Australian immune-oncology stock Imugene [ASX:IMU] released a letter this morning addressing shareholder discontent at the recent share price decline.

In late afternoon trade on Monday, IMU shares were up 10%.

The shareholder letter comes after Imugene shed 45% in the last 12 months.

Will management’s optimism about Imugene’s prospects assuage investor concerns?

Source: Tradingview.com

IMU’s letter to shareholders

In a joint statement, Imugene CEO Leslie Chong, and executive chairman Paul Hopper, addressed shareholders about Imugene’s recent share price performance.

In a nutshell, the executives think Imugene is still well-placed, with a ‘rich pipeline and prospects’.

Imugene endeavoured to assure shareholders, claiming it’s ‘as strong as it has ever been in its history’.

Despite this strength, Imugene’s management admitted it was sailing through turbulent seas.

In fact, Imugene reeled off some statistics, showing that since December 2021, biotech shares have ‘fallen dramatically’.

Citing figures from Bloomberg, Imugene reported that ‘April was the worst month on record for US biotechs since at least 1997’.

The biotech sector fell 65% from a peak registered in February 2021.

Despite the souring sentiment for the sector, Imugene remains upbeat.

Why?

In its own words, Imunege management noted:

‘In reality, things have only improved from our share price peak last year. Allow us to remind you about the company you are a shareholder in. Imugene is as strong as it has ever been as we continue to make good progress.

- We have $100 million in cash making us one of the most financially secure biotechs on the ASX

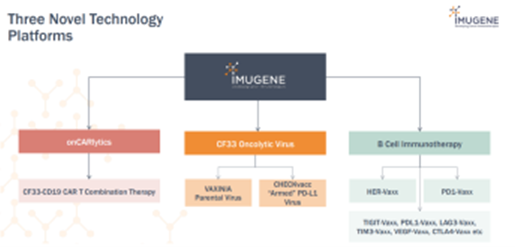

- We have 3 unique platform technologies supporting 6 unique assets – onCARlytics, CHECKvacc; PD1-Vaxx; CF33 (VAXINIA) & HER-Vaxx

- Within 12 months we expect to have ~10 clinical studies supported by 5-6 FDA IND’s

- Our drugs are targeting more than 10 disease areas

- We have 2 supply agreements with leading pharmaceutical companies

- We have 2 industry/scientific collaborations’

Imugene also addressed the recent cancellation of a supply agreement with Merch & Co.

Imugene labelled the reaction to the cancellation as a ‘storm in a teacup’:

Source: Imugene

Imugene share price outlook and seeking bargains in today’s market

In its most recent half-yearly results, Imugene reported a net loss of $14.8 million, up from $6 million in the prior corresponding half.

Proceeds from issuing new shares during the half propped up Imugene’s cash holdings, with the biotech stock ending the period with $118.4 million in cash and cash equivalents.

Today’s jittery climate spooked by inflation and rising rates doesn’t help sectors like the biotech industry, whose stocks often operate without revenues for years.

Rising rates make distant profits in research companies less appealing.

But that’s not to say that rising rates affect all stocks equally.

The current climate offers opportunities for the savvy investor willing to zag while others zig.

But how best to identify the opportunities?

Our expert, Callum Newman, recently released a report on ‘left-for-dead’ stocks that could rebound in a big way.

You can find out more about Callum’s three ‘grave-dancer’ stocks here.

Regards,

Kiryll Prakapenka,

For Money Morning