The IGO Ltd’s [ASX:IGO] Kwinana Lithium Hydroxide Refinery successfully produced its first lithium hydroxide chemical product.

IGO holds a 49% interest in Kwinana through a joint venture with Tianqi Lithium.

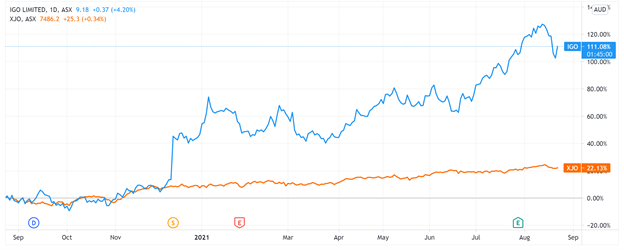

The news saw IGO Ltd [ASX:IGO] share price rise 4% at the time of writing, with the IGO share price gaining 105% over the last 12 months.

IGO’s successful lithium hydroxide production

On 30 June 2021, IGO formed a lithium joint venture with Tianqi Lithium Corporation and holds 49% interest in Kwinana.

Current operations managed by this joint venture also include a 51% stake in the ‘world-class’ Greenbushes Lithium Mine.

IGO made US$1.33 billion worth of completion payments to Tianqi for the joint venture.

IGO said Kwinana is set to become Australia’s first lithium hydroxide facility, with commissioning of the refinery’s first production train (Train 1) underway.

The process will go from calcining, acid roasting, leaching, purification, and crystallisation on a batch basis, culminating in the production of the first lithium hydroxide chemical.

Having already demonstrated lithium hydroxide production, IGO said the focus now turns to operating Train 1 on a continuous, rather than batch, basis.

This will happen all the while improving product quality to a ‘battery grade product for qualification by our off-take customers.’

IGO expects to produce saleable product in the December 2021 quarter and that battery grade product for accreditation by customers will be produced in the March 2022 quarter.

Finally, IGO expects Kwinana’s Train 1 to progressively ramp up to a design production rate of 24ktpa lithium hydroxide by the end of 2022.

IGO’s Managing Director and CEO, Peter Bradford, shared his views:

‘First production of lithium hydroxide is the first step of a journey but nevertheless represents a key milestone for the Lithium JV.

‘We are therefore delighted to have achieved this first important step in the commissioning of Train 1 and to have done so ahead of the internal schedule developed earlier this year.

‘We congratulate the Kwinana team on this milestone and their progress over the last few months.

‘The strong demand being witnessed in the lithium market globally reinforces the strategic nature of Kwinana which, together with the Lithium JV’s interest in the Greenbushes mine, is rapidly evolving into a globally significant, integrated lithium operation catering to the specific needs of premium lithium-ion battery manufacturers.’

What next for IGO: lithium outlook

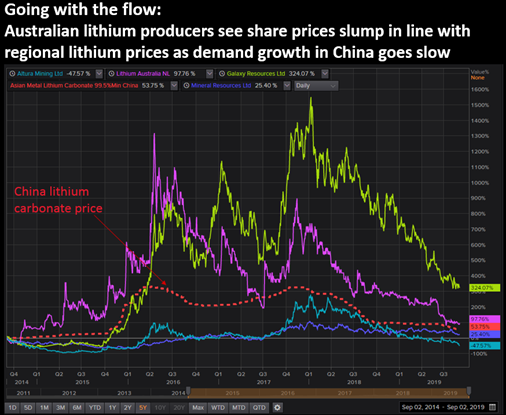

As we’ve covered earlier this year, it’s important to note when analysing the lithium sector that the white metal is a commodity.

Lithium producers and explorers are often considered price takers.

Essentially, price takers are businesses that largely do not have the power to influence the price of their products.

Price-taking stocks ride the price fluctuations of their underlying commodity.

That’s why lithium stocks dipped in 2018/19 after an oversupply of lithium precipitated a fall in the price of the metal.

But the price of lithium is rising once more on the back of greater demand and strained supply as producers rush to go live.

There is also more strength in the lithium demand argument in 2021 than in 2018.

Governments are getting more involved in shifting to cleaner energy. Traditional automakers like Volkswagen are setting ambitious electric vehicle goals.

And the UN’s Intergovernmental Panel on Climate Change (IPCC) just released a climate report that signals a ‘code red for humanity’.

The EV future is looking clearer.

With the shift towards electric vehicles, the global lithium-ion battery market is projected to grow from US$41.1 billion in 2021 to US$116.6 billion by 2030.

But as prices rise and demand surges, the lithium sector is starting to attract more entrants, heating up competition.

It is unlikely that all lithium producers will succeed even in the current hot market.

There may be more consolidation among bigger players, or producers investing in more efficient technology may gain a pricing advantage.

Or the likes of Vulcan Energy Resources Ltd [ASX:VUL] and Lake Resources NL [ASX:LKE] may initiate an ESG trend where sustainability-minded end clients seek out lithium producers with the cleanest record.

All in all, positive market conditions for lithium may not suffice.

That’s why IGO shareholders will likely monitor if IGO’s plans for Kwinana to become the ‘first fully automated lithium hydroxide refinery in Australia’ becomes a competitive edge.

If the potential of lithium-ion batteries to accelerate the clean energy revolution interests you, then you may enjoy reading the latest report from Murray Dawes and Ryan Clarkson-Ledward, our small-cap market experts.

They just released a report sharing their research on companies that seek to chemically ‘crack’ fossil fuel and transform it into clean energy.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.