The Humm Group Ltd [ASX:HUM] share price is up 8% after posting a strong transaction volume of $774.9 million, with a record quarterly buy now, pay later (BNPL) transaction volume of $304.9 million.

HUM stock rose as much as 10.2% in early trade, as impressed investors bid up the BNPL player’s shares.

Despite today’s positive market reaction to Humm’s business update, HUM shares are still trading 6% year-to-date and 10% over the last 12 months.

Transaction volume humming along

Here are the key highlights of Humm’s latest quarterly:

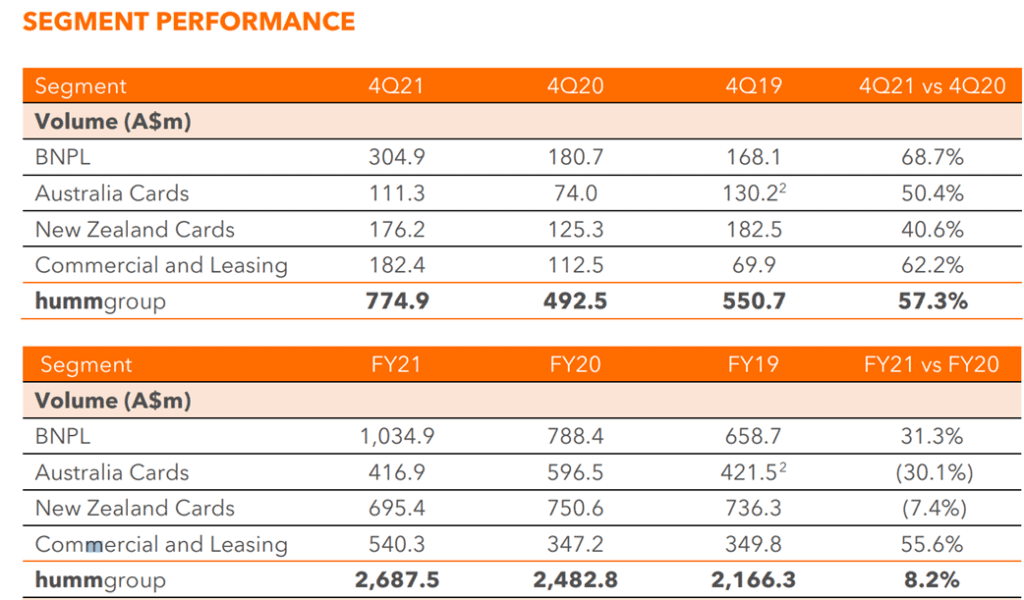

- ‘Hummgroup 4Q21 transaction volume of $774.9m, up 57.3% on pcp

- ‘Record quarterly BNPL segment transaction volume of $304.9m in 4Q21, up 68.7% on pcp

- ‘Cards (Australia and New Zealand) 4Q21 transaction volume of $287.5m, up 44.3% on pcp with spend continuing to return across key categories

- ‘Commercial and Leasing transaction volume in 4Q21 of $182.4m, up 62.2% on pcp

- ‘Total hummgroup customers of 2.7m as at 30 June 2021, up 19.7% on pcp

- ‘Continuing improvement in net loss (gross write-offs net of recoveries) of $30.2m in 4Q21, down 20.3% on pcp

- ‘1,362 new merchants integrated across Australia and New Zealand in 4Q21 including strong growth in key verticals of health, luxury retail, home improvement, and automotive

- ‘Based on unaudited accounts, Cash Net Profit After Tax of $68.4m, up 121.1% on pcp.’

In Q420, Humm’s BNPL segment accounted for 36% of the group’s transaction volume. In Q421, it accounted for 39%.

Humm’s Australian BNPL market continued to gather market penetration and brand awareness.

The company reported that transaction volume for items over $2,000 increased 26.1% in Q421 against Q420.

Volume for items under $2,000 increased 149.8%, with these transactions ‘benefiting from ecommerce volumes continuing to increase.’

Individually, Humm’s BNPL segment has the highest transaction volume, contributing more to total volume in Q421 than Humm’s Australia Cards and New Zealand Cards combined.

In FY21, BNPL accounted for $1.03 billion of the firm’s total $2.69 billion transaction volume.

HUM share price outlook

Humm CEO Rebecca James said today’s business update contributes to the firm’s expectation of FY21 cash NPAT of $68 million, a 121% increase on FY20.

This profitability is what she thinks is a ‘key differentiator against many of our competitors, and importantly will be the fuel to fund the company’s growth strategy.’

A growth strategy can be fuelled by your cash reserves or a capital raising. Ideally, a capital raise takes advantage of a high stock price.

In Humm’s case, the share price hasn’t performed well this year, despite the company’s unique profitability in the BNPL sector.

With a modest price-to-sales ratio of 2.6 and a price-to-earnings ratio of 17.4, it will be interesting to see whether today’s growth numbers change the market’s sentiment.

Finally, if you’re interested in the changing payments landscape and wondering if there are other fintech investing opportunities apart from the saturated BNPL space, check out our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here