‘Is Inflation Dead?’

That was the question Bloomberg Businessweek asked in April 2019 on their cover. It ran with this catchy picture:

| |

| Source: Bloomberg Businessweek |

At the time, central banks had been injecting money for years into the economy while keeping interest rates at record lows. Yet, inflation was nowhere to be seen.

As one of the articles inside the magazine commented:

‘If economics were literature, the story of what happened to inflation would be a gripping whodunit. Did inflation perish of natural causes — a weak economy, for instance? Was it killed by central banks, with high interest rates the murder weapon? Or is it not dead at all but just lurking, soon to return with a vengeance?

‘At a press conference on March 20, Fed Chairman Jerome Powell said low inflation is “one of the major challenges of our time”.’

Famous last words…

The pandemic hit shortly after, and central banks pumped even more amounts of cheap money into the economy.

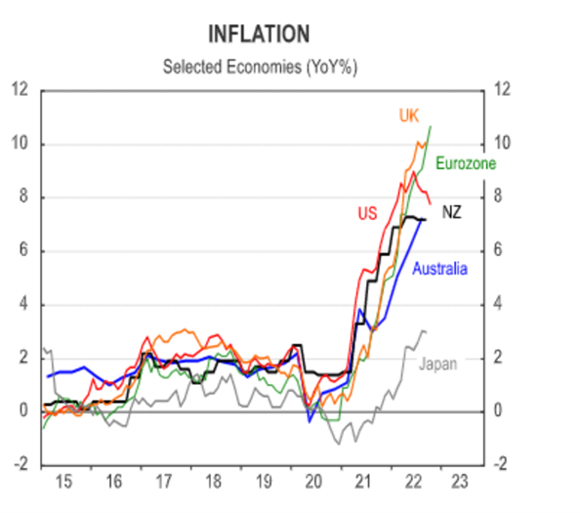

All that cheap money sloshing around, the reopening after COVID, supply chain disruptions, and the Ukraine-Russia war saw inflation ‘return with a vengeance’, as you can see below:

| |

| Source: Firstlinks |

While we’ve recently seen some better numbers on inflation in the US, inflation remains high. People are concerned about higher prices and paying off their mortgages.

There is no denying 2022 has been a tough year for investors, and, ready or not, here comes 2023…

Be wary when interest rates are rising

It’s clear that last year central banks made a big mistake by brushing off inflation as transitory.

By the time they started raising rates, it was too late in the game.

Now central banks seem intent on raising rates into the new year. The Fed, the European Central Bank, and overnight, the Bank of Japan surprised markets.

The bank said they would allow the 10-year bond yield to move to plus or negative 0.5%, which could spell the beginning of the end of their loose monetary policy.

As former BOJ official Masamichi Adachi put it:

‘Whatever the BOJ calls this, it is a step toward an exit. This opens a door for a possible rate hike in 2023 under a new governorship.’

Investors, on the other hand, are trying to figure out when the Fed will stop hiking and start lowering interest rates…and individual and institutional investors are holding onto stocks.

From The Wall Street Journal:

‘During the wildest year for global markets since 2008, individual investors have been doubling down on stocks. Many professionals, on the other hand, appear to have bailed out.

‘U.S. equity mutual and exchange-traded funds, which are popular among individual investors, have attracted more than US $100 billion in net inflows this year, one of the highest amounts on record in EPFR data going back to 2000.

‘Ben Snider, a managing director at Goldman Sachs, said institutional and individual investors often dump stocks in tandem when the economy is slowing and indexes are tumbling. That doesn’t appear to have happened this year, despite the S&P 500’s decline.

‘“The fact that you have not seen very much selling from households is surprising,” Mr. Snider said.

‘U.S. households typically sell about US$10 billion in stocks after the S&P 500 falls at least 10% from its peak. Investors yanked money from stock funds in 2015 and 2018, the last times the index suffered annual losses, EPFR data show.’

While I still think central banks will have to pivot in the near future, there is a very real possibility that they will keep tightening well into next year…

They could tighten too much for too long, causing a huge increase in unemployment and a recession.

I mean, it’s certainly happened before. Often recessions have happened just as the Fed stopped raising or pivoted into lower rates.

In dangerous times like this, one of the best things you can do is get your house in order. That is, prioritise securing what you have and wealth preservation.

We have no idea how the next year will play out, so I think it’s a case of preparing for the worst but hoping for the best.

It’s not all doom and gloom though

Around this time last year, I wrote about the one commodity to get exposure to in 2022: lithium. And it didn’t disappoint. Lithium carbonate prices are up 186% since last year, according to Benchmark Minerals.

And at the moment, to me, commodities still look like the best plays out there into the next year.

This is due to a couple of reasons. For one, with energy prices remaining high, there’s still plenty of incentive to continue to invest in energy security and renewable energy.

And then, China finally reopening could create more demand for commodities.

Of course, commodities would take a hit if there were a massive crisis. But then, don’t forget that commodities are real assets.

So things like gold, silver, iron ore, and critical minerals — like graphite and nickel — are something to keep an eye out for in the new year.

That’s it from me for this year. I hope you enjoy the holidays and wish you all the best in the new year.

All the best,

|

Selva Freigedo,

For Money Morning