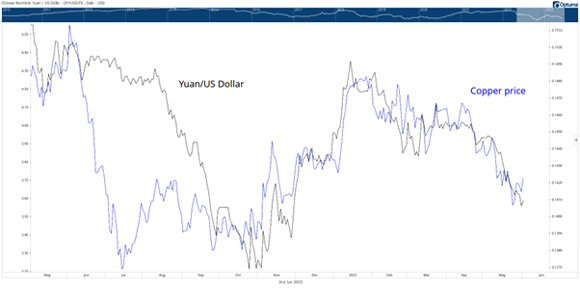

You can see that in the chart below, which Greg Canavan supplied for last week’s What’s Not Priced In podcast.

The chart depicts the strong relationship between the yuan and the copper price over the past year or so.

|

|

| Source: Optuma |

But what about the long-term? Can we look past the current malaise?

In a May monthly report, James Cooper did just that, arguing the recent slump did not change the bigger picture of structural imbalance between supply and foreseen copper demand:

‘Assuming you remain bullish on the long-term outlook for copper, recent price weakness may offer a solid buying opportunity…

‘I’ve always been of the philosophy that weakness in the market is a key time to add quality stocks…But only when the long-term fundamentals remain strong.

‘In my opinion, copper fits that thesis extremely well.’

And why is that?

Copper is about to shoulder more of the world’s industrial burden. If you’ve been following James’s writing, you’ll know the structural issues coming.

Electrifying the world in the great energy transition will require a stupendous amount of copper…and lithium, cobalt, graphite, nickel, etc.

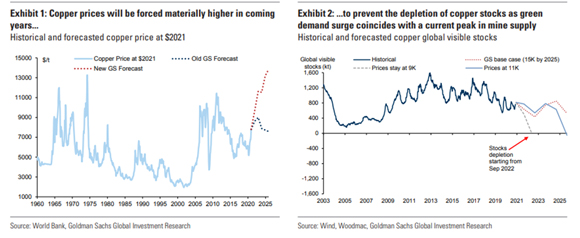

That’s why Evolution Mining mentioned decarbonisation as one of the key drivers. Goldman Sachs wrote in a 2021 report there is ‘no decarbonisation without copper’.

And as a 2022 research paper from S&P Global found:

‘Achieving the stated climate ambitions will require a rapid and massive ramp-up of copper supply far greater than is visible in any private or public plan.

‘The key point is this: technologies critical to the energy transition such as EVs, charging infrastructure, solar photovoltaics (PV), wind, and batteries all require much more copper than conventional fossil-based counterparts. The rapid, large-scale deployment of these technologies globally, EV fleets particularly, will generate a huge surge in copper demand. Major investments in the power grid to support electrification will further amplify the trend. Meanwhile, copper continues to be a critical material for many other sectors of the economy not directly related to the energy transition but fundamental to overall economic growth and development, and from which copper consumption is projected to grow continuously.

‘The result of the energy transition growth on top of traditional growth will be an overall more than doubling of copper demand by 2050.’

That puts the current copper correction in perspective. Especially when you consider the issue of supply.

|

|

| Source: Goldman Sachs |

Economics of commodities

Commodities are highly attuned to gyrations in supply and demand. And when analysing commodity markets, paying attention to both variables is vital.

But as historian Edward Chancellor noted, investors often spend 90% of their time thinking about and forecasting demand and only 10% of their time thinking about supply.

That imbalance skews analysis. We should pay more attention to supply.

And supply is often determined at the margin.

Here’s a telling excerpt from a resources economics textbook by Thomas Tietenberg:

‘An understanding of this relationship between scarcity rent [profit] and marginal discovery cost allows us to think about how exploration activity would respond to population and income [and usage] growth. Since both of these factors contribute to rising demand over time, they raise the marginal user cost and the scarcity rent, stimulating producers to undertake larger marginal discovery costs. How much this demand pressure is relieved depends upon the amount of exploration activity and the amount of resources discovered per unit of exploration activity undertaken.

‘If the marginal discovery cost curve is flat (implying a large amount of relatively available resources), increases in scarcity rent can stimulate large amounts of successful exploration activity. If the marginal discovery cost curve is steeply sloped (as would be the case when exploration had to take place in increasingly hostile and unproductive environments), increases in scarcity rent stimulate less exploration activity.’

The world’s rising dependence on copper will require more output. But output depends on the marginal discovery costs for miners.

Here’s the kicker.

Even when copper prices are high, exploration activity can still fall if the marginal discovery costs are steep.

If you’ve been reading James’s dispatches, you’ll know costs are high.

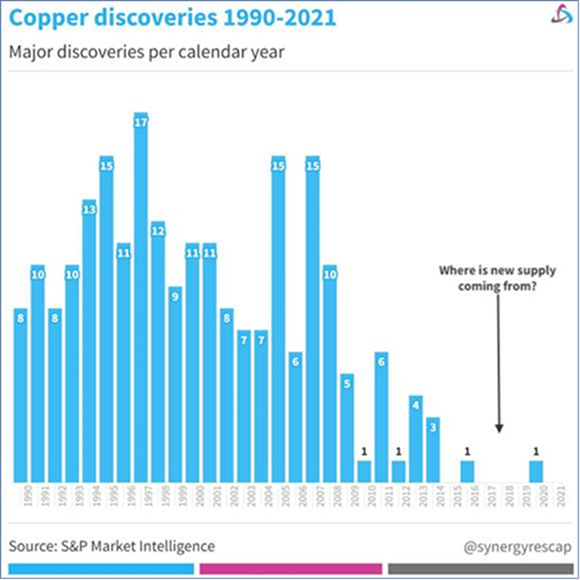

For one, copper discoveries have cratered in recent decades.

|

|

| Source: S&P Market Intelligence |

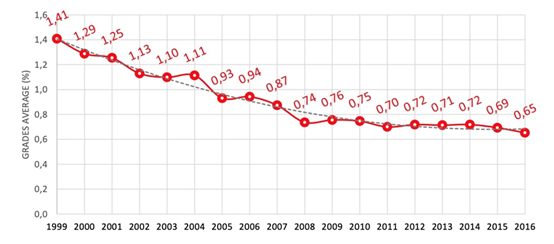

And two, the copper output is declining in the largest mines because of plummeting copper grades.

|

|

| Source: James Cooper |

As Tietenberg wrote, when exploration must take place in increasingly hostile and unproductive environments, even rising prices don’t induce exploration activity.

The outlook for copper supply is not great. Coupled with a surge in demand, the long-term outlook for the price of copper is positive.

Demand for gold

Now, Evolution Mining’s claim that financial stress is a key investment driver rings truer for gold than for copper.

A few years back, commodities legend Rick Rule was interviewed by Resource World. Asked about the ‘real determinant of the gold price’, Rule said:

‘I think if you look at the real determinant of the gold price over the last 40 years, it’s been the popularity or lack of popularity of the US dollar and, in particular, the US 10-year Treasury.

‘People use geopolitical events as a narrative to justify what they were going to do anyway. It seems to me that the most effective determinant of the gold price since 1980 has been the negative correlation between the US 10-year Treasury and the price of gold. I think that’s the most important thing.

‘If you believe, like I do, that gold trades inversely to the US 10-year Treasury, with the US 10-year Treasury at the end of the bull market or the beginning of a bear market, that would suggest to me the gold price is at the end of a bear market or at the beginning of a bull market.’

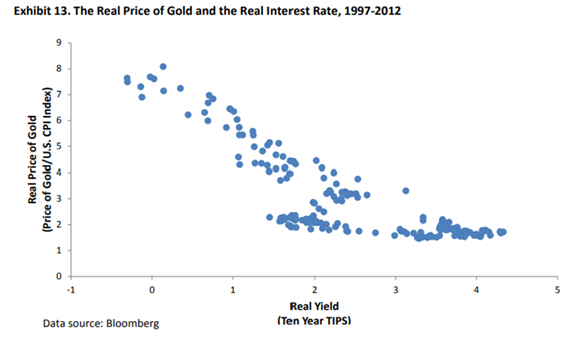

In 2012, economists Claude Erb and Campbell Harvey found that the correlation between the real price of gold in US dollars and the real yield of a generic 10-year Treasury Inflation Protected Security (TIPS) was -0.82!

|

|

| Source: Bloomberg |

Fellow economist Brad DeLong provided an explanation:

‘Basically, gold pays no dividends or interest. It is thus expensive to hold in your portfolio when real interest rates are high, and cheap to hold it in your portfolio when real interest rates are low. When interest rates are high, you have to be pretty confident that gold is going to rise in price in order to hold it in your portfolio — which means that when interest rates are high you sell gold unless you think the price of gold is low.’

Campbell and Erb found the correlation ‘compelling’ but wanted to avoid the ‘correlation implies causation trap’. The pair cautiously opined:

‘While it is possible to argue that historical data suggest that low real yields “cause” high real gold prices (Gibson’s paradox), it is equally possible to argue that causality runs in the other direction and that high real gold prices actually “cause” low real yields. Alternatively, it is possible that both low real yields and high real gold prices are driven by some other influence, such as a possibly immeasurable fear of hyperinflation.’

For those interested, you can read the whole paper here.

Campbell and Erb do make you think of Harry Truman’s exasperated desire for a ‘one-armed economist’ incapable of qualifying everything with ‘on the other hand…’, but the prose is sharp and the insights many.

In any case, the outlook for gold rests in big part on where real interest rates are heading.

If central banks acquiesce and cut rates while inflation remains high, real rates will fall — and make gold attractive.

But if central banks stubbornly keep monetary policy tight while inflation craters, real rates will jump…and gold may suffer.

I’ll be sure to ask Brian Chu his thoughts on gold. His expertise is vast. Stay tuned for that.

In the meantime, have a great week!

Regards,

|

Kiryll Prakapenka,

For Fat Tail Commodities

Comments