Chad Hurley, Steve Chen and Jawed Karim…

Do those names mean anything to you?

Probably not…

But there’s a very good chance you use their product regularly (a 1 in 3 chance actually).

These three 20-somethings came out of nowhere in 2006 and sold their video-sharing website for US$1.65 billion…then vanished back into semi-obscurity.

Today, that same video-sharing website is worth US$455 billion!

It’s the second biggest search engine in the world.

And it’s called YouTube…

***

The story of Chad, Steve and Jawed is the archetypal start-up success story.

A combination of luck, youthful ignorance, grit, and brilliance all rolled into one.

But above all, it was a case of having the right product at the right time in the right space.

I love studying case studies like this.

As an investor in exponential technology stocks, it pays to examine these famed tales so you can recognise where new ones might be emerging.

While every success is different, there is a framework for hunting down the next tech giant.

It all comes down to timing…or nailing the inflection point as I call it.

Right now, as artificial intelligence (AI) creeps its way towards its own ‘gradually then suddenly’ moment, I think this case study is an important one to look at.

We all know the internet changed the game for many industries.

And it seems clear to me that AI could do something similar again.

But how do you invest through it?

That’s the topic for today…

From zero to a billion (in just two years)

It all started at a dinner party in 2004…

The PayPal colleagues, Chad, Steve, and Jawed were chatting about how hard it was to share videos online.

They hit upon a brilliant idea!

No, not YouTube.

Their first idea was a video dating site with the tagline ‘Tune in, Hook up.’

While the success of apps like Tinder a decade later would prove the viability of this idea, the world wasn’t ready for it in 2004.

The idea bombed.

Undeterred, the trio brainstormed a new idea – they called it YouTube.

The idea of YouTube stuck to their original premise that it was hard to share videos online.

In a nutshell, YouTube made it simple to share any video, no matter what.

The first ever video posted to YouTube was of Jawed at the zoo talking about elephants.

You can watch it here.

This remarkably simple idea hit the mark.

With no external investment, YouTube quickly grew from a garage start-up to a global phenomenon at an incredible pace.

Within one year YouTube was getting 100 million daily views and 65,000 new videos were being uploaded daily.

By 2006 the trio were cutting billion-dollar deals with every big media company.

And that’s when Google – another famous tech start-up success story – swooped in and bought the site for the seemingly astronomical fee of US$1.65 billion.

As it turns out, it ended up being a bargain given what this platform has transformed into today!

Over the next few years, Chad, Steve, and Jawed stepped away from the company and have mostly taken back-seat investment roles, staying out of the limelight.

Though, Chad did also buy his own NBL basketball team (Golden State Warriors)!

What an amazing story.

In just two years, the trio went from average employees to near billionaires.

Delivering a product that now has 2.6 billion users worldwide.

So, what can we take away from their incredible story?

Three lessons for investors

The first is timing.

YouTube might have been a dud if it had been released a few years earlier when internet speeds were slower.

Before 2004, there were ways to share videos online. However, due to very low bandwidth, the quality was very poor, and there were frequent latency issues.

It wasn’t until 2002 that VHS quality became technically possible online.

YouTube hit the sweet spot in terms of creating a product using the latest capabilities before anyone had noticed.

Which brings me to the second point.

Big companies are bad at innovating!

A lot of investors overestimate the incumbent’s ability to compete against innovation.

But the history of tech is littered with the failure of very high-profile businesses to respond to start-ups.

Kodak and Blockbuster Video are two that quickly come to mind.

Google itself was originally the small garage start-up fighting against the big early tech titans of AOL and Yahoo!.

And look what happened there.

The third lesson is in understanding the power of disruption.

YouTube wasn’t simply a way to do the same old stuff.

It was a new way to do new stuff. And it was a cultural phenomenon.

For example, YouTube launched Justin Bieber, it created the new US$15 billion content creator economy, and it revolutionised how we consume news and entertainment.

To Google’s credit, they must have realised some of this potential when they bought the company in 2006.

And that US$1.65 billion price point looks like a stunning bargain now.

I mean, in 2021, YouTube made a whopping US$28.8 billion in revenue, more than 10% of Google’s overall revenue.

And one-third of the entire internet (2.6 billion people) are active users!

But the biggest lesson…

Solving problems, growing fast

World-changing ideas start from solving simple but common problems.

Paradigm changing technologies create the opening for nimble tech companies to find such solutions.

You won’t find out who the winners are at such times by studying balance sheets and income statements.

You need to think bigger and try to navigate changes at breakneck pace. It can seem like chaos!

But the biggest opportunities for mega gains are in that flux.

And that brings me to AI…

This year, we’re seeing a lot of headlines about AI.

The mainstream press waxes and wanes on it. One minute, it’s an existential threat to humanity; the next, it’s a big, nothing burger!

Both are the wrong way to think about it.

AI is real. It is a step change in what was possible.

It is improving every week, and entrepreneurs are working to create useful things.

Many will fail.

Some will succeed.

The ones that will succeed will create game-changing products.

And their companies will rival the stunning success of the late ’90s ‘internet-era’.

Right now, no one knows who or what they will be.

But I know which ones will succeed…they’ll be the ones solving problems, embracing change, and growing fast.

Those are the ones you need to look out for.

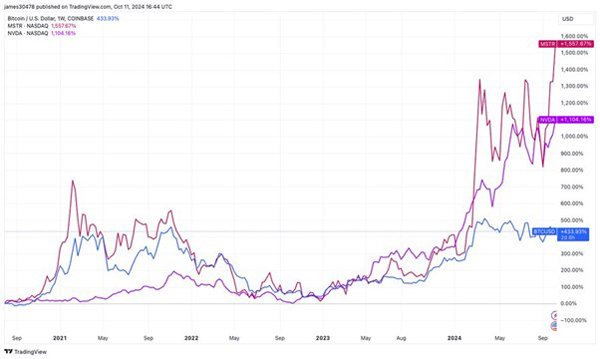

[Editor’s Note: While Nvidia has been in all the headlines for over a year, one stock has massively outperformed it…and it has nothing to do with AI.

The stock is called MicroStrategy, and in 2020, it silently implemented a strategy that it continues to this day.

These are the results:

| |

| Source: Trading View |

That red line is MicroStrategy, and the purple line is Nvidia.

So how did MicroStrategy beat this AI darling? And why haven’t you heard of them… Yet?

Well, I’ll share with you how they did it.

Amazingly, you can do almost the exact same thing today. If I’m right, your results four years from now could be just as good.

Click here to find out more…]

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments