In today’s Money Morning…have we passed the point of peak inflation?…where the experts are putting their money…bargain buys are coming…and more…

Overnight the latest US inflation numbers came in…

Once again, prices have risen on a month-to-month basis. However, this time, it was a mercifully modest 0.3% gain.

As a result, the year-on-year trend for overall US inflation actually dipped slightly. It looks as though things may be cooling off after the huge surge we saw in March.

The Fed’s messaging and planned rate rises are finally kicking in.

Which begs the question, have we passed the point of peak inflation?

Our Editorial Director, Greg Canavan, certainly thinks so. He shared his view with many of our paid subscribers yesterday, before the official US inflation data was even made public:

‘Let’s have a look at some signs that inflation is in the rear-view mirror.

‘I know headline inflation around the world is very high right now and putting lots of pressure on household budgets. But financial markets are telling you much of this recent surge is transitory.

‘Yes, I know, transitory is a ridiculed word. But that’s exactly what it is.

‘The chart below shows the 10-year breakeven inflation rate. This is a market-implied rate that tells you average US inflation expectations over the next 10 years.

‘The rate peaked at 3.02% on 21 April.

‘It’s now at 2.65%. That’s still high by recent historical standards. But it tells you the market thinks inflation pressures have peaked.’

|

|

|

Source: St Louis Fed |

Where the experts are putting their money

So it seems as though Greg was spot on the money. His ‘peak inflation’ call looks to have been largely confirmed by the April data.

With both the Fed and the Biden administration transfixed by inflation too, don’t expect a reversal. We may see some slight deviation due to extraneous circumstances, but it would require a truly dramatic event to derail their plans.

That doesn’t mean you should expect an end to volatility in markets, however.

Investors and analysts are still trying to digest and process the ramifications of this inflation. That’s why we continue to see heavy selling of tech stocks, with the Nasdaq down a further 3.18% overnight.

People are clearly worried that the Fed is going to have to keep pushing heavy-handed rate rises. Because even if the June and July hikes are already priced in, the possibility for more intervention in September and beyond is what seems to be troubling the market.

Does that mean it’s time to reassess your portfolio?

Perhaps.

Renowned market guru and contrarian investor Jim Rickards is certainly preparing for major shifts.

In Jim’s view, the forces at play on markets currently are shaping a new era. He believes we’re going to see some seismic shifts in finance due to a wide range of factors, not just inflation.

While that may sound ominous, it may actually be a good thing. Jim certainly thinks there is still a major opportunity to use this sweeping change to your advantage. You just need to know how to use your capital wisely to make the right returns…

That’s why we’ve teamed up with Jim directly to bring you his latest portfolio. It’s a collection of the best possible investments to not only avoid the current market headwinds but actively profit from them.

You can check it out for yourself, by reading all about it right here.

As for me, I certainly agree with a lot of Jim’s sentiments. It’s hard not to when the man has been so right on so many fronts for so long.

But I suspect the one area where we may differ is those beaten-down tech stocks…

Bargain buys are coming

Like I explained last week, Warren Buffett is already scooping up cheap tech stocks. He’s probably doubling down on the current rout we’re seeing right now, too.

After all, it’s hard to ignore the fact that tech is being heavily oversold right now.

Markets are too caught up in the inflation and rising rate agenda. This narrative is bad for growth stocks, like tech, largely because higher rates impact discount rates and valuation modelling. But any impact from these forces only really kicks in once interest rates start creeping toward or above 5%.

Right now, the Fed is sitting on an official 0.75% cash rate.

Even if we factor in two 50 basis point rises for June and July, that still only brings it up to 1.75%. Or, if we assume the worst-case scenario, and the Fed raises rates by 75 basis points twice, the cash rate will climb to 2.25%.

Either way, it’s still well below the 4–5% range that often leads to messier outcomes.

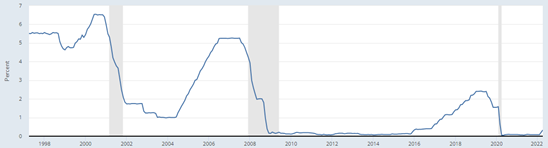

In fact, if you look at the 25-year chart, 2.25% would bring us back to around pre-pandemic levels:

|

|

|

Source: St Louis Fed |

You may recall that back in this 2018–19 period, tech stocks were booming!

This is because a healthy level of interest rates isn’t necessarily bad for growth. It is simply the short-term memory of some investors, who have grown addicted to pandemic stimulus, that have forgotten that.

Don’t be surprised if by the end of the year tech stocks are flying higher once more. Because right now, with the way they’re being oversold, a big bounce looks as though it is coming.

All that’s left for you to do is pick the right stocks to profit from this reversal. Something that you can certainly expect to hear a lot more about in Money Morning in the coming months…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.