Cancer-combating biotech company, Imugene [ASX:IMU] has now gained ethical approval to start its Phase 1 Clinical Trial of its virotherapy, Vaxinia, in Australia.

This milestone has seen a 5% surge in share price for the biotech, boosting shares by more than 15% for the first week of 2023.

Despite a tumultuous 2022, in which the biotech fell more than 53%, today’s results suggest 2023 shows some promise.

Now the hurdles have been met and passed, human clinical trials can begin, and a fresh outlook is cast.

Source: marketindex.com

Imugene pushes forward with ethics approval

Imugene has received Human Research Ethics Committee (HREC) approval to begin Phase One of Australian clinical trials for its Vaxinia product, an oncolytic virotherapy developed by the City of Hope.

Imugene has taken the approval as confirmation of satisfactory clinical safety requirements and testing in Vaxinia’s effectiveness as an experimental anticancer drug, paving the way for the next phase — human clinical trials, to begin right here in Australia.

The Australian component of the Phase I trial will be conducted under Australia’s Clinical Trials Notification (CTN) Scheme.

Imugene will notify the Therapeutic Goods Administration (TGA) of HREC approval and complete local site initiation activities as required under the scheme.

Tasman Oncology Research, a South Australian cancer hospital, will be the first to begin trials.

More Australian clinical sites are to open, echoing processes of the US Food and Drug Administration (FDA) a year ago.

Vaxinia Phase One trial

The trial bears the lengthy title of ‘A Phase I, Dose Escalation Safety and Tolerability Study of VAXINIA (CF33- hNIS) Administered Intratumorally or Intravenously as a Monotherapy or in Combination with Pembrolizumab in Adult Patients with Metastatic or Advanced Solid Tumours (MAST).’

In a nutshell, it’s a test to determine the best dosage of Vaxinia, first as a monotherapy, to later take a starring role alongside other immune checkpoint inhibitors.

Effectiveness, tolerance, and immunity responses will be monitored.

The trial is expected to run across 24 months and is to be funded by the company’s present budget and resources.

Imugene recapped the qualities of the drug, saying that it ‘has been shown to shrink colon, lung, breast, ovarian and pancreatic cancer tumors in preclinical laboratory and animal models.’

Leslie Chong, Imugene’s MD & CEO, stated:

‘The start of our Australian study is a significant milestone for Imugene and clinicians treating Australians faced with the challenge of advanced solid tumour cancers. Accomplishing this goal speaks to the perseverance and dedication of Imugene’s clinical and research team as we continue to build on our clinical and commercial potential. In addition to the positive preclinical results, we’re incredibly eager to unlock the potential of VAXINIA and the oncolytic virotherapy platform for Australians inflicted with cancer.’

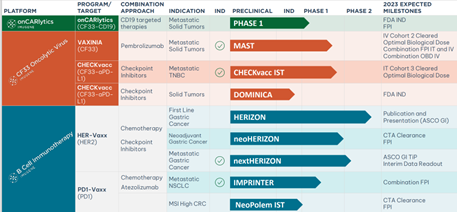

Imugene’s Vaxinia is one of several cancer and immunotherapy treatments circulating in the developer’s project portfolio.

With tumour products onCARlytics, CHECKvacc, HER-Vaxx and PD1-Vaxx also approaching various milestones for 2023.

It’s shaping up as a busy year for Imugene, with research and development phases paying off and the real test only beginning.

Source: IMU

ASX bargain stocks

Inflation hit quite hard towards the end of 2022.

And to begin 2023, many will still be looking to save a pretty penny where they can.

But it’s times like these that some real ASX bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what the calls are the ‘best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning