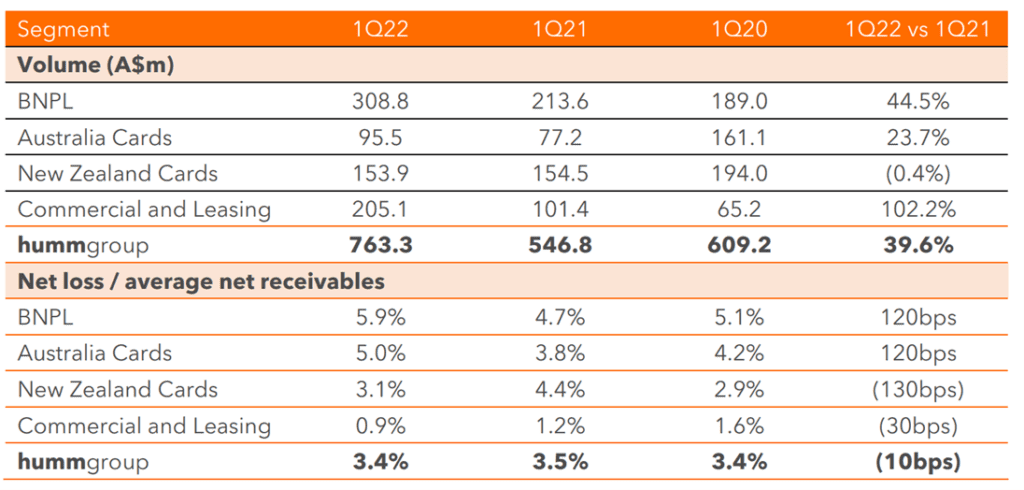

The Humm Group Ltd [ASX:HUM] registered volume of $763.3 million in 1Q22, up almost 40% on the previous corresponding period.

HUM’s BNPL segment volume stood at $308.8 million, up 44.5%.

Despite the solid growth, the market was somewhat indifferent. Humm Group Ltd [ASX:HUM] share price is currently trading at 91 cents per share, up slightly by 0.6%.

While HUM continued to improve its key metrics, it was another BNPL stock that jumped on good quarterly numbers.

Laybuy Holdings Ltd [ASX:LBY] was up as much as 15% in early trade as it delivered record Q2 results and secured new debt facilities.

Both LBY and HUM, however, are down over the last 12 months, with LBY down 70% and HUM down 19%.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Humm continues to grow its top line

Humm today released its unaudited financial results for the quarter ended 30 September 2021.

As already mentioned, HUM’s group transaction volume rose 39.6% in 1Q22 over 1Q21.

That said, total transaction volume was up only 25% on 1Q20, with many of HUM’s key segments regressing in 1Q21.

1Q22 saw BNPL become Humm’s largest volume segment, surpassing its cards segment.

BNPL volume this quarter rose 44.5% to $308.8 million while the cards segment (ANZ) rose a modest 7.6% to $249.4 million.

Total Humm customers stood at 2.7 million on 30 September, up 6.1% on the prior corresponding period with BNPL customers rising 16%.

BNPL customer growth was offset by a fall in customers linked to a few grandfathered consumer products.

While higher income-generating ‘Big Things’ BNPL volume grew only of 2.5% — impacted by store closures in NSW, Victoria, and Auckland — ‘Little things’ volume increased 156.8%, driven by e-commerce transactions during lockdown.

Despite the top line growth, HUM posted a net loss (gross write offs net of recoveries) of $24 million this quarter, up 9.3%.

Humm attributed this to receivables growth.

Seeking to expand, the fintech also announced the pricing of $390 million of asset-backed securities for receivables originated through HUM’s flexicommercial segment.

Humm Group Chief Executive Officer Rebecca James commented:

‘We are extremely pleased with the growth momentum across the Group considering key markets were predominantly in lockdown during the quarter.

‘BNPL growth remains strong with humm “Little things” in Australia up 157% in 1Q22 which more than offset the smaller growth of 3% in “Big things” which was impacted by lockdowns.

‘The Company’s overall volume growth of 40% highlights the advantages of our diversified portfolio offering products able to finance smaller and larger items seamlessly, for both consumers and SMEs.’

.

If you’re interested in the changing payments landscape and wondering if there are other fintech investing opportunities apart from the saturated BNPL space, check out our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here