Earlier this week, my colleague Ryan Dinse pondered what the market response to the Fed would be.

In his own words:

‘For example, if the Fed surprise us with a 0.5% rise, you should expect to see sharp falls across most major markets.

‘If they decide not to raise at all — the so-called pivot the bulls are banking on — then this rally might go into overdrive.

‘As my colleague and our Editorial Director Greg Canavan remarked in an internal discussion:

“If the Fed caves and goes all dovish, cover your shorts!”

‘But the odds-on result is they do indeed raise by 0.25%.

‘If that happens, the market will go back to trying to guess what they’ll do in future meetings and we may see a period of volatile sideways action as bets are made on this.’

The punters certainly got it right this time with the Fed delivering a 0.25% hike overnight, but the bigger story was the massive spike across the Nasdaq following Powell’s comments:

|

|

| Source: Google |

You can see the stark response for yourself right around 2:30pm, smack-bang in the middle of Powell’s presser.

So, what did he say to stir the bulls?

The unwind is underway

As far as anyone can tell, it seems Powell’s admission that the ‘disinflation process has started’ was enough to spur a mini market rally. It certainly helped that the Fed chair was quick to reassure the public on his ability to switch to looser monetary policies if need be:

‘If we feel like we’ve gone too far, and inflation is coming down faster than we expect, then we have tools that would work on that,’

And this, in my view, is perhaps the key point.

Because while interest rates have always been imperfect in terms of their ability to control the levels of cash in an economy, they’re typically better at increasing liquidity compared to restricting it.

In other words, it’s far easier (and usually quicker) for the Fed to get the desired response with rate cuts than rate hikes. The real question is just how stubborn Powell and co may be in releasing the floodgates.

After all, it’s not like the US has beaten inflation just yet.

Powell was quick to point out that today’s rates rise isn’t likely to be the last. He still foresees a need for a ‘couple more rate hikes’.

But for the forecasters and market predictors out there, it seems many are now banking on cuts starting in the second half of this year:

|

|

| Source: Bloomberg/Zero Hedge |

As the chart above shows, terminal rate expectations dropped significantly. And expectations for cuts in the second half of 2023 (H2) plummeted even lower.

Despite this overnight jubilation, I wouldn’t get carried away.

There are still some big concerns and big challenges ahead for not only the US economy, but the entire globe…

Too little, too late

One thing to keep in mind is that inflation, as we were saying when it was going up, is a lagging indicator.

The Fed is using data that’s likely months old to try and gauge its policies. This means that even when the cuts do come, we could see inflation data continue to reflect declines because of the lag.

As a result, central bankers have to play a game of chicken as to when they pull the trigger. For Powell, this is made even tougher as he not only has to accurately predict the turning point, but also ensure he doesn’t wait too long and crash the world’s largest economy in the process.

Powell is obviously confident he can avoid doing this and deliver the ‘soft landing’ he keeps promising. But talk is cheap, as they say.

Remember, this is the same guy who told the world inflation wasn’t a problem in late 2021 and had to admit he got that wrong in 2022. Whether it was ignorance or stupidity, you shouldn’t blindly trust the words of any central bankers, least of all Powell.

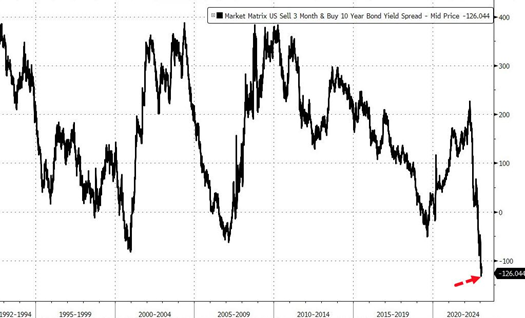

Case in point, just look at how deep the inversion of the yield curve has become:

|

|

| Source: Bloomberg/Zero Hedge |

As the chart shows, long-term US treasury yields are deep into negative territory compared to short-term treasuries. This is a bad omen for anyone hoping for that ‘soft landing’.

A yield curve inversion has typically been a reliable indicator for recession in modern times. And when the inversion is as deep as it is currently, it signals that a lot of people are fleeing to long-term bonds to protect themselves from some serious short-term pain.

It obviously doesn’t guarantee a recession, but the signs are certainly there.

Which, of course, begs the question…

Is the Fed’s pivot too little, too late?

Maybe.

But we’ll have to see what the coming weeks and months have in store.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning