Many people hate reading about the manipulation in the gold price.

It almost sounds like a sore loser who didn’t get his way.

Those who cry manipulation are certainly a bunch of conspiracy theorists, like those people who believe in space aliens running mankind and that school is meant to indoctrinate children to conform.

I mean, the market is supposed to be perfectly competitive — the power of supply and demand is what drives prices.

Plain and simple.

Right?

But should we dismiss the notion that the way gold behaves isn’t consistent with a free market?

Mysterious spikes and dips at certain time periods

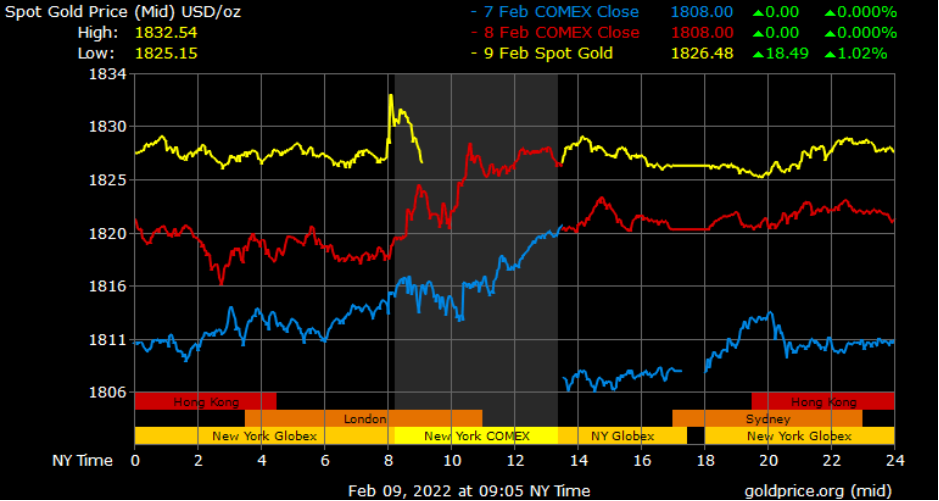

The New York Global Exchange (Globex) and Commodities Exchange (Comex) quote the official spot price of gold. The chart below shows the times when the spot gold price is quoted on these two exchanges, as well as the major international markets that are trading:

|

|

| Source: Goldprice.org |

You can see that the gold market trades 23 out of 24 hours every weekday. The one hour where trading doesn’t occur is usually between 9:00–10:00am Sydney time, just before the Australian Stock Exchange opens.

Gold enthusiasts have found that the gold price can usually move abruptly when the major markets in Hong Kong, London, and Sydney change over.

Movements of as much as US$100 an ounce can occur in these periods.

But to suggest anything suspicious about this is generally regarded as taboo in a public gathering.

Yes, stop being paranoid.

Or is that what the central bankers, financial institutions, and their captive mainstream media companies want you to think?

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Top-down planned economies, price controls, and rigged markets

In June 2021, I wrote an article about central banks, monetary policy, and price fixing. I presented to you how the Reserve Bank of Australia and other central banks around the world set the overnight interest rates as a means to achieve economic stability.

Put it any way you like, this is basically price fixing.

The overnight interest rate determines the short-term price of risk in our fiat currency system. This has a bearing on asset prices and lending rates.

I argued that even if the rest of the market is allowed to function purely by the forces of supply and demand, the system is still underpinned by a centrally planned base.

Therefore, price fixing or targeting can occur at anytime and anywhere.

The price of gold, and many stocks or cryptocurrencies for that matter, have seen movements that suggest these can occur regularly and predictably.

As to why this happens, please entertain the following idea in your mind.

Central bank mandates and running a monopoly on the monetary supply

Most of you hear time and again that central banks are essential institutions in our economy. Their task is to provide economic stability and encourage full employment.

It is as if without them, the free market cannot function properly.

Therefore, you have economists and former banking bigwigs sitting around the table deciding what is the rate of interest that will ensure a smooth economy.

It sounds benign.

However, the reality is that these central banks are working to ensure that their fiat currency remains the pre-eminent instrument of exchange.

Remember that central banks and other banks have a role in creating currency and putting it into circulation.

Take a $50 bill and look at the order of the signatures.

In the US, it is even clearer. The US dollar is a Federal Reserve note.

The central banks effectively lend to the government, putting this debt into circulation.

Monetary policy is about ensuring the stability of their ‘money’. They earn interest from us through lending or through tax revenues.

Alternative money is competition for them. Gold, precious metals, and cryptocurrencies all have their use as a means of exchange. These assets rising in price over time signifies the falling value of their fiat currency and vice versa.

Read that last paragraph again. It is key to understanding why central banks fear inflation more than deflation.

They want you to think it is the other way round.

Earning profits through grasping the right price dynamics

I’ve had several readers write to me asking why I rarely talk about the movements in the amount of physical gold that central banks, jewellers, and gold ETFs buy or sell in my analysis on gold.

It’s a very good question. It’s like asking why a diver is going into the water without an oxygen tank.

My reason is that I believe the central planning we have right now nullifies these dynamics.

The digital contracts determine the price of gold.

This market consists of traders in financial institutions, producers hedging their gold production, and speculators seeking to make a quick buck.

And central banks, investment banks, as well as the Bank of International Settlements (look up the name Benoit Gilson) have deep pockets. It’s their playing field, and they own the scoreboard (at least for now).

I see movements in physical gold holdings as the market participants responding to the price dynamics. The price movement is likely planned by the powers that be.

Personally, I believe that trying to predict the price of gold is like trying to read your opponent dressed in a balaclava.

I prefer formulating my strategies watching how the gold price moves and how gold stocks respond. I can identify value this way and find stocks with the most potential.

A master chess player does not simply guess what are the next moves his opponent will make. He must respond to the moves as his opponent makes them.

It has served me well. And I’ve shared my insights with my readers.

Jump in now and get started on building a solid gold portfolio.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments