How is the COVID-19 health crisis impacting the Australian property market?

There are two real points to make here.

The first relates to what’s likely to happen now.

The second, to what is likely to come next.

I’ll cover it all today.

In a nutshell: There’s bad news for sellers…better news for buyers…and great news for investors and developers.

I’ll explain as we go.

But re that ‘great news’, let me just be clear:

I’m not here to ‘spruik’ property. The market is likely to weaken before the outlook brightens.

Timing is everything here.

This report will tell what you need to know, what to look for…and give you a potential timeline so you can plan your next move.

** Market expert Shae Russell predicts five knock-on effects of the recent market crash that could be even bigger threats to the average investor’s wealth than the crash itself. Learn more. **

First, how did we get here?

There was strong, positive momentum for property at the beginning of 2020.

Sentiment and credit were rebounding after the Banking Royal Commission jolted house prices and caused them to fall off.

Interest rates remained low.

And the traditional tailwinds of infrastructure and population growth were blowing.

Respected forecasting firm SQM Research said Melbourne and Sydney could conceivably see 15% capital growth.

Prices and buyers were responding to this and pushing the market up.

Everything was looking rosy…or at least rosier than it had been.

Enter a once in a century virus outbreak…

Right out of left field, a pandemic emerges from a wet market in Wuhan, China…wreaks devastation on the global population and shuts down the world economy.

People lost their jobs…their businesses…and in some cases, their lives.

The share market has collapsed as people are forced to stay at home in widespread government lockdowns.

The Australian Treasury forecasts the unemployment rate to hit 10% in June.

The Grattan Institute suggests it may worsen.

The outlook would be even worse without the huge government rescue package.

An economic stimulus so big, it amounts to 10% of Australia’s GDP!

None of this helps us make money in property right now

But spare a thought for the sellers…

While we’ve all been stuck at home, real estate transactions have ground to a complete stop.

The nominal reason is that the usual prerequisites to a sale of viewings, inspections, and auctions can’t be met under the lockdown.

But buyers disappear anyway when they suspect prices could fall further and/or their income is no longer secure.

They become more conservative, even if they can still access financing. But many, likely, can’t.

Lenders also become more conservative as they anticipate a surge in bad debts and further job losses.

Already we’re seeing banks and other financial firms become stricter with their lending.

That means it’s almost certain that prices will fall as buying and lending falls back and unemployment rises.

In 2018 we saw a similar dynamic, and it produced a downturn not seen in Australia for 30 years.

Australia’s banks can’t even work out yet how bad the hit is going to be to their business.

So much depends on when the Australian government lifts the lockdown so that economic activity and incomes can recover.

However, we do have a guide from previous real estate downturns.

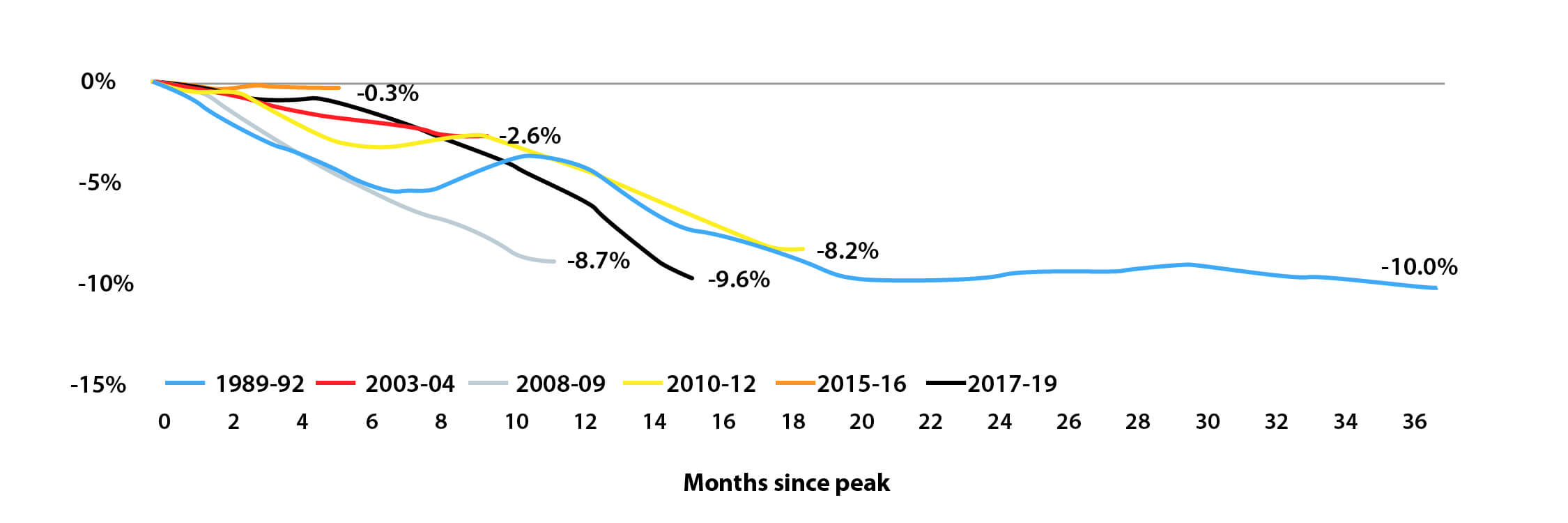

Residential property market downturns typically take 1–1.5 years to play out.

You can see the evidence for this on the chart below…

|

|

|

Source: Corelogic |

I’m using Melbourne data to illustrate this.

It shows the percentage declines from peak levels in 1989, 2003, 2008, 2010, 2015, and 2017.

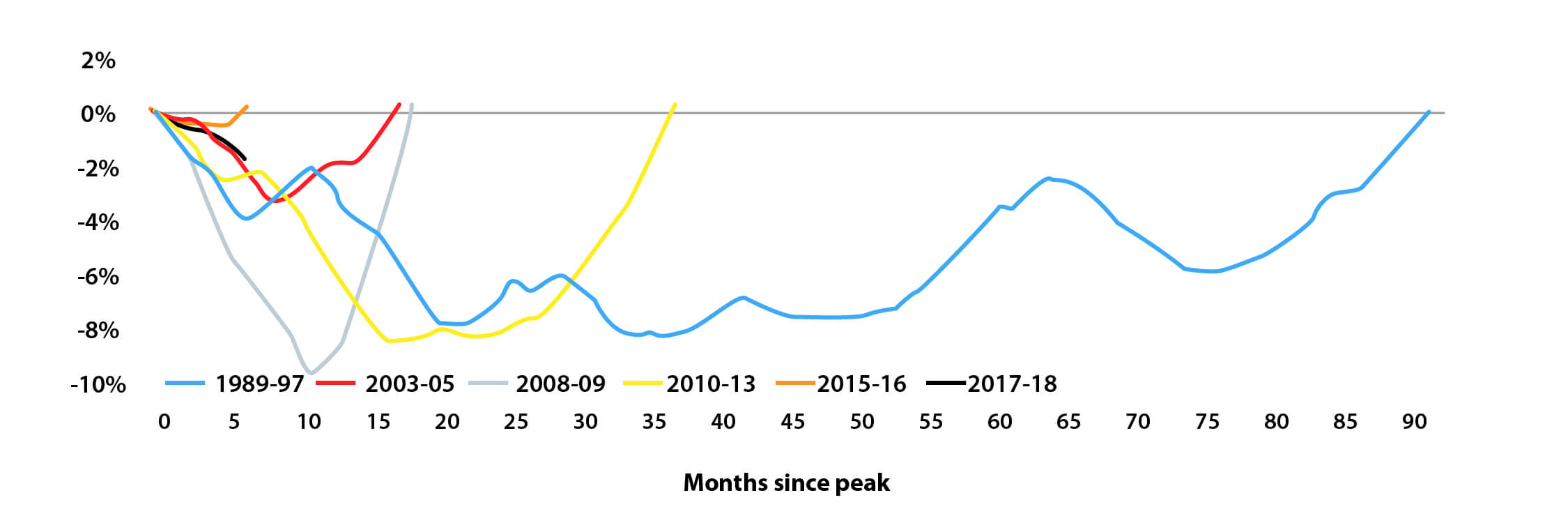

The good news is that the time it generally takes for the market to exceed previous peaks is relatively short in duration.

You can see that below too…

Time below previous peak

(Melbourne)

|

|

|

Source: Corelogic |

Can we expect this downturn to turn around just as quick?

It’s likely.

And that could spell great news for buyers and developers. If you’re cashed up and ready once this market turns, you may find yourself able to acquire prime Aussie real estate at a bargain.

All those suburbs you thought you were priced out of may be back on the table…for a limited time.

By that I mean your opportunity could be big…but short-lived.

One reason is the sheer scale of the Australian government stimulus. It’s big. And it’s going to quickly find its way back to the land.

The JobKeeper package is the biggest government spending package in Australian history.

The separate JobSeeker payment also temporarily doubles unemployment benefits.

[conversion type=”in_post”]

We can also note the following:

- Banks are currently offering mortgage relief for affected borrowers for up to six months.

- The Reserve Bank of Australia is supplying the big banks with cheap funding.

- Other initiatives include Victoria’s $500 million package offering land tax relief to landlords and rent assistance to vulnerable tenants.

Don’t underestimate the lengths the Australian government will go to prop up the economy while this crisis plays out.

RBA Governor Philip Lowe said recently:

‘We are prepared to transact in whatever quantities are necessary to achieve this objective…There are no limits on what we can buy or how much we can buy.’

Government debt-to-GDP was only around 18% before the crisis. That’s low by international standards. And it means there’s TONS of wiggle room for the RBA.

That’s not to say they can prop up jobs and industries entirely, or for everybody. But it’s likely to help prevent the market collapsing harder than it would have otherwise.

All these measures act as a kind of ‘bridge’ between now and the end of the lockdown.

They are designed to stop a wave of foreclosures smashing the market, the banks, and the economy.

But what I suspect will happen is that this huge wave of stimulus money will be hoarded…and then used to fuel the second leg of Australia’s unprecedented property boom…

What does that mean for you as a housing investor?

Get ready for the buying opportunity of a lifetime

The current downturn is likely to take 6–18 months to play out.

And I know there’ll be pain for sellers.

However, it’s also going to bring to market a raft of highly desirable properties.

I’m talking about prime Australian real estate that you can go after with money in your pocket and less competition up against you.

Some shrewd property players are already doing this in anticipation of a renewed boom in house prices.

The Australian Financial Review reported in March:

‘Rich lister Nigel Satterley and his co-investors have swooped on almost $200 million of development sites in Greater Perth and Melbourne, as they prepare for a rise in housing demand after the coronavirus pandemic passes.’

And then there’s this from 6 April:

‘Prominent Melbourne-based developer Jeff Xu has agreed to pay $23 million for a 1.65-hectare residential site in the city’s south-eastern suburbs…we may see a surprising degree of activity from developers in acquiring sites in preparation for an inevitable upturn.’

Do they know something we don’t?

Of course not…they just have deeper pockets!

My point is, pretty soon, you won’t need deep pockets to rejoin the property market.

But until then, a good idea is to use the current period to build cash in anticipation for the market to weaken…

…and then wait for the tailwind to return!

|

Sincerely, |

|

|

Callum Newman, |

PS: Learn why a recession in Australia is coming and three steps to ‘recession-proof’ your wealth. Click here to download your free report.