In today’s Money Morning…the great growth gambit…a matter of relativity…seek and you shall find…and more…

2020 has been a challenging year for many. Sweeping the world with huge social and economic changes.

We’re going to look back at this pandemic one day and wonder how it all went so wrong…

And for a certain subsect of the financial world, it will be no different. Because despite the remarkable resilience of stock markets, not every investor is a ‘winner’.

As the Bank of America proclaimed last month: ‘Value is dead’.

Meaning that value investing is dead. A strategy that relies on finding undervalued companies relative to some broader indicator.

In other words, a ‘value’ stock may be priced cheaply compared to its assets, its competition, or a range of other factors. This, in theory, should make it an attractive buy for potential shareholders.

An easy way to make a quick return.

History has certainly leaned that way. With many famous investors over the last century often relying on value to make their millions. Ben Graham, John Templeton, and Warren Buffett are just a few names that championed value.

If 2020 is any indication though, value investors may be a dying breed.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

The great growth gambit

Throughout much of the 20th century, value was king.

It dominated long-term return metrics in almost every way. Ensuring that patient and predictable investors could ‘beat the market’ by simply investing in cheap and good companies.

Today, that is no longer the case…

|

|

|

Source: Bank of America |

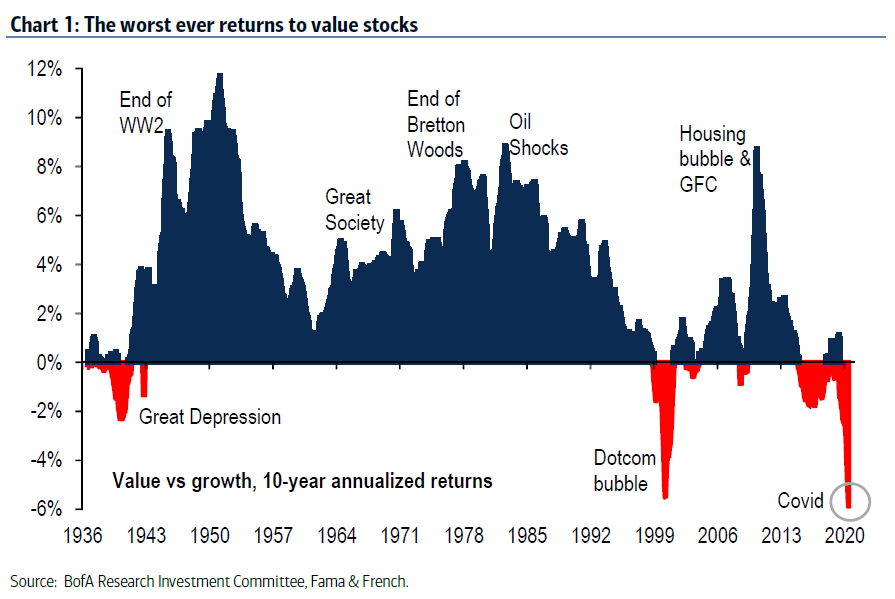

The graph above shows the fluctuating performance of value versus growth investing. With the former represented by the blue section, and the latter represented in red.

As it highlights, 2020 has been a standout year for growth. While value investors have had to grapple with the worst returns in recorded history.

Keep in mind, this is strictly US data though. Not that that means Australia is immune to this value erosion though.

You need only look at the meteoric ascent of stocks like Afterpay Ltd [ASX:APT] to see that. Growth stocks (particularly in tech) have undeniably been behind the market resurgence. With a similar, albeit far more concentrated, story in the US.

So, that begs the question, is value investing really dead?

Kind of…

A matter of relativity

First and foremost, let me just say that traditional value stocks can still be found.

A quick scan of price to earnings (P/E) ratios will turn up a long list of ‘cheap’ stocks.

Take Retail Food Group Ltd [ASX:RFG], Grange Resources Ltd [ASX:GRR], and Zimplats Holdings Ltd [ASX:ZIM], for example. Each of which are trading at a 2.2, 2.3, and 2.8 P/E ratio respectively.

These are some seriously undervalued stocks by today’s standards.

But that doesn’t necessarily make them good investments. After all, there is usually a reason for the market to price certain stocks at certain levels.

However, that is exactly the point. ‘Value’, at least by modern standards, needs to be quantified relatively.

Sure, you could throw money at cheap stocks like the ones I mentioned. Just don’t think that will make you the next Warren Buffett.

You still need to invest in good companies — not to suggest that any of my examples are necessarily bad either.

2020 though, with its low-interest and stimulus-pumping agenda, has tipped the balance toward growth. When money is as cheap and easy to get as it is now, stock prices are bound to get a little crazy.

In fact, the only inflation central banks can seem to produce is asset inflation. A phenomenon that is almost certainly responsible for wiping out a lot of hope for value investors.

Well, the traditional value investors anyway.

Seek and you shall find

The point is, dear reader, value is not dead — it has simply changed.

Parking your money in cheap or undervalued stocks is still possible, it just won’t necessarily net you the best returns. Investors need to understand that ‘value’ by today’s standards is a lot different to the ‘value’ seen in the ‘50s, ‘70s, and ‘80s.

Arguably, you can even find growth stocks that present a strong value proposition. Companies that still have the inherent potential for bigger future returns, just with a cheaper price today.

Finding such companies though, is no easy feat.

Fortunately, it is still very much possible. Especially when you start delving into the realm of small-caps.

You just need to know what to look for, and how to find it. A skill that is reserved entirely to stock pickers.

And right now, we’re in midst of one of the greatest stock picking markets we may ever see. A situation that is ripe for growth and value investors alike.

The only question is, are you game enough to give it a crack?

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.