The latest CoreLogic data is out for the month of April and — as we forecast since the end of last year — the market is turning in 2023.

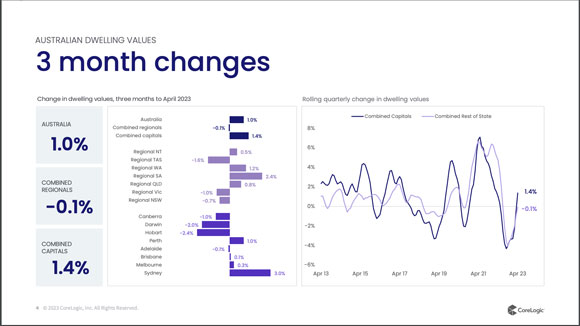

In the three months to April, national values have increased by 1% — led primarily by Sydney and Perth.

In fact, it’s playing out just as Louis Christopher (founder of SQM Research) forecast in his Boom & Bust Housing Report back in November last year.

(You can listen to the chat I had with Louis a day prior to his Boom & Bust Report coming out here.

In it, he outlines why he foresaw Sydney’s dwellings values leading the property market into a modest recovery in 2023.

No other forecaster pinned it!)

Sydney’s dwellings values are now 3.5% higher from their February low. Meanwhile, Perth’s quarterly dwellings values have increased by 1%.

Take a look at the breakdown below.

|

|

| Source: CoreLogic |

The shift comes despite three 0.25% increases in the official cash rate (February, March, and May).

Still, movements in cash rate were the sole item that the major banks and leading financial institutions were basing their forecasts of the 20%+ peak to trough falls on.

‘Australian house prices will bottom out in September this year, falling by 20% from their peak in April 2022, Shane Oliver, chief economist at AMP, has predicted.’ (brokernews.com.au — January 2023)

Assuming the turn sustains, which I expect it will, the peak-to-trough fall in capital city dwelling values over the course of the 2022/3 downturn was just 8.4%.

Considering the exorbitant profits that the majors rake in, and the press attention their economists get — it’s embarrassing that their forecasts are so woefully inaccurate.

Still — for our purposes, it means that the cycle is on track for a potentially strong run to the forecast peak around 2026.

We have a rapidly increasing population.

Overseas migration is on track for around 400,000 this financial year and 315,000 next financial year.

That’s higher than the highest population growth of the resources boom years!

The migrants are flooding into markets that are short on available supply.

Latest ABS data shows a 31% year-on-year drop in loans issued to purchase a new home or construct a new dwelling — the lowest level in 15 years.

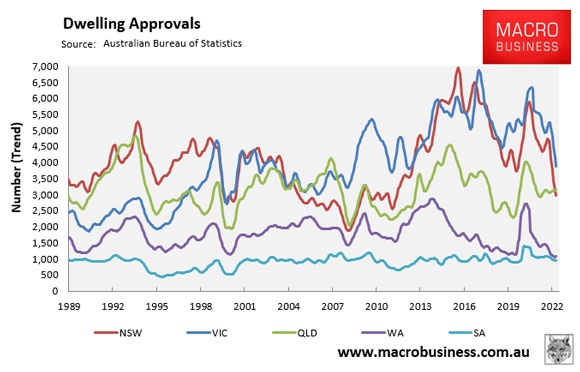

Dwelling approvals are at their lowest level since April 2012.

The markets in Sydney and Melbourne have been affected the most.

|

|

| Source: MacroBusiness |

They’re the two cities where the population growth is forecast to be the strongest.

It means that increases in rental assistance written into the Federal budget — announced last night — will do nothing in the shorter-term other than feed directly into landlord pockets.

Further tax cuts were announced for build-to-rent projects also. However, the corporatisation of the rental market is not designed to produce affordable accommodation for renters — as I pointed out here.

In the US, the rise of build-to-rent has led to the development of ‘rental-backed securities’.

This is one of the hottest products on Wall Street.

Rental-backed securities are similar to the subprime mortgage-backed securities that blew the market up into the GFC.

They bundle together streams of rental payments as collateral.

You already know where this is heading.

Tick tock on the real estate cycle clock.

The budget also gifts a commitment of $2 billion in funding for social rental housing, which will assist in the supply of affordable housing to some extent.

However, it’s not going to substantially off-set the supply/demand conditions that we’re facing right now.

Let’s not forget also, that the First home buyers’ shared equity scheme — previously only available to married or de facto couples and singles — is now expanding to allow friends and family members to ‘identify’ as the definition of a couple, to be eligible to access government funding.

|

|

| Source: Twitter |

It means siblings and friends can now purchase a house together with a deposit as low as 5%, with the federal government acting as guarantor on up to 15% of the loan. From Sky News Australia:

‘Housing Minister Julie Collins said the expansion of the three programs was about “moving to meet the times”.

‘“Households have changed, and the Albanese government is moving to meet the times,” she said.

“We know friends and family members are already teaming up to secure their own place to call home.

“Our actions will allow them to access vital assistance, just as couples have been able to previously.”

‘Minister Collins also announced the expanded scheme would be applied to permanent residents as well as Australian citizens, in a move likely designed to ease pressure on the housing market ahead of an influx of migrants expected over the coming 18 months.’

There are limitations on the price of a property eligible to meet the criteria.

However, it will undoubtedly have a price multiplier effect across all market sections — giving those selling at the lower end more to leverage up the mythological property ladder.

In short — lack of listings, soaring rents, record immigration, and home buyer incentives are proving again and again, that you cannot analyse the market through a one-eyed lens of interest rates alone.

Without an understanding of the timing of the 18-year property cycle — mainstream analysists are running blind.

They’re unable to foresee the drivers that will eventually take the world’s markets into the next deep land based led recession — into 2028.

As it is, we can tentatively conclude that we’ve passed the bottom of the downward house price cycle.

The next phase into 2024 is the winner’s curse.

The two-year period of irrational exuberance between 2024-2026.

There’s money to be made in the property market for those that purchase prior to prices taking off.

There’s also money to be made in the stock market.

In the second half of the cycle, banking, materials and commodities perform strongly.

Additionally, copper prices explode running into the peak of the real estate cycle.

If you want to learn how to take advantage of the trends — sign up to Cycles, Trends & Forecasts today, and let me walk you through it!

Best Wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments