In today’s Money Morning…lithium stocks are firmly in the spotlight at the moment…mainstream press isn’t always right, but commodities bull is all about psychology…Murray’s list of open positions reflects what the market is throwing up…and more…

Yesterday, Ryan Dinse wrote to you about the clean energy revolution that could be set for lift-off if the US gets its infrastructure bill over the line.

And lithium stocks are firmly in the spotlight at the moment, but where can you look for the less obvious opportunities?

At Exponential Stock Investor, these types of opportunities were what our ‘Clean Energy Second Order’ thesis was all about:

|

|

|

Source: Tradesmith |

But there’s a broad-based commodities beast forming at the moment as inflation beyond central bankers’ wildest nightmares threatens to set off a boom like no other.

Gold is starting to move while agricultural commodities and industrial metals with exposure to tech applications bolted long ago.

Always a bit late, the commentary coming out of the big outlets is starting to shift…

Mainstream press isn’t always right, but commodities bull is all about psychology

Here’s how the Australian Financial Review recently covered the topic of commodities:

‘Given the unprecedented monetary and policy support already in place for the US economy, Stephen Miller, strategist at GSFM, believes inflation pressures may be more persistent than the temporary upturn the Fed is envisaging. Last week’s PMI data showed the prices paid index of the survey rose to the highest in about 40 years, the strategist said.

‘Monetary policy accommodation, fiscal impetus, a large pool of savings, inventory shortages, supply chain constraints and regulatory changes such as the minimum wage are factors that could result in longer-lasting price pressures. “These things are quite meaningful and there might be some transitory elements to them, but I think there are also some persistent elements,” the strategist said.

‘“It’s a real and present danger,” he said. “If that inflation genie gets out of the bottle, it can build upon itself.”’

Now, as much as I don’t like what the mainstream mastheads throw up, this is not confirmation bias.

Instead, this is the way I think about it.

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

Firstly, the commodities as a hedge against inflation hypothesis requires the two core psychological elements: greed and fear.

You’ve heard the Buffett quote before about being greedy when others are fearful, and maybe even the Albert Einstein quote which refers to three forces (greed, fear, and stupidity), but have you heard of this one:

‘Greed, like the love of comfort, is a kind of fear.’

Cyril Connolly

I reckon the old English literary critic was onto something there.

And it’s not different for markets — the two aren’t diametrically opposed.

You see, they actually work in concert to produce huge booms.

First, fear of inflation — that’s how you get the huge rise up the charts across pretty much all commodities that’s just taken place.

Second, greed kicks in as investors chase the companies that produce these commodities higher up the chart as their profits start to swell.

This one-two punch of the two primary emotions in the market makes for the perfect storm.

When it hits the mainstream press it just adds fuel to the fire.

Bottom line, there’s no point trying to be a contrarian here because this is a deeply psychological phenomenon.

So, how can you trade a looming commodities boom?

Enter veteran trader, Murray Dawes.

Murray’s list of open positions reflects what the market is throwing up

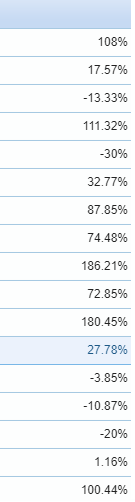

I did a bit of a dive into Murray’s open positions again to see what he’s up to.

From what I can tell, he’s got 10 commodities stocks out of 17 total open positions:

|

|

|

Source: Tradesmith |

Needless to say, he’s crushing it.

But it’s not just about the returns, it’s how he does it.

I see a range of commodities companies in there, uranium, lithium, mining services, a couple energy stocks, rare earths, and some gold.

Murray is a technical analysis specialist that also has a deep understanding of macroeconomic trends.

The macro picture informs where he goes hunting for trades with the right setup.

Once he’s identified a chart with a good setup, he then meticulously plans his trades to reduce risk.

This is how he takes the psychological element out of his trades.

No fear, no greed, just disciplined trading to ensure your P and L column looks healthy.

Let the market have a conniption or enter full-blown euphoria.

Doesn’t matter, your job as trader is simply to follow the money and enter and exit at the right points.

So, when the commodities bull enters overdrive mode, you know what to do.

Better yet, get a head start on it — I can’t stress Murray’s trading acumen enough.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here