Brain-computer interfaces will soon see us ‘lying on a beach on the east coast of Brazil, controlling a robotic device roving on the surface of Mars’.

Fully self-driving cars will be everywhere by 2020.

Electric vehicles will replace all internal combustion engines by 2025.

Advanced economies are on the brink of an ‘AI revolution which could fundamentally change the workspace’.

We have a habit of getting carried away by technological advancements.

An exciting new technology can lead to outlandish claims, as feverish extrapolations compound into fanciful projections.

Some of these claims were listed earlier.

Clearly, AI is another major technological advancement set to influence society. But we must not get carried away.

Especially as investors.

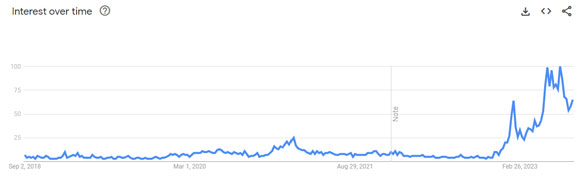

Market interest in AI is febrile, with search volume for ‘AI stocks’ spiking this year:

|

|

| Source: Google Trends |

But a hot theme like this should not be hopped on with abandon.

Investors must figure out whether the AI hype will endure or fade.

Chipmaker Nvidia’s latest quarterly gave many confirmation the AI boom is here.

Nvidia’s big numbers

Nvidia’s 2Q24 results were well ahead of consensus expectations, reporting record revenue of US$13.51 billion, up 88% on the previous quarter and 101% on the previous year.

A huge jump!

Nvidia’s founder and CEO, Jensen Huang, said a ‘new computing era has begun’, an era seemingly in need of Nvidia’s powerful chips.

Nvidia expects revenue to grow 18% quarter-on-quarter in 3Q24 to US$16 billion.

A very interesting number from the results was the gross margin.

2Q24 gross margin was 70.1%. It was 64.6% in the prior quarter and 43.5% in 2Q23!

That suggests customers were bidding up Nvidia’s chips, helping quantify Huang’s comment that ‘the race is on to adopt generative AI’.

Big firms wishing to get ahead in the AI space are willing to pay up for the chips necessary to conduct their work.

But how long can Nvidia hope to bank on this frantic race? What happens when the race stops?

AI boom, what boom?

The AI tide isn’t raising all boats, however.

Australia’s AI-adjacent stock Appen [ASX:APX] sank on Monday after poor results.

Appen describes itself as the ‘market leader in data for the AI lifecycle’.

Whether or not that’s true, Appen was definitely the leading loser on the All Ords on Monday.

The data services firm closed 32% down, falling to a new 52-week low.

Despite saying generative AI will ‘create a significant growth opportunity for Appen, with the market expected to grow from $8 billion in 2021 to $111 billion in 2030’, 1H23 revenue fell 24%, leading to a US$43.3 million loss.

Revenue fell, ‘primarily reflecting a lower contribution from Global Services which recorded a revenue reduction of 27.4% to US$100.1 million’.

Revenue from new markets also fell, ‘impacted by a lower contribution from Global Product’.

In all, the half-year net loss widened from US$9.4 million to US$43.3 million.

Why is Appen struggling, despite hitching its wagon to the AI bandwagon?

Appen CEO Armughan Ahmad blamed the ‘challenging external environment’ (which didn’t seem to phase Nvidia one bit).

APX said customers ‘cut costs and evaluated their AI strategies in response to external headwinds’.

Ahmad said there’s a ‘broader technology slowdown’, but also said ‘it is an exciting time for AI’.

He thinks Appen’s data and services ‘power the world’s leading AI models’.

But if that’s true, why the slowdown and the challenging external environment?

Isn’t AI adoption in its infancy and only accelerating from here?

AI business models

It’s often said the benefits of technological advancements accrue largely to users, not businesses who commercialise the technology.

That’s because transformative technology makes things cheaper.

Take artificial light.

It’s cheap enough that we hardly think about it when illuminating our homes or offices.

But two centuries ago, light was a luxury you paid for dearly.

If you wanted to read at night, the book better have been worth it.

Nobel Prize economist William Nordhaus showed that it would cost 400 times what we pay now for the same amount of light.

Subsequent improvements and cost reductions lit up the benighted world (and made office cubicles possible).

This is a key feature of any big technological breakthrough.

As economists Ajay Agrawal, Joshua Gans, and Avi Goldfarb wrote in Prediction Machines, technological change makes things cheap that were once expensive.

The Internet is a great example, and analogous to the advent of AI.

Here’s the trio explaining the principle of technology’s deflationary tendencies (emphasis added):

‘[With the Internet], goods and services could be distributed digitally. Communication was easy. And you could find information with the click of a search button. But you could do all of these things before. What had changed was that you could now do them cheaply. The rise of the internet was a drop in the cost of distribution, communication, and search. Reframing a technological advance as a shift from expensive to cheap or from scarce to abundant is invaluable for thinking about how it will affect…business.’

What will AI make cheaper?

And who will stand to gain the most? The AI businesses or the consumers?

AI’s gold rush enriches the peddler of picks and shovels

What are trains for?

What are airplanes for?

In both cases, these inventions were transformative, impactful, and their use cases well-defined.

But it’s not as clear cut with AI.

What is AI for? What’s its use case?

We are still (as a society, as users, as businesses) figuring out AI’s essential use cases, which means it’s still unclear what business models will win out in the sector.

So the most visible way to play the AI theme currently has been via its basic infrastructure.

Investing in the means that enable AI use cases.

Picks and shovels.

That’s why Nvidia is printing money at the moment, selling the shovels to firms rushing out to hit AI gold.

But what happens when a business overestimates the intensity of the gold rush and overorders the picks and shovels?

It’ll be stuck with clattering tools in the warehouse, unused and unwanted…yet already paid for.

The expected revenue will not offset the very much realised capital outlay.

Take the large data centre company NEXTDC [ASX:NXT].

In its FY23 results released this week, NEXTDX mentioned the ‘insatiable demand for computational power from AI and cloud’.

It thinks it’s well-placed to serve that demand:

‘NEXTDC is exiting FY23 in a strong financial position to be able to take advantage of the opportunities presented by…the unprecedented acceleration of AI-driven applications driving one of the most powerful computational transformations in our lifetime.’

Given the ‘insatiable demand’, NEXTDC said FY24 will be a ‘critical investment year’, guiding FY24 capital expenditure to be between $850 million to $900 million.

It was $687 million in FY23.

NEXTDC explained the higher expenditure:

‘At the core of the future growth of AI and cloud computing lies the pivotal role of the underlying digital infrastructure.’

The data centre firm is definitely banking on big usage in the years ahead because it admitted FY24 underlying EBITDA is expected to be flat or down on FY23.

Will the gold rush last long enough for firms like NEXTDC to clear its backlog of picks and shovels?

Imagination and/or scepticism?

All this brings me to the final topic — the role imagination and scepticism play in investing.

Investment ideas about AI involve plenty of imaginative leaps about the future from some…and plenty of pooh-poohing by others.

But which tool should get more use?

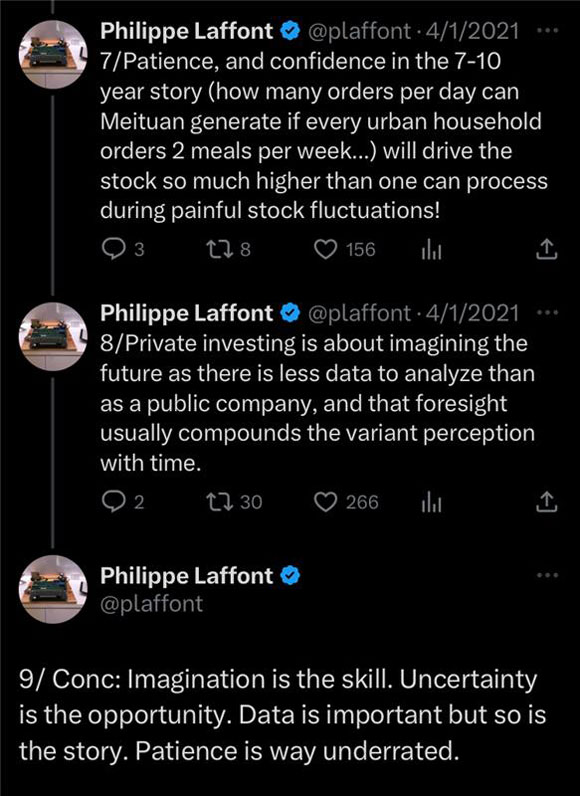

Growth investors like hedge fund manager Philippe Laffont espouse the importance of imagination.

For Laffont, ‘imagination is the skill’, not discount cash flow modelling or financial statement analysis.

But can imagination lead us astray?

|

|

| Source: Twitter |

Can it lead us to erect castles in the sky?

Scepticism guards against flabby assumptions and identifies gaps where we mistook wishes for evidence.

On the other hand, scepticism can bleed into cynicism.

And a cynical investor is a poor investor, missing every big opportunity.

An extreme sceptic sees little value and realises none.

Maybe we could say that scepticism should serve imagination in coming up with credible ideas well-tested and well-evidenced.

What do you think, what role should imagination and scepticism play in investing?

Regards,

|

Kiryll Prakapenka,

Editor, Money Morning