The Incannex Healthcare Ltd [ASX:IHL] advanced its clinical trials in the December quarter while posting a cash balance of $10.4 million.

At time of writing, the Incannex share price was up 3.5%, gaining as much as 8.9% in early trade.

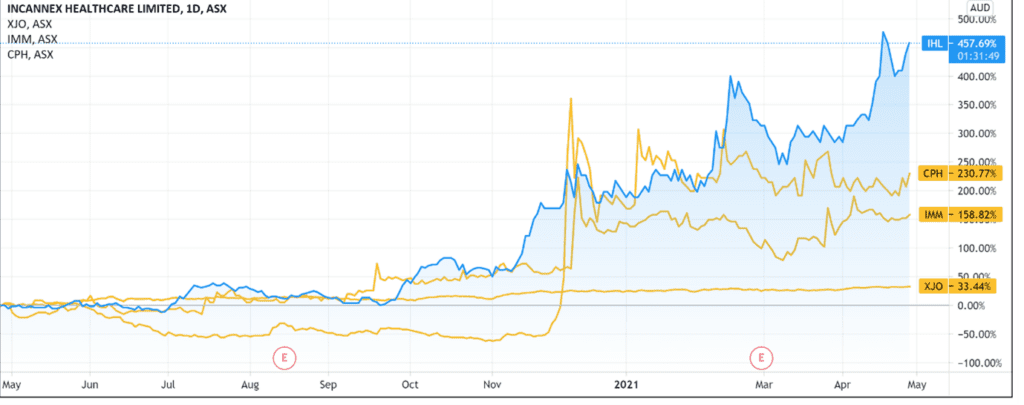

IHL shares are up 85% year-to-date, gaining 455% over the last 12 months.

IHL activities report

Incannex, which specialises in medicinal cannabis pharmaceutical products and psychedelic therapies, today released its activities and cash flow reports for the quarter ended 31 December 2020.

We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

Here are the key highlights:

- ‘Psi-GAD-1 psilocybin-assisted psychotherapy for generalised anxiety disorder phase 2 clinical trial protocol and US FDA pre-IND meeting package advancing.

- ‘IHL expands target indications for IHL-675A to lung inflammation, IBD and rheumatoid arthritis following pre-IND meeting with US FDA; initiates clinical trial program for a multi-use drug as IHL675A performs better than CBD for inflammatory conditions in animal studies.

- ‘Incannex continues recruitment and has initiated dosing IHL-42X to patients with Obstructive Sleep Apnoea in its phase 2 clinical trial.

- ‘IHL-216A being assessed in a model of traumatic brain injury developed by US NFL as a precursor to pivotal in-human trials required for drug registration.

- ‘IHL continues to work with its advisors on a potential US listing, given increasing investor interest in both cannabinoid-based pharmaceuticals and psychedelic therapeutic endeavours in North America.’

Elaborating on its Psi-GAD-1, IHL confirmed it executed a partnership agreement with Monash University in December 2020 to conduct the trial.

Incannex described it as a ‘world-first clinical trial’ that will include ‘major innovations in treatment approach and study design.’

The Psi-GAD-1 clinical trial will recruit at least 72 patients.

The company believes its Psi-GAD-1 trial may become ‘one of the pivotal trials necessary’ for registration and marketing approval in the US.

To assist in this goal, IHL engaged Camargo Pharmaceuticals to work with Incannex and Monash University in compiling a pre-investigational new drug (PIND) information package required to call a PIND meeting with the FDA.

There were further updates on the FDA front.

IHL revealed that two of its psilocybin research programs for depression received breakthrough designation from the US regulator.

Incannex also summarised its progress with IHL-675A, a product it thinks can become a multiuse pharmaceutical drug:

‘Results from an in vivo model of rheumatoid arthritis indicated that IHL-675A has a benefit in the treatment of rheumatoid arthritis greater than that of CBD or HCQ alone.

‘HCQ is currently approved and widely used for treatment of rheumatoid arthritis in the form of hydroxychloroquine sulphate; marketed as Plaquenil.

‘In an animal model, low dose IHL-675A was 1.06 to 3.52x more effective at reducing arthritis across multiple assessments including clinical score, paw volume, pannus score, total histology score and serum cytokine levels versus the standard dose of HCQ.

‘The results demonstrate that IHL-675A has the potential to permit a ten-fold reduction in HCQ dose, without sacrificing efficacy, in treatment of arthritis.

‘If replicated in human studies, IHL-675A could result in a lower side effect profile for patients currently being treated with HCQ.’

IHL also revealed that it currently has six US Food and Drug Administration (FDA) programs for medicinal cannabinoid pharmaceutical products and psychedelic medicine therapies.

IHL’s cash position

Incannex reported holding cash at bank of $10.4 million at the close of the quarter.

The company recorded net cash outflows of $1.98 million, comprising mostly research and design expenditure.

IHL noted part of the R&D expense will be eligible for a R&D rebate scheme.

Cash inflows in the form of customer receipts totalled $638,000.

These receipts were associated with the sale of unregistered cannabinoid oils.

What is the outlook for IHL?

In today’s quarterly update, Incannex stated that the combined global market size of the indications it is targeting with IHL-675A is over US$125 billion per annum.

As with a lot of junior pharmaceutical and pot stock companies, the upside is enticing.

A large, untapped addressable market. Moats in the form of successful regulatory approval.

But just as the upside is large so, too, is the risk.

As IHL explained, commercialising IHL-675A will take time and depends on FDA approval.

Its activities report listed multiple steps still ahead of IHL before it can begin capturing the US$125 billion a year addressable market.

Additionally, investors will likely pay attention to IHL’s coffers.

It burned through $1.98 million in net cash outflows in the December 2020 quarter on total available funding of $10.34 million.

This implies that IHL has about five quarters left of funding available at current levels.

This could worry some investors, especially with the company today revealing the board of directors’ notice ‘substantial and increasing margin compression in a space that is becoming overcrowded.’

Incannex admitted that this led to ‘significant product discounting throughout the sector.’

No doubt the market will track IHL’s progress with the FDA closely.

But, equally as likely, investors may also be monitoring the health of Incannex’s cash position.

ASX pot stocks certainly caught the eyes of investors lately who are seeking growth markets.

If you are interested in pot stocks and wish to research the growing CBD healthcare industry and what investing opportunities are out there, then this free report is highly recommended.

Regards,

Lachlann Tierney,

For Money Morning