It was a newsworthy day for gold miners on the ASX with three of Australia’s industry leaders providing updates on gold projects and mines with very mixed scenarios.

For Red 5 [ASX:RED], the news was positive with the company reporting its third consecutive month of record gold production at King of the Hills, with 19,039 ounces.

Meanwhile, Ramelius Resources [ASX:RMS] provided an update for operations at its Penny mine, declaring its stoping well is officially underway, and a haulage ramp-up addressing previous shortfalls.

Lastly, gold mining heavyweight Perseus Mining [ASX:PRU] wished to quell concerns over an armed conflict in the area which caused the miner to withdraw most of its employees from MSGP.

PRU shares had bumped down by nearly 2% by the early afternoon. Meanwhile, RMS was majorly flat and RED, unsurprisingly with the best news, jumped by 5%:

Source: TradingView

Perseus debriefs on trouble at Meyas Sand Gold Project

The least reassuring news of the three gold miners today came in the form of Perseus’ Meyas Sand Gold Project (MSGP) update, in which the company owns 70% and is in northern Sudan — 75 kilometres south of the Egypt border.

Back in April, the miner had alerted shareholders that it had been forced to remove most of its employees from the MSGP site when an escalation of armed conflict broke out in and around Khartoum.

The conflict was between the Sudanese Armed Forces (SAF) and an influential militia group, the Rapid Support Force (RSF).

Perseus now says that while hostilities continue in certain parts of Sudan, the area of the MSGP site has not been near the conflict. With no incidents reported, it is allowing its employees and contractors to return to the MSGP site, and re-commence preliminary site works and confirmatory drilling activities by month’s end.

Perseus’s Board of Directors was scheduled to make a Final Investment Decision on the Meyas Sand Gold Project in the second half of 2023. However, this decision has been ‘deferred for the foreseeable future’.

KOTH delivers record gold production for Red

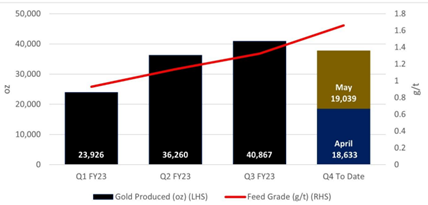

Red 5 took the biggest slice in shares for its news on its King of the Hills (KOTH) gold mine which reportedly delivered its third consecutive month of record gold production.

KOTH churned 19,039 ounces in May — a healthy increase on the 18,633 ounces produced in April.

The ore is processed at an average head grade of 1.80 grams per tonne with a record gold recovery of 93.6%.

Red expects a strong June 2023 quarter, saying that half-year production and cost guidance has been maintained.

Second-half FY2023 production guidance is maintained at 90,000–105,000 ounces at an AISC of $1,750 –$1,950 per ounce.

Source: RED

Ramelius’ penny gold update

Lastly, Ramelius provided highlights for the latest operations at its Penny Gold Mine in WA.

The miner reported its second stope has been completed with estimated grades ranging from 15–20 grams per tonne of gold.

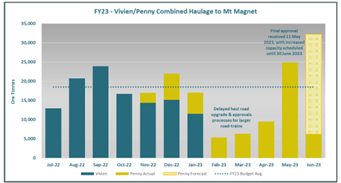

Ramelius plans to increase haulage to Mount Magnet in May and clear site stockpiles by the end of June, with final ore haulage approvals having been received.

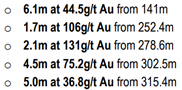

Drilling continues at Penny West, and highlights for ongoing diamond drilling at Penny North included the following results:

Managing Director, Mark Zeptner, commented:

‘It is pleasing to see our high-grade Penny mine really start hitting its straps from a mining, haulage and exploration point of view.

With the full mining team in place, stoping well underway and the haulage cranking up to address the previous shortfall, an extremely strong finish to the financial year looms for Ramelius.

We are also encouraged by the very decent exploration hits outside the current resource envelope that look like adding high margin ounces to the project and extending the overall mine life.’

Source: RMS

How to Buy and Store Gold in 2023

In a world where people are feeling more pressure in their finances than ever, this makes it even more important to find ways to build and protect wealth.

How are you meant to do this with the increasing interest rates, sky-high energy bills and general dismal high cost of living environment?

Fat Tail’s gold bug Brian Chu, editor of Gold Stock Pro and host of the Bullion and Bordeaux Hour, has advice for those worried about the rapidly changing environment…and why gold just might be the answer.

Click here for Brian’s latest gold report.

Regards,

Fat Tail Commodities

Comments