The rental market couldn’t be tighter.

Properties available for rent are at an all-time low — and falling.

SQM Research recorded a 4.5% drop in listings over the last four weeks.

Sydney and Melbourne are starting to feel the pain, with the number of homes available for rent in Sydney at a five-year low and in Melbourne at a three-year low.

This from SQM Research’s Managing Director Louis Christopher:

‘Rental listings in Sydney and Melbourne are continuing to fall at a time when demand is soaring due to increased migration and local demand, so we’re likely to see vacancies fall further.’

The situation will inevitably be further strained with the Albanese Government confirming a week or so ago that they plan to ramp up immigration to record levels.

Rental demand soars

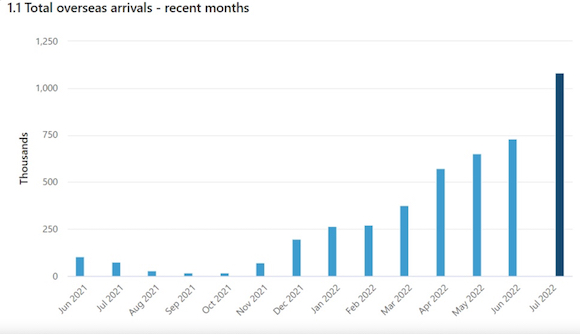

It’s estimated that there were 1.1 million overseas arrivals last month:

|

|

| Source: ABS |

They will likely be capital city renters before they’re buyers.

Migrants flock mostly to Sydney and Melbourne.

This goes some way to explaining why we’re seeing headlines such as:

|

|

| Source: AFR |

That should feed into higher apartment prices over time.

Some suburbs are already seeing it.

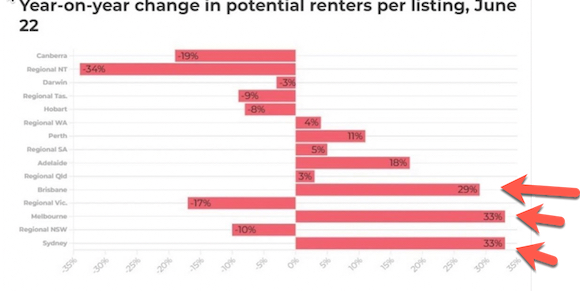

Capital city rentals are also benefitting from a U-turn of workers (at least in part) returning to the city:

|

|

| Source: PropTrack Rental Report |

The sharp increase in rental demand in Brisbane, Melbourne, and Sydney is highlighted on the chart above by the red arrows.

The thing is, there’s no sign of a significant lift in rental supply to ease soaring demand either.

Multiple major construction firms have collapsed due to the cost of building materials and labour shortages.

Steel and timber have escalated by more than 40%. And labour costs have additionally increased by more than 10%.

Long term versus short term

Demand for short-term rentals from strong domestic tourism is stressing the long-term rental market further.

No surprise, considering new research showing the difference in income between a good short-term and long-term let.

Take a look for yourself:

|

|

| Source: The New Daily |

The difference is substantial.

According to the data, a short-term let with good occupancy in Sydney can get 171% more weekly rent than a long-term rental.

That could go some way to explaining why Sunshine Beach house prices have almost tripled in five years.

Property prices in Noosa Shire have lifted a whopping 195.5% over five years to June — the steepest growth of any suburb in the country!

The auction market has picked up over the last few weeks as well.

Likely buoyed by investors searching for yield and the renters that can, jumping into the property market to avoid future rent rises.

Auction stats are not 100% reliable due to the number of unreported results that need to be chased up mid-weekly.

However, the percentage change from week to week is a leading indicator to changes in market prices. So it’s something I watch closely.

Saturday’s results once again showed a marginal uplift of activity in Melbourne.

An auction I attended in Melbourne’s Mill Park sold for more than $100K above reserve, with multiple bidders.

It wasn’t the only one either…

‘A surging suburban auction that smashed its reserve by an incredible $385,000 has market experts saying homebuyers no longer fear interest rate rises.

‘Multiple homes sold hundreds of thousands of dollars above reserve yesterday as Victoria’s auction market recorded an 66 per cent clearance rate from 476 reported results, according to preliminary PropTrack figures.

‘A Wantirna South house was arguable the day’s most impressive result, sold for $1.74m and earning its owners an incredible $385,000 premium above their reserve.’

The Herald Sun

Makes me wonder how inaccurate ANZ’s call for an 18% drop in prices through 2023–24 will be!

‘We expect capital city prices to fall 18 per cent over the balance of 2022 and 2023, before a 5 per cent gain in 2024 as mortgage rates fall.’

The problem is that real rates (adjusted for inflation) are sitting around -4.25%.

Something Terry McCrann noted the other week in The Weekend Australian — arguing that the RBA interest rate hikes are, in fact, ‘super stimulatory’:

‘Now the RBA’s cash rate is up to 1.85 per cent. But inflation for the year to June was 6.1 per cent.

‘In real terms, over the year so far, the RBA has cut its official rate — from minus 3.4 per cent to minus 4.25 per cent; going from super-stimulatory to even more super-stimulatory.’

Have faith in the property cycle

That’s not to say it’s an easy ride for mortgage holders right now.

But hikes in the cash rate are clearly not crashing the property market either.

Let’s not forget that the major banks have an appalling track record for accuracy in their forecasts.

They’re like lousy weather forecasters.

The outlook flips depending on what’s happening in the moment.

Hence why in 2020, the forecasts of a 30% crash flipped as soon as buyers started rampaging into the market.

The problem is, with no overriding knowledge of the property cycle, they’re blind.

You, as an investor, don’t need to be.

To find out why — click here!

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia