GrainCorp [ASX:GNC] announced it’s on track for an ‘exceptional FY22 result’with global demand remaining strong.

GrainCorp’s shares were up 4% in late afternoon trade on Wednesday.

The agriculture stock is up 100% in the last year, buoyed by strong prices for grain:

Source: TradingView.com

GrainCorp investor presentation — financial performance

On Wednesday, GrainCorp presented at the Bell Potter Home Grown Agriculture Conference, outlining its strategy outlook and reaffirming guidance.

The agriculture stock also rehashed its recent financial results for the first half of 2022.

Here are the highlights:

- ‘EBITDA rose to $427 million, up from $140 million

- ‘NPAT rose $246 million, up from $246 million

- ‘Unsurprisingly, the profit boost saw ROIC rise to 25.7%, up from 11.1%’

GrainCorp also reiterated its FY22 earnings guidance.

Underlying EBITDA is expected to be in $590–670 million and underlying NPAT is expected to be $310–370 million.

GrainCorp expects the Northern Hemisphere’s supply to remain disrupted, ‘supporting demand for Australian grain’.

The company said its guidance estimates depend on 2H grain receival and export volume as well as supply chain margins.

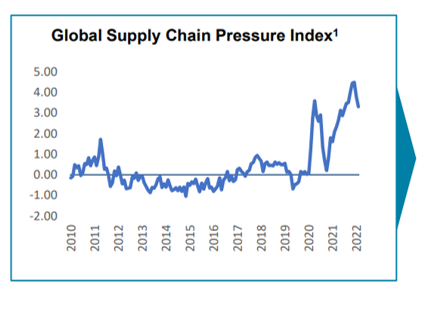

GrainCorp flags global supply chain pressure

During the conference, GrainCorp pointed to macroeconomic themes it thinks supports its strategic priorities.

GNC pointed out that the global supply chain is still under pressure, which reinforces the need for supply chain resilience.

Relatedly, supply chain pressures are incentivising research in the agtech sector.

The company identified agtech as one of its targeted growth opportunities, along with alternative proteins and animal nutrition.

GNC pledged to invest ‘up to $30 million into AgTech over next three years’.

Source: GrainCorp

GNC share price outlook

Sustained supply chain stress and Russia’s invasion of Ukraine have strained the world’s food supplies.

In an effort to shore up supply, countries have bid up prices.

Suppliers like GrainCorp have benefited from the windfall.

The key, however, is sustainability.

How long can grain prices remain elevated? What is the long-term outlook for GNC’s future cash flows?

Angus Hewitt from Morningstar says that GrainCorp’s 1H22 brought an ‘exceptional result driven by exceptional conditions’.

But Hewitt added that ‘grain volumes can fluctuate from year to year, over the long run GrainCorp’s value hinges on a normalised crop-growing year — which won’t be as lucrative’.

Now while broader markets slumped this year, GrainCorp’s success vindicates the old adage that it’s not a stock market, but a market of stocks.

Opportunities are always present. The trick is finding them.

In our recent report, we think we have. In fact, the report outlines seven Aussie stocks with potential to succeed long-term.

To read about the seven stocks, click here.

Regards,

Kiryll Prakapenka.