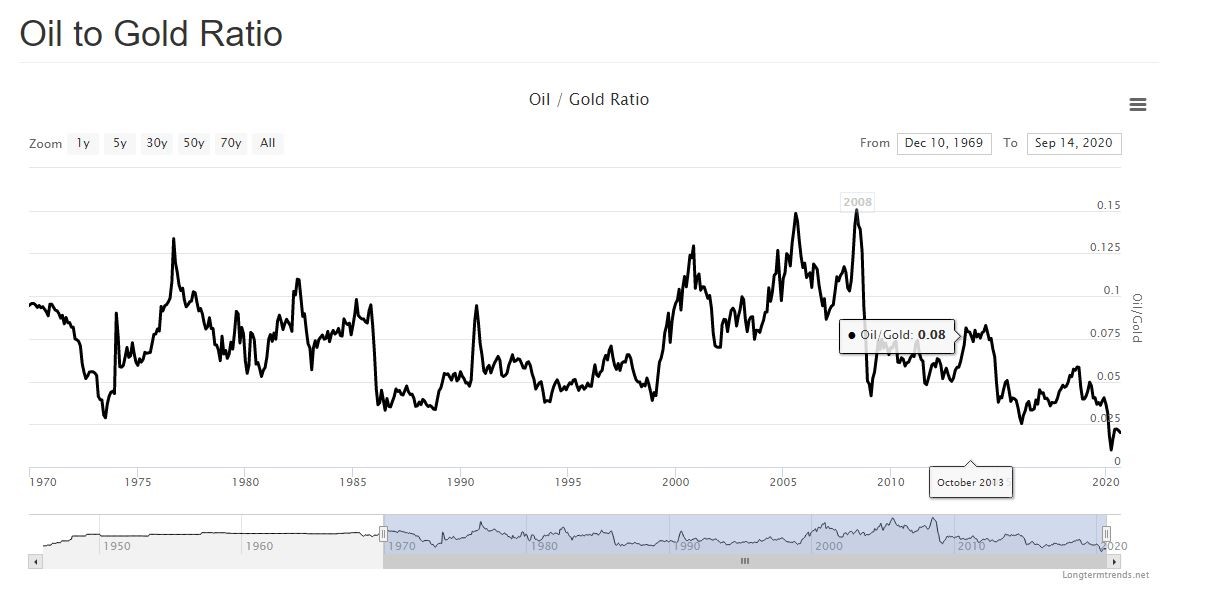

There’s an argument out there that oil is ‘great value’, that it is at a cyclical low.

Take for instance the oil to gold ratio which you can see below:

|

|

| Source: longtermtrends.net |

With the US election coming up, some may be looking at this low point in the chart as a tantalising proposition.

This is how people usually think of the ratio:

‘The oil to gold ratio indicates the number of ounces of gold it takes to buy a barrel of oil. Similar to the copper gold ratio, the oil gold ratio is an indicator of the health of the global economy. It is recognized as a measure of the volatility that comes from significant political and economic events.’

But I think the cycle may be broken.

I’m not denying that it’s not worth trading.

For example, I know someone who made a significant return on opportunistically trading oil futures when the oil price briefly went negative.

What I am saying however, is that oil may not be a viable long-term investment because the world is rapidly changing.

It’s a bit like what I said about the big banks last month.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Refinery margins squeezed like never before

Take this from Reuters:

‘Refiners cut output by as much as 35% in spring as coronavirus lockdowns destroyed the need for travel. As lockdowns eased, refiners increased output slowly through late August. But in top fuel consumer the United States and elsewhere, refiners have been decreasing rates for the last several weeks in response to increased inventories, a sustained lack of demand and in response to natural disasters.

‘The hit to capacity has been most notable in China. The second largest fuel consumer led the world in oil demand recovery after taming its outbreak of coronavirus. But its refiners also export fuel, and those shipments have been weak due to the virus’s effect on fuel demand in other Asian nations.’

And Scott Wyatt, chief executive of Viva Energy Group Ltd [ASX:VEA], was quoted as saying:

‘The impacts of COVID-19…are putting extreme pressures on the refining business that we have not experienced before and are not sustainable over the longer term.’

Margins are being dramatically squeezed by low demand.

Typically, to turn a profit in the US ‘the crack spread’ or the difference between crude and fuel needs to be $10, and it is currently sitting at $9 — meaning refiners are effectively making a loss on the conversion.

Japan and South Korea’s refiners are cutting operations as well.

This is a global phenomenon.

Now that being said, you may still be able to make some headway on smaller oil companies, should they come across a big resource.

Take for instance the rise of Strike Energy Ltd [ASX:STX]:

|

|

| Source: tradingview.com |

The STX share price is up more than 200% from the March market lows.

I’d argue that this movement is far more correlated with factors internal to the company than some form of miraculous recovery in the macroeconomic picture for oil.

Green stimulus could top $6.7 trillion, value options are not in oil

If you’ve lost track of the amount of stimulus in the system, I don’t blame you.

I think the mainstream financial press is losing track of it already.

By Reuters’ last count it was upwards of $15 trillion, and that was back in May.

Why would governments reverse this trend?

I doubt they are going to suddenly experience a bout of fiscal responsibility.

No, they are going to double down and you should be looking to capitalise.

As the Australian Financial Review noted on Friday:

‘Democratic Party presidential nominee Joe Biden has already committed a further $US1.7 trillion in government spending if he wins in November, while further increases in the European Union and G20, based on spending on green initiatives coming out of the GFC, could take the total as high as $6.7 trillion.’

This is part of the Green Wave we discussed earlier.

Along with the push towards renewables, you can also expect to see mammoth amounts of money pouring into infrastructure.

As a result, for those investors looking for value in oil stocks, it might make more sense to be looking at beaten-down construction companies that could accumulate contracts from the government in the coming years.

So, forget the trifecta of fossil fuel giants that is Woodside Petroleum Ltd [ASX:WPL], Santos Ltd [ASX:STO], and Oil Search Ltd [ASX:OSH].

While I mainly focus on exciting small-caps, if I were bargain hunting for macro plays I’d be focused on the winners from an infrastructure push.

These include companies like Cimic Group Ltd [ASX:CIM], Lendlease Group [ASX:LLC], Brickworks Ltd [ASX:BKW], and Fletcher Building Ltd [ASX:FBU].

I’m prepared to say that the prospects of these companies are far better than their big oil/gas peers, given what we know about the green shift in finance.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments