Lithium explorer Green Technology Metals [ASX:GT1] provided a lithium drilling update regarding its ‘second key lithium project’ in Ontario.

GT1’s McCombe pegmatite project, dubbed the Root Project, is situated 200km away from its flagship Seymour Project.

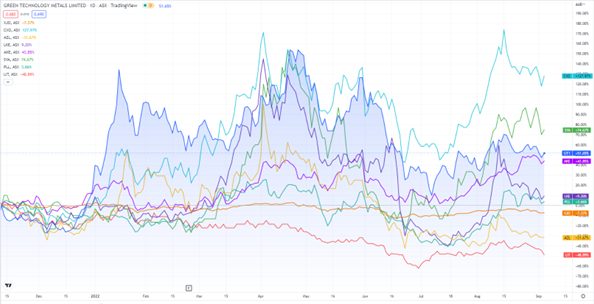

While flat year to date, GT1 shares are up 80% over the past 12 months.

www.tradingview.com

Green Tech’s McCombe drilling

On Monday, Green Technology provided a rundown of its Ontario Root Lithium project.

Here are the key details:

- ‘Phase 1 diamond drilling has commenced at the McCombe LCT (Lithium-Caesium-Tantalum) pegmatites (Root Project)

- Initial 22-hole, 2,500m program set to confirm McCombe historical drilling and sampling results.

- Phase 2 diamond drilling to target significant expansion of the known McCombe mineralisation.

- Historical drilling demonstrated down-dip continuity at McCombe (including 67m @ 1.75% Li20).

- Total 24,000m diamond drilling program initially planned over McCombe and Morrison pegmatites.

- Targeting rapid delineation of a maiden Mineral Resource estimate for the Root Project.

- Drilling continues in parallel at Seymour with two drill rigs operating’

GT1 noted historical drilling had been undertaken by Ardiden Limited in 2016 — six holes were drilled at the time.

The second stage of drilling at McCombe will soon commence, which will target testing for extensions of mineralised pegmatites in all directions of the project area, also for key infill sections.

The second stage of drilling at McCombe is also expected to drive mineral resources estimates for the project.

GT1 has declared the McCombe pegmatites as being ‘the most advanced prospect’ at its Root project in Ontario.

The mapping of LCT pegmatites by field geologists is still ongoing, and the company is using aerial photography and Earth interpretations to establish targets for future field testing at the project:

Source: GT1

Outlook for GT1 shares

Green Tech’s CEO Luke Cox commented on the drilling campaign:

‘Commencing drilling at Root is another significant milestone for our business. The initial focus at the advanced McCombe LCT pegmatite is confirmation and extension of known mineralisation, followed by rapid estimation of a maiden Mineral Resource estimate. We then plan to target other known spodumene-bearing LCT pegmatites at Root, including Morrison and Root Bay.’

As at 30 June, GT1 reported $65.2 million in cash and declared no debt outside usual trade credit.

With three major hard-rock assets in Ontario (Seymour, Root, and Wisa), Green Tech has an interesting array of prospective lithium assets.

But lithium exploration and development incur high upfront costs and the need for careful execution.

Overlooked ASX lithium stocks

In 2021, junior lithium stocks like Sayona and Lake Resources were some of the top performers on the All Ords.

But junior lithium miners are now well down from their 52-week highs, despite sustained high lithium prices.

Not to mention that junior lithium developers like SYA and LKE are still years away from production.

Will market conditions remain this tight once the likes of Sayona and Lake Resource begin shipping commercially?

So are there any lithium stocks the market is overlooking right now?

According to Money Morning’s recent research report on the Aussie lithium sector, there are at least three.

To find out more, access the report here.

Regards,

Kiryll Prakapenka,

For Money Morning