The Hazer Group Ltd [ASX:HZR] share price is on watch today after the ASX-listed technology developer issued an update on its Hazer Commercial Demonstration Project (CDP).

The project is currently being constructed at Water Corporation’s Woodman Point Water Recovery Facility.

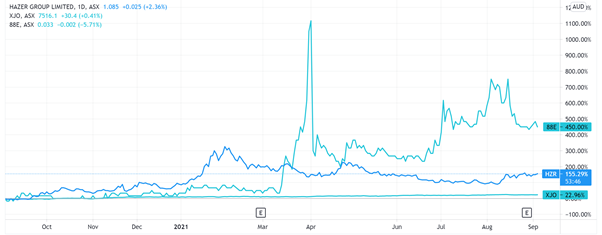

In morning trade, shares took a dip by nearly 2% but have seemingly recovered in the afternoon.

At time of writing, Hazer’s share price was sitting at $1.07 per share, up 1.42%.

Source: Tradingview.com

Today’s project update was written to alert investors to the progress, cost, and schedule of the CDP, which is designed to be the first-of-its-kind, fully-integrated operational production facility based on the Hazer Process.

Today, we’ll go through today’s announcement to get a clear idea on how Hazer’s project is progressing — and what these results might mean for the company’s future.

Could this be a game changer for the energy industry?

Hazer is currently embarking on the commercialisation of the Hazer Process, a low-emission hydrogen and graphite production process.

The Hazer Process allows natural gas and similar methane feedstocks to convert into hydrogen and high-quality graphite.

Iron ore is used as the process catalyst.

If Hazer is successful in its mission, it will hold true innovator status across the technology and energy markets.

Its low-emission capabilities fit well with the global transition to a cleaner energy industry and environment.

So Hazer investors who have been following the company would have been very eager to hear about how the project was tracking…

According to today’s announcement, mostly it’s going well.

The majority of the project items have remained on schedule.

Engineering, procurement, fabrication, and construction activities are meeting milestones.

Transformer equipment required for the connection to grid has been secured and the installation schedule agreed with Western Power.

Geoff Ward, Chief Executive Officer of Hazer Group, commented:

‘We remain pleased with the progress of the CDP, in particular achieving the completion of main civil works and commencement of mechanical construction.

‘We are also pleased that key equipment items and modules are now being completed and delivered to site.’

Delays for days and days…

Though much of the update was positive, the CEO revealed significant delays for several project items.

He commented:

‘The Hazer reactor and furnace is a complex, first-of-kind equipment package which is being made more challenging by the current operating environment with significant disruptions to supplier operations and freight schedules due to the global Covid-19 pandemic, which has impacted the delivery time of high-temperature materials for the reactor and heat exchangers.

‘We will continue to monitor these issues and do all we can to mitigate the impacts on the project.’

The fabrication of the main reactor shell has been delayed due to changes in the production schedule of the selected mill.

It’s predicted that this delay and others will result in the overall project schedule slipping.

Typhoon Ida has also had an impact on scheduled shipping deliveries between China and Australia.

Judging from the zigzagging share price, it’s clear the markets are divided.

On one hand, it’s good to see the project forging ahead and meeting key milestones in some areas.

On the other, these delays may have been a disappointment to some investors.

What’s happening next for the Hazer Share Price?

It’s expected that civil construction works will be completed in the first week of September.

But due to the delays, Hazer now guess that commissioning of the project will be achieved in Q1 2022, rather than their previous target date of December 2021.

However, their current guidance of $21–22 million for the cost of the CDP remains the same.

Hazer’s clearly got an interesting project in the works, and I believe the share price will be worth watching in the coming weeks.

But in the meantime, our energy expert James Allen believes there are several other firms in the multimillion-dollar clean energy market worth looking into.

If James is right, any single one of these stocks could soar to superstar heights in the 2020s.

Want to know the details?

His free report is a must-read and you can access it here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is an easy way to start finding investment opportunities in energy and beyond. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.