Australian mobile game-maker iCandy Interactive [ASX:ICI] was up as much as 25% on Thursday after releasing its half-year results.

ICI reported its ‘best half-year financial results’ with a 1,600% increase in revenue growth and positive EBITDA as it consolidated results from its Lemon Sky Studios acquisition.

www.TradingView.com

iCandy gives its best results to date

Thursday morning brought a wave of enthusiasm for iCandy investors after the company announced its ‘best first half year financial results’, which were delivered for the first half of 2022.

‘On the back of its highest ever half year revenue, iCandy is operationally profitable for the first time ever,’ stated the company.

The gaming developer saw a surge in revenue growth by 1,600% — 17 times the amount reported this time last year.

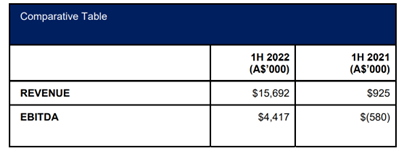

Revenue for 1H22 came to the total of $15.7 million, which was $0.9 million in 1H21, thanks to bonus results coming from newly acquired Lemon Sky Studios back in February.

This was a trend the company wished to assert is ‘not a one-off’, as ICI expects figures to climb as contributions from new acquisitions (ie: Lemon Sky Studios) will begin to top up company revenue.

In reaching an EBITDA of $4.4 million, iCandy claimed another new milestone — excluding one-off acquisition costs related to Lemon Sky Studio.

iCandy also reported record quarterly cash receipts totalling $8.2 million, an increase of 82% over the quarter.

Key points of half-year included:

- Revenue from ordinary activities were $16 million for the most recent half-year, 1,595% higher than $925,785 in the same period last year.

- Losses from ordinary activities before tax was down 176% from $1.2 million in 1H21, to $898,478 this past half-year.

- Customer sales pulled in A$12.5 million in the last half-year — a huge improvement on the $839,649 recorded in 2021.

- More cash was splashed on investing activities – $10.6 million up from $2 million spent last year, as was cash used in financing activities, up $17 million from 2021’s $1 million.

- Cash and equivalents at the end of the period were at $28.3 million, another big improvement from 2021’s account balance of $10 million.

Source: ICI

Is ICI onto a good thing?

iCandy has expressed it believes revenue trends to keep on climbing, with help from continuing revenue contributions from newly acquired subsidiary Lemon Sky Studios.

The gaming company was particularly encouraged by the possibilities in the pipeline for Lemon Sky, creator of popular shooter-gaming franchise Call of Duty Infinite Warfare and Marvel universe games.

Strong demand is already showing for its AAA robo-suit war-machine metaverse game (Metal Genesis) development services — with a playable demo due in Q4 FY22 — and three years’ worth of interest-driven opportunities secured for the subsidiary.

iCandy also has 51% ownership of Asia-based gaming company Storm, which will also be contributing higher revenue and further opportunities.

The EV revolution is coming

While the gaming world is fun to escape to, there’s something we cannot escape.

With one shared, all-important goal, countries all over the world are striving to decarbonise their economies.

And EVs are a big part of that push to get them there.

And while lithium caught the most attention last year, the world’s mass adoption of EVs is set to boost demand in other battery metals as well — like copper, nickel, cobalt, and graphite.

In fact, the lithium rush has got our team at Money Morning thinking…there must be a much smarter way to play the EV boom.

And they found one.

It involves what you can call lithium’s ‘little brother’.