Critical metals and clean energy front runner IGO [ASX:IGO] has released its latest news on the pegmatite diamond drilling at its joint-owned lithium project at Mt Alexander.

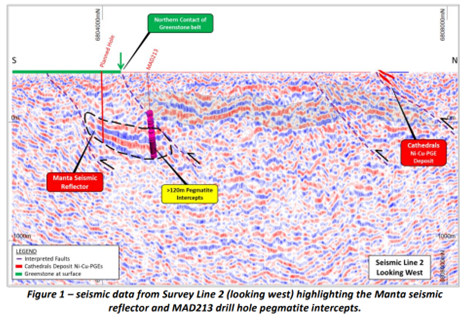

IGO listed the highlights for testing at the Manta seismic reflector, with a total of 225 metres of pegmatites intersecting within the MAD213 hole.

The miners have been drilling 121 metres of continuous pegmatite interval drilling at the reflector and have found a continuous collection of coarsely crystalline pegmatites.

These pegmatite samples have been sent for assaying, and more drilling is due to commence in April.

IGO’s share price jumped just shy of 7% following the update, trading around $12.79 by mid-morning.

In the week the IGO share price has leapt 6.5%, it has slumped 5% so far in 2023, and is below its sector average by around the same:

Source: TradingView

Promising pegmatites located at IGO’s MAD213 diamond drill hole

Courtesy of JV partner St George, the group has provided an update to shareholders in regard to operations at the Mt Alexander Project at Manta.

The project, in which St George holds 75% and IGO 25%, has been undergoing further diamond drilling in the first drill hole to test the Manta seismic reflector.

The miners have found that a very wide gap of pegmatite has been discovered, 121 metres of continuous in the MAD213 drill hole and a total of 225 metres of pegmatites intersecting within that hole.

The MAD213 diamond drilling was decided to test the source of the reflector, and it has been confirmed that multiple intervals of coarsely crystalline pegmatite have indeed been intersecting — in a continuous 120.8m interval of pegmatite from 631.2m to 752m downhole and multiple additional pegmatite intervals of varying width from 369m to 624m downhole.

IGO says there is an ongoing review of the seismic data of the drill core at MAD213, which is being reported by Rock Solid Seismic consultants, and it’s already been confirmed that the strong reflector is associated with the pegmatites.

According to IGO and St George, the Manta pegmatites have been noted to differ from numerous outcropping and cross-cutting pegmatites in the Mt Alexander corridor, and the Manta pegmatites may be intruding into a flat extension structure over the area.

St George Mining’s Executive Chairman John Prineas said:

‘This is an exciting development in our lithium exploration at Mt Alexander.

‘The early results from MAD213 are very encouraging with a large intersection of pegmatite that may be associated with significant structural activity.

‘We are looking forward to further drill testing this very large pegmatite unit.’

MAD213 pegmatite samples have been sent for analysis, and the group will soon hear back if there’s any anomalous mineral or geochemical compositions worth noting.

Further diamond drilling of the Manta pegmatites is planned to start in April. This will be to test potential for mineral zones for the pegmatites, within the greenstones at shallower depths:

Source: IGO

A boom for drillers

Lithium is only one part of a universe that is chock-full of potential.

It’s part of a wider industry making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

To put it bluntly, drillers are booming.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Our experts definitely say so — but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia