It’s been a big night for pot stocks in the US. With a nail-biting election that could dramatically impact the future of cannabis legality.

But, back in Australia, local pot stock Incannex Healthcare Ltd [ASX:IHL] has had a big day too.

The IHL share price is up 7.69% at time of writing. Suring on the back of an update regarding a key clinical trial. One that bears great news for investors. Not to mention key applications for the ongoing COVID-19 pandemic.

So, could this cannabis player be the next big biotech success story?

Anti-inflammatory breakthrough

Incannex has been working hard on their IHL-675A drug candidate. A mixture of cannabidiol (CBD) and hydroxychloroquine (HCQ); a drug that is most commonly used by arthritis patients.

Cruically, HCQ acts as an anti-inflammatory, and Incannex has been investigating whether mixing it with CBD could improve this effect. Hoping to produce a potential solution for sepsis associated acute respiratory distress syndrome (SAARDS). Which is a complication that has been linked to, and is the chief cause of mortality amongst, COVID-19 victims.

So, by addressing this unique bodily response, Icannex is hoping to provide treatment to save lives. Even though it isn’t strictly a ‘vaccine’ for COVID-19.

Which begs the question, how well does IHL-675A perform?

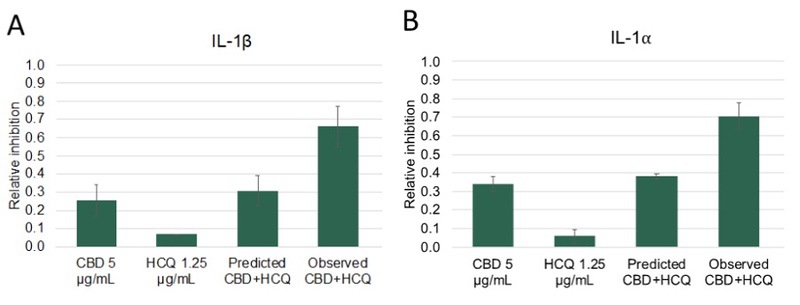

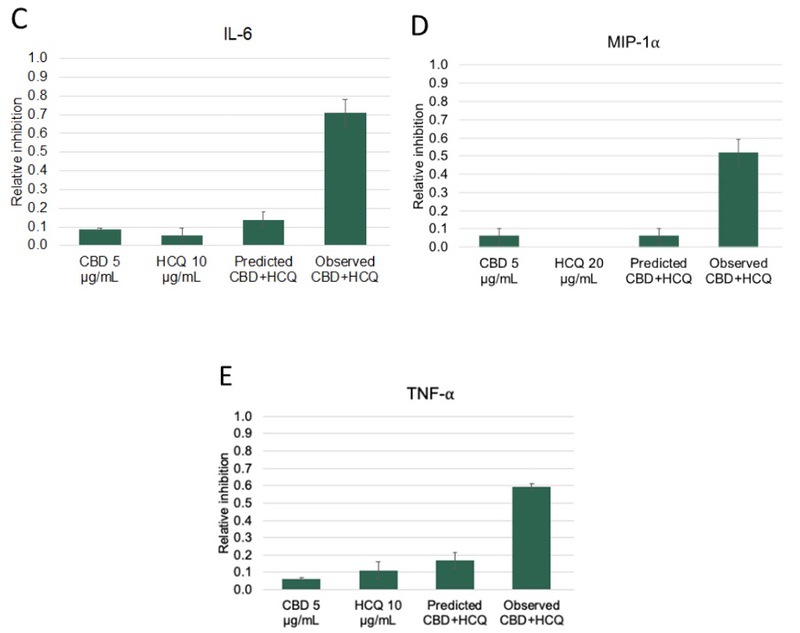

Well, pretty damn well according to early results from Incannex. As the following graphs show:

Source: Incannex

What you’re looking at is the anti-inflammatory response of CBD on its own, HCQ on its own, as well as the predicted and observed CBD + HCQ results. Five tests which clearly demonstrate a consistently greater response from CBD + HCQ than even Incannex was expecting.

Leaving CEO, Joel Latham, stunned by his company’s own results:

‘As a company, we set out to gain evidence that our proprietary combination of CBD and HCQ would exhibit significant synergistic outperformance against the individual constituents.

‘Not only have we managed to achieve this, but we have significantly outperformed against our predictions of anti-inflammatory activity in the IHL-675A combination drug. Potentially, this could mean that IHL-675A is a better alternative to CBD oil products for inflammatory diseases, subject to further examination.’

Keep in mind though; this data has come from in vitro studies. In other words, data that isn’t from human patients.

So, the next step for Incannex is to figure out if these results are just as likely on real people. A breakthrough that would put them in the box seat in terms of their goals.

What’s next for Incannex?

Clearly Incannex needs to pursue further research for IHL-675A. Not only to further the findings they have released today, but also any other potential discoveries.

As any seasoned biotech investor can tell you, early results like these need to be taken with a grain of salt. It is the challenge of passing several, rigorous clinical trials, including human test subjects, that is the real metric for success.

But, at the very least, Incannex now has a path forward to pursue this goal. And for investors, that is something worth getting excited about.

Regards,

Ryan Clarkson-Ledward,

For Money Morning

PS: For more exciting stock tips, check out our new report on the fintech sector. Including three of our favourite picks to lead the next wave of the financial technology revolution. Get your free copy of the full report, right here.