Retail giant Harvey Norman [ASX:HVN] released its Q1 trading update today, showing a significant slowdown in sales across its Australasian stores.

Shares are up by 3% today, trading at $3.65 per share, as the company also announced its plan to buy back up to 10% of the company’s shares for approximately $442.3 million.

The buyback will start in November and be completed within 12 months, as the company views its low share price as a good time to consolidate.

Today’s announcement stated the company would ‘…continue to monitor and assess opportunities for growth and retain financial flexibility in order to execute strategy…depending on market conditions.’

So far this year, market conditions have not been kind to Harvey Norman, who are down -11% in the past 12 months and have been in a longer downtrend since the pandemic-era spending spree ended.

Source: TradingView

Sales momentum deteriorates for Harvey Norman

Harvey Norman saw sales in their ANZ stores and franchised overseas outfits fall by 9.1% in the quarter to 30 September.

The worst performance was in the Australian franchisees, down -13.6%, while New Zealand also finished the quarter down -3.3%.

A bright spark in the results was the Ireland stores, which bounced back from previous falls to gain 12.6% in sales for the quarter.

Many of these sales figures could have been worse for the company’s bottom line but were helped by the appreciation of foreign currencies like the Euro, Pound and Singaporean dollar.

In total, the unaudited results for the quarter were down nearly half at $86.23 million, compared to $169.45 million for the prior corresponding period.

The company focused on the planned buyback and did not comment on today’s results, but the company had previously flagged in August that it was likely to face challenges.

Executive Chairman Gerry Harvey blamed cooler temperatures on the East Coast for poor sales of air conditioning units, outdoor furniture and barbecues over the year’s second half.

The Australian franchise has also been struggling to recover after a scandal involving their $400 million Sydney businesses earlier in the year.

Division Manager Alan Stephenson was accused of manipulating the books in April, while two others were charged with stealing around $600,000. Mr Harvey described the incident as a ‘one-off’.

Outlook for Harvey Norman

It seems the weather and the broader economy are currently working against Harvey Norman. With cyclical spending moving away from furnishings and uncertainty about interest rates, consumers have put away their purses for now.

Discretionary spending peaked in April 2021 amid the pandemic, which Harvey Norman capitalised on with its broad set of goods. However, things have shifted since then.

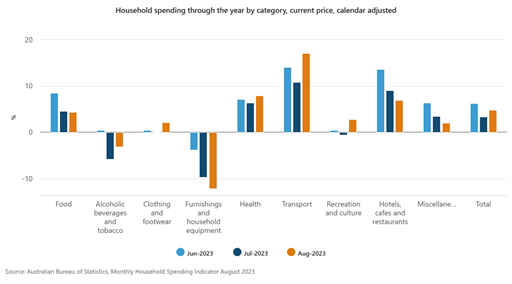

Here’s the most up-to-date view of shifting consumer spending from the ABS.

Source: ABS

Australians are now spending more on travel and recreation than household goods at the same time spending is going down. This spells a tough year ahead for Harvey Norman.

The problem is even worse in the major cities where Harvey Norman pulls their profits. Half of the states and all of the cities in Australia saw double-digit decreases in spending within their goods categories.

An optimist’s view would be that it’s unlikely things will get much worse from this point.

A better summer ahead should turn around spending in many segments that have built up inventory, while stage 3 tax cuts in the year ahead should provide a boost to discretionary spending for the group.

Beyond the buyback, Harvey Norman’s investments in warehousing and logistics have helped maintain solid home delivery services post-pandemic. The company sees this as a strong path to revenue.

It will be important for investors to watch the company’s margins as it attempts to right the ship into calmer waters.

With such a significant drop in profits for the company, the next concern for shareholders will be the likely haircut to its dividends.

Many investors have looked at companies like Harvey Norman because of their strong dividend yields in the past.

But where can investors look now?

Dividends and growth

Finding the right dividends that give you security and income in market downturns is always a prudent option.

When things look choppy in the stock market, big yield payers like Harvey Norman become attractive.

But smart investors need to be looking at just buying whoever’s yield is good today.

Blindly buying the ‘best dividend-payers’ could be a fruitless move beyond the short-term and leave you with less when things turn around.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding the smart move.

He calls it the Royal Dividend Portfolio, and he believes it’s the sweet spot between growth and dividends.

If you think you’re overexposed in uncertain times or simply too defensive, you may want to consider having your money do more for you.

Click here to learn more about what that could look like.

Regards,

Charles Ormond

For Money Morning