In today’s Money Morning…a timely reminder of hedging your bets…the almighty blockchain…you’ve been warned…and much more…

Jerome Powell has finally admitted what everyone else already knew…

Inflation, both in the US and abroad, isn’t ‘transitory’.

Quite the opposite in fact. Rising costs are proving far more stubborn than many imagined, particularly when it comes to key goods like fuel, food, and homes.

Now, while that certainly doesn’t mean people should panic, it is cause for concern. And the fact that the Fed is conceding a need to taper sooner than expected, markets have naturally been rattled.

Add on top of this the yet unknown implications of Omicron and you can see how things could go from bad to worse. After all, if the stimulus stops right as another wave of COVID starts spreading, expect the situation to get a whole lot uglier.

Whether it will come to that, though, only time will tell.

Personally, from all that I’ve read on this new strain, opinions are split. All I know is that I can speak for most Melburnians when I say this city will tear itself down if there are more lockdowns.

But I digress…

Instead, let’s discuss what this means for investors.

A timely reminder of hedging your bets

Back in September — when central banks were choosing to stick their head in the sand — I wrote up some simple trade tips for possible inflation or even stagflation. So I’d urge you to check those two articles out here, and here.

For now, though, I want to re-highlight two of my points from these timely tips.

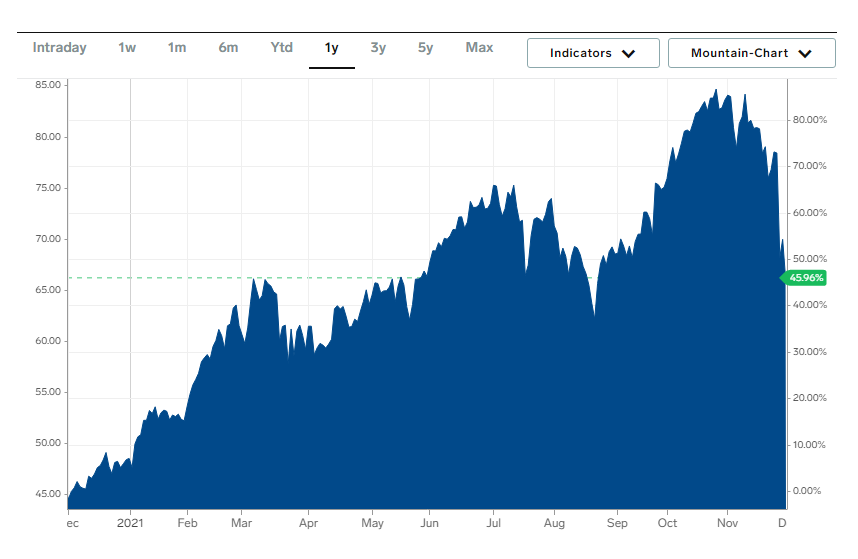

First, oil is once again something I’d be looking at closely. At the time of these original articles, the price of Brent crude was hovering right around the US$70 per-barrel mark. And in the weeks following, climbed all the way up to US$84.65 by late October.

A nice avenue to make a quick buck.

Right now, though, as Omicron fears grow, oil has sold off dramatically once again. It’s back down to US$68.50 per barrel. A move that in the short term may seem troubling. After all, it has crashed hard over the course of November.

But, in the grand scheme of the entire year, oil is still in a decent position. As you can see for yourself in the following chart:

|

|

| Source: Market Watch |

Keep in mind, it may continue to fall further from here, especially if Omicron turns out to be as bad as some suggest.

Despite this key risk though (which could go one way or the other), the medium- and long-term opportunity in oil is hard to ignore. In fact, in Australia, total spending on exploration for oil and gas is on the up.

$284.7 million was spent during July–September on new exploration, well above the $215.9 million spent during the same time last year.

And while this higher figure doesn’t necessarily mean more production or returns for shareholders, it is a noteworthy indicator that interest is returning. 2020 was the worst period in 16 years for total expenditure in this sector.

So classic inflationary hedges like oil are certainly something investors need to stay aware of.

But there are also plenty of new ways to diversify your exposure to inflation too…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

The almighty blockchain

By now you’re probably sick of hearing about Bitcoin [BTC], crypto, and blockchain from me. But that is simply because I can’t emphasise enough just how important it is.

Even if you aren’t or don’t want to invest in it, you need to be aware of the impact it is having.

Fiat currency, particularly the USD, is constantly being eaten away at by these central bank decisions, or lack thereof in some cases.

All the while, though, despite its own notorious volatility, cryptocurrency is gaining traction. And not just in terms of price appreciation…

A recent third-party report by Pymnts has stated that 58% of multinational companies are using at least one cryptocurrency. And when they say ‘use’, what they mean is they’re using it for cross-border transactions, not just some frivolous punt on the chance that bitcoin could climb to some astronomical figure.

More importantly, while bitcoin is the most common crypto used by these companies, it isn’t as dominant as you might think. Pymnts reports that 31% of the respondents used bitcoin, followed by 29% using stablecoins, and 24% using ether.

That’s a pretty mixed bag, suggesting that there is plenty of experimentation.

Granted, this report is extrapolating data from only 250 company responses, so take it with a slight grain of salt.

Nevertheless, though, it is an important statistic, showcasing just how fast the wider adoption of crypto — for non-investment purposes — is becoming.

For that reason, you definitely want to get involved yourself. You could do this either by simply learning how crypto works and what it will change, or, better yet, by dabbling in some investment yourself.

Because while it is still certainly risky, so too is the current state of traditional finance.

Never before have central bankers looked so lost and so out of their depth. Which is why now, as inflation is starting to rear its ugly head, markets are looking to take back control of money.

If things get worse from here, don’t be surprised if fiat spirals out of control.

You’ve been warned.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here