Three things you need to know today…

1. The heat is on. Big selling lately. But…

It’s times like this we need to keep a cool head.

Do we have anything to take heart from, right now?

Two things I reckon.

First, any time there’s a gap down like this is a chance to consider buying James Altucher’s AI 2.0 plays at prices you may never see again. (Discover his hitlist here.)

Second, fund manager Auscap did a webinar last week.

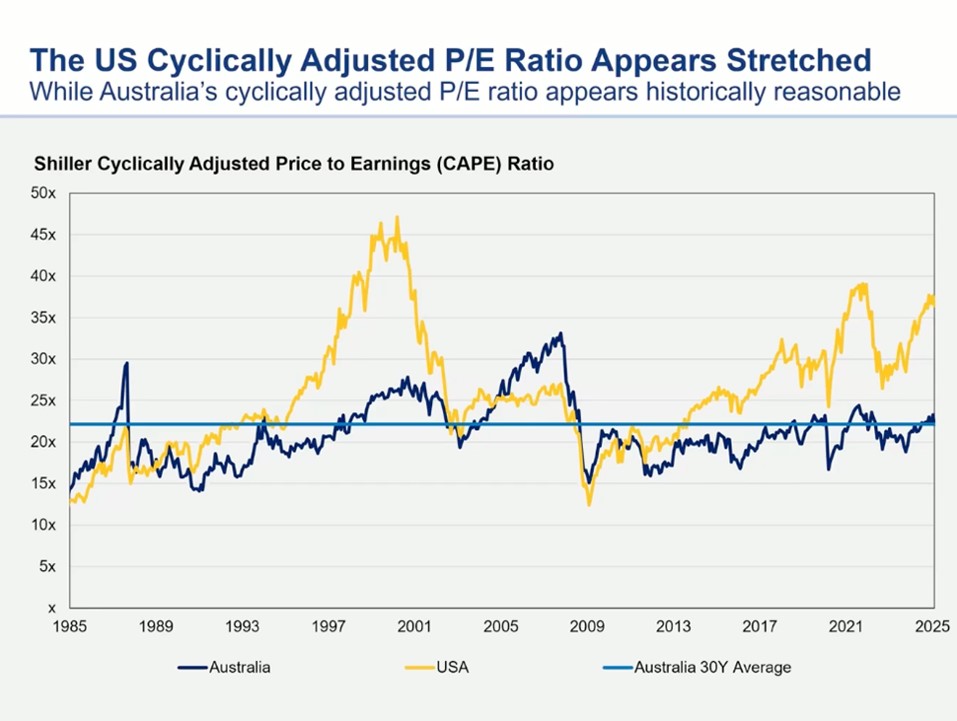

They shared this handy chart. It compares the Aussie and US share markets and their valuation.

Check it out…

| |

| Source: Auscap |

The US is in yellow and Australia blue.

Clearly, US stocks were up at lofty levels, and still are.

But you can see the ASX never got anywhere near the same extreme, and hasn’t for years.

It seems unlikely we’d fall precipitously from here with this in mind.

I’m not saying we’ll go up today, tomorrow or next week. We’re in a tricky moment.

Keep in mind the following…

My colleague Murray Dawes makes a compelling case that there’s huge long term support around 7000 points on the XJO.

That’s still 10% lower than where the market is now. We could test this range sometime in the next few weeks.

That said…

The hardest thing, when the market sells off, is not to extrapolate the price action too far.

Shares are volatile, and we live in unpredictable times.

My expectation?

Fund managers should move to take advantage of the current volatility.

See above. They’ll have some confidence they’re operating within the bounds of ‘normal’.

The mainstream media will do a good job of spooking you, as it always does.

The share market is in its worst start to the year since Covid, reported the Australian Financial Review yesterday.

I remember a similar stat going around in 2016, funnily enough. It was the worst start to the year in the Dow ever…and that was in the first week!

One known market bear said US stocks could fall 75% at the time.

That didn’t happen.

And you know what?

The wealth creation opportunities since have been staggering.

2016 was a long time ago now. I certainly had less grey in my beard then.

But you see my point, right?

These type of sell offs happen regularly…if you stick around long enough.

Then the media trots out some doomer to forecast more doom, the clicks go up…and in 12 months we’ll probably be talking about something else.

That said…

How to handle current events right now?

2. The easiest thing – and probably the smartest – is to do nothing.

Study after study has shown investors are their own worst enemy.

Every sell off, recession, spook or bout of volatility is an excuse to go to cash and play it safe.

Over time the stock market makes fools of those who are prey to this.

But you could have said that in 1929, too, right?

Here’s some help on that…

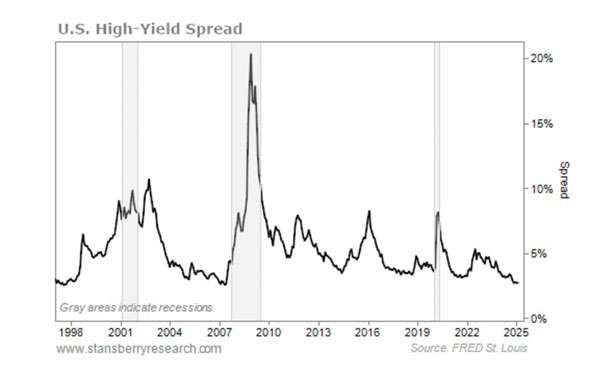

One way to test the level of market risk is via the credit markets.

If corporate bond investors think we’re on the edge of a big recession, they’d be demanding higher rates.

Analysts at Stanberry Research checked in on this recently. You’ll like what they found.

Analyst Brett Eversole writes:

“The chart below shows the high-yield bond spread – that is, the difference between the yields on high-yield bonds versus risk-free U.S. Treasury bonds. The spread tends to spike when a recession is on the way. But as you can see, that hasn’t happened…

| |

| Source: FRED St Louis |

“We’d need to see it spike above 4% or even 5% before we started to worry.

“If that happened, the bond market would be confirming our worst fears… that a recession is imminent. And it could cause the current correction to plunge into an all-out bear market.

“But that signal isn’t here yet. And until it shows up, we should assume we’re working through a painful air pocket, nothing more.”

In other words, shares are volatile. Get used to it. Bond investors aren’t panicking. Neither should you.

3. Now, for the risk takers and adventurous…

Personally, I don’t mind buying on market weakness as long as I’m buying into industry strength.

It’s cash flow and earnings that drive stock prices over time. Look no further than the standout sector of the ASX in the last 6 months: gold, gold, gold.

Aussie gold prices are near $5000 an ounce. That’s huge! The gold bull market can keep surging while this continues.

I also expect a wave of mergers and acquisitions to sweep over the sector. In fact, it’s already started with Ramelius moving on Spartan Resource recently.

There are likely plenty more gold buyouts coming up. For my subscribers, I’ve got one company lined up as a perfect candidate. More soon.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

PS. Don’t forget to tune into my colleague James Altucher and what he’s saying about the “wealth window” forming now. This is around the second wave of AI share market winners brewing.

AI, like gold, is not something that’s going to reverse tomorrow. It could run for years, if not decades, in the same way social media has driven US stocks like Meta for over a decade now.

Believe it or not, they laughed at Mark Zuckerberg when Facebook listed on the share market. No one’s laughing now, as Facebook became one of the greatest businesses in history.

We could see a repeat with AI. Get what you need to know here.

***

Murray’s Chart of the Day

— Brent Crude Oil

| |

| Source: Tradingview |

Brent crude oil has managed to bounce from major support at US$69.00.

So is that the end of the selling? Is it time to load up on oil and gas stocks?

Not yet.

We could see further upside now that major support has held, but the jury is out about whether the downtrend is over.

If we were to see a monthly close above the high of US$75.00 created in March, a monthly buy pivot would be confirmed. That is when you could start asking yourself whether buying oil stocks made sense.

A fall under US$69.00 would remain a very bearish prospect, but the risk/reward set up could favour buying oil with a stop loss set below US$69.00.

In trading you are always looking for situations where you are proven wrong quickly.

The quicker you are proven wrong, the better your risk/reward on the trade.

Remaining open minded and prepared to change your view if the charts tell you to is necessary. When you get stubborn you are heading for a fall.

We all have a tendency to see what we want to see when looking at a chart. That’s why a clear set of rules that puts a straitjacket around your impulses is so important.

So for now the odds of oil going one way or the other has fallen back to around 50%, so we watch and wait for the opportunity to evolve.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments