I was reading comments on HotCopper yet again, because I find it so fascinating, and came across a comment that made me laugh out loud.

The guy asked how he could find out about stocks before they jumped higher because he always seemed to find out about them too late.

You can’t fault his question. It’s a great question. Probably the best question one can ask.

But I’ve spent the last three decades working on an answer to that very question and yet this guy thought someone might be kind enough to answer it for him and save him the hard work.

I think it shows quite clearly that the markets are being flooded by noobs, as my five-year-old Daniel would call them.

People who really haven’t got a clue what they are doing, but the market has been going up and they are bored at home during COVID, so why not punt on stocks? Seems easy. Press a few buttons and you’re making money.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Monitoring HotCopper is actually quite valuable. If I could work out a way to create an algorithm that graded the level of hysteria on HotCopper, I reckon I could make a motza from it.

The little stock that had them frothing at the mouth yesterday was Oakdale Resources Ltd [ASX:OAR].

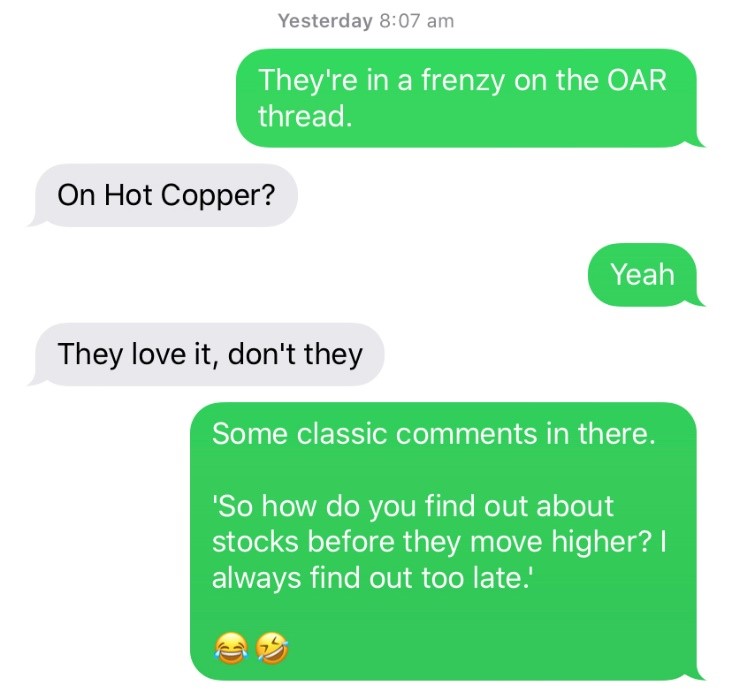

I was monitoring the thread over the weekend and saw the levels of excitement hitting fever pitch. I sent a text to a trader mate of mine on Monday morning before the market opened…

Text sent at 8:07am Monday morning

|

|

|

Source: Murray Dawes |

The game on HotCopper appears to be getting as many likes on a thread as possible so it goes up the HotCopper rankings and sits at the top of the site as one of the most discussed stocks of the day.

That’s when every Tom, Dick, and Harriette finds out about it and sees the price going up and decides to join in on the fun.

Oakdale Resources went up 34% from 2.3 cents to 3.1 cents over the day yesterday, with 259 million shares changing hands out of a total of 1.63 billion shares on issue.

That’s a 16% turnover of shares on issue in one day.

There’s also about 500 million options with a 4-cent strike and an expiry of late 2021.

I’m not knocking the stock. It may be going to the moon. They have a few interesting irons in the fire, such as nearology to Chalice Gold Mines Ltd’s [ASX:CHN] Julimar discovery. They will also be drilling for gold in Nevada soon and they have a gold processing plant in Peru that could actually provide them with some cash flow (unheard of for an explorer).

But the chain of events that led to the 34% jump in the price of the stock yesterday may not be about a rerate in the price due to known shifts in fundamental value.

There is a sea of punters out there hungry for action and they have had their appetite whet by the US Fed’s hockey stick save of markets since the crash.

Oakdale Resources is still in the ‘top rated posts’ section of the website and it’s had 216,000 views so far, and I’m sure after my article that number will continue to grow.

I am not making a recommendation one way or the other on the stock. I haven’t done enough due diligence on it.

All I am saying is that the inexperienced punter needs to keep their wits about them and consider whether they are like the guy who said he keeps finding out about stocks too late.

The music can stop in the blink of an eye

When the pump is on it all seems so simple. But the music can stop in the blink of an eye. If you haven’t been managing your position actively you will be staring at the screen watching the price plummet wondering why you thought it would be a good idea to buy a million shares.

If you want to get involved trading small-cap stocks, you should consider getting some professional guidance. Ryan Dinse’s Exponential Stock Investor hunts for stocks that can blast off, but he manages the positions to ensure you aren’t taking completely wild, unguided risks. You can check out what he’s up to here.

Ryan thinks we are in the early stages of a new bull market in commodities and he is getting investors’ portfolios positioned for it.

I have started taking action to lower risk in the portfolio of my trading service Pivot Trader. I sent out an alert last Thursday to hedge half the portfolio because I reckon US equities are looking toppy.

The virus appears to be picking up steam in Europe, and the US election is now just around the corner.

One of the cornerstones of my approach to trading markets is that false breaks occur far more often than breakouts.

The S&P 500 looks like it is in the early stages of having a false break of the high set in February before the crash. Even if prices are ultimately heading higher, we can see a sharp correction from these levels, and I’d prefer to lower risk now and see how things play out.

The S&P 500 was down nearly 100 points during the session last night and saw a late bounce to close down 38 points at 3,281. Gold was also hit hard, trading as low as US$1,882 before bouncing to close down 2% at $1,912.

Other commodities also saw stiff selling pressure and oil, copper, nickel, and zinc fell by 2–4%.

The rally from the lows in the crash has been mind-blowing and there will be plenty of support on the way down, so I’m not calling for another crash.

But when I look at the bearish technical setup and read the frenzied comments on HotCopper with literally thousands of people chasing a penny dreadful explorer that may be worth nothing, my gut tells me that we are getting close to a good old-fashioned correction.

Regards,

|

Murray Dawes,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.