Broken supply chains, geopolitical tensions, war, inflation, rising energy costs, food crisis, droughts, famine, depleting mines…Welcome to the 2020s!

The patterns defining this decade suggest more volatility is on the way…especially in the things that matter most…food, energy and shelter.

It’s why investors should be focusing on commodities.

A perfect storm of tight supply that spans minerals, oil, gas, food and water is approaching.

This has been the key theme behind my Diggers & Drillers service since launching 12 months ago.

As a former geologist I’ve had a front row seat to the future problem of supply.

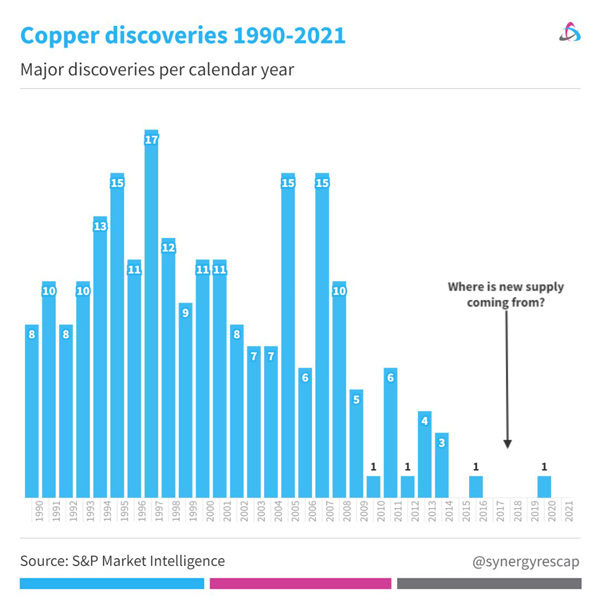

Just take a look at the graph below showing the number of copper discoveries over the last 30 years.

| |

| Source: S&P Market Intelligence |

It’s simple maths: as populations continue to grow we’re finding less of the things we need most.

The SUPPLY problem is crystal clear.

But what’s not so easy to predict is DEMAND

Of course, there’s the green energy transition.

Any number of analysts have declared a five-fold, ten-fold or even 20-fold increase in demand for any particular future facing commodity.

But these projections are guesses. They’re meaningless statistics.

That’s why I’ve kept my focus on supply.

Yet, there is one aspect to the green energy transition where DEMAND is clear….

Power grids built in the ‘age of oil’ are useless in an electrified economy.

As you know, governments are set to phase out fossil fuels and replace them with wind turbines and solar panels.

But there’s a problem…renewables are NOT energy dense.

First, wind and solar farms HAVE to be big — way bigger than traditional power stations to generate the same output.

That’s also why they’re typically found way out in the country, because you need a lot of empty land.

Even then, you can’t just put them anywhere.

Wind farms have to be where the wind blows, typically at altitude.

Solar farms need to be where the sun shines.

That’s why there are currently 18 solar farms in rural Queensland, the ‘Sunshine State’, but only seven in Victoria.

Basically, to make renewables work, you need a lot of wind, a lot of unobstructed sun, and a lot of uninhabited land.

By definition, those are places where nobody lives.

To bring this electricity from rural areas to the CITIES — where over 90% of Australians live — we’ll need 10,000 kilometres of NEW transmission cables.

That’s more than the entire width of Australia, coast to coast, twice over.

But the story doesn’t stop there.

Governments in Asia, North America, and Europe require even larger projects.

For example, Sweden just decided to replace 16,000 kilometres of cabling to enhance their national electrical grid.

In India, this number goes up to 27,000 kilometres.

Meanwhile, in the United States, they’re constructing over 75,000 kilometres of new cables to meet the demands of Full Electrification.

But here’s the big problem — these new cables don’t exist yet.

The Net Zero ‘movement’ has been preoccupied with energy generation…whether that’s solar panels, wind turbines or nuclear.

It’s also heavily focused on transport…EV’s.

But very few have considered the LIMITATIONS of the existing energy grid.

The critical link that connects power generation to the end consumer.

The nuts and bolts of the green energy movement.

But replacing decades old power lines won’t come easily or cheaply…

According to Bloomberg NEF, nations will need to spend AT LEAST US$21.4 trillion to upgrade existing grid networks.

This is why you only need ONE metal in your portfolio

No doubt, technological advancements will smooth out the bumpy ride to Net Zero.

Engineers are focused on developing renewable technologies that eliminate certain critical metals.

Take the iron-air battery…it’s expected to cost just one tenth of a traditional Li-ion battery.

As the name suggests the primary metal uses iron, a highly abundant metal in the earth’s crust.

If commercial trials prove effective, this could wipe out the outlook for lithium and graphite miners currently feeding the Li-ion battery revolution.

Technology remains a key threat to critical mineral developers.

But the laws of physics ensure ONE metal will hold its throne in the adoption towards electrification.

Thanks to its unique properties, including supreme ability to conduct electricity and form long strands of wire…

COPPER will be the only option available in rebuilding global power grids.

Electrification is a megatrend.

It offers enormous opportunities across tech, mining and infrastructure.

But copper is a clear bet in this multi-trillion dollar undertaking.

As part of my brand new presentation, I’ll be profiling TWO Aussie explorers set to gain upside from this trend.

Both companies hold large, high grade copper deposits in one of the safest places to mine on earth.

From my experience, these are the factors that drive juniors up the development cycle, into production.

That makes them ideally positioned to deliver copper to market just as the world needs more of it.

The sweet spot of the mining life cycle when miners hit maidan production just as prices begin to rise.

That’s what a copper company I worked for in the last mining did…Equinox Minerals.

A small junior that rose into a $7.5 billion giant as it entered production on the back of surging copper prices.

I believe these two explorers are about to re-play the Equinox handbook…

Watch this just-released presentation for more info.

Enjoy!

Regards,

|

James Cooper,

Editor, Fat Tail Daily

Comments