Here’s how it usually works when you invest in commodities.

The natural resource in question — be it iron ore, copper, soybeans or oil — goes into a bull market, with a rising price over time.

The associated shares then rally as the market prices in improving profits and margins for producers thanks to the rising commodity price.

That’s the gist, anyway.

Now ask any gold share investor today about what’s happening in their portfolio, and you might get a different response.

The gold price is marching up…and gold shares are lagging.

Confused? Many are. But it’s important to you understand what opportunity presents itself here.

That’s what I’ll try to do today.

Let me set the scene for you first…

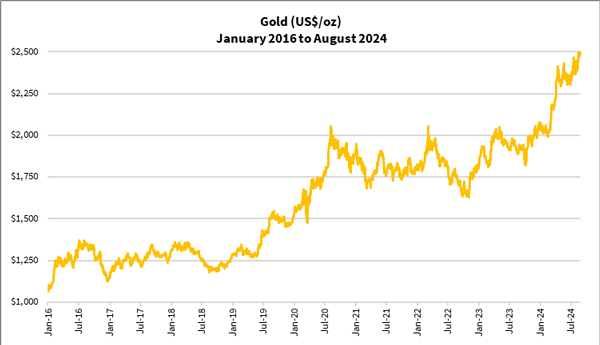

Since late-2015, gold’s up by almost 150% in US dollar terms. You can see this big run up below:

| |

| Source: Refinitiv Eikon |

What’s holding back gold stocks

Just by looking at that figure, it’s safe to assume gold’s run would deliver a windfall to gold stock investors, right?

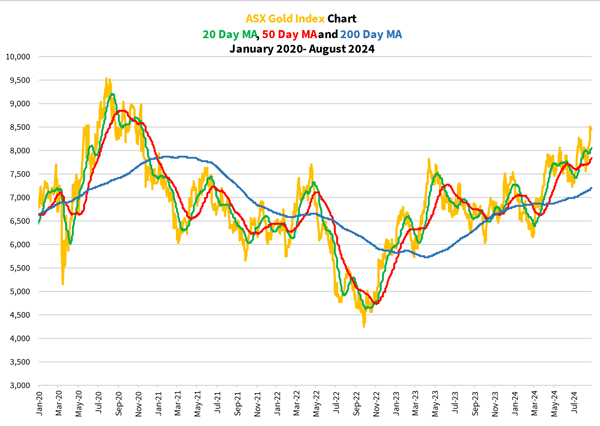

As above, no. Check out how the ASX Gold Index [ASX:XGD] performed these last four years:

| |

| Source: Refinitiv Eikon |

Remember what we went through globally during this period and let’s unravel the mystery.

What’s been the biggest issue plaguing markets in the last two years?

Inflation!

This plays for gold miners in the same way as other companies like industrials.

Why’s that?

Think about their inputs…like diesel, labour and energy! Their prices have increased.

Can you see what I’m driving at here?

The missing piece in the puzzle

An inflationary economy may be good for gold bullion as investors turn to gold to protect their capital and preserve purchasing power.

But gold miners are running a business. Inflation can squeeze their operating margins even as it helps their sales.

Herein lies the critical piece of the puzzle.

Investors aren’t paying for gold when they buy gold stocks. They’re buying investment potential. That comes from future cashflow and profits.

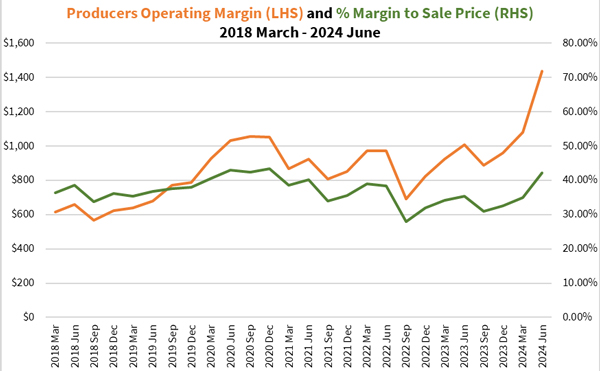

As I invest exclusively in gold shares for many years, I track important metrics like production costs and margins. The hard data speaks for itself.

Here in Australia, the average gold mining operating margin in percentage terms fell from 2020–22.

In fact, you’ll see below this margin reached its lowest point in the 2022 September, quarter to less than 30%:

| |

| Source: GoldHub Australia |

No wonder gold shares can’t fire!

There’s good news though. Notice that the average operating margin recovered to as high as 36% in 2023. It gets better this year, with the margin rising to 42% in the most recent quarter.

Taking gold stocks back to their 2020 highs…

even beyond!

The last time gold producers delivered margins at this level was in 2020.

And this is what excites me, I hope you get my drift!

I’ll show you the ASX Gold Index figure again so you don’t need to scroll up:

| |

| Source: Refinitiv Eikon |

Gold stocks made an all-time high in mid-2020. That’s around 12% higher than current levels!

How do you like that?

With gold at a record high, and margins improving to their former level, we have every reason to think gold shares will break out above this old 2020 high…

Could it happen in the coming year? The odds look favourable to me.

Of course, I can’t guarantee this. Gold stocks can be high risk investments.

But let’s add to that impending rate cuts from the US Federal Reserve, the first cut expected next month. That could give gold an extra boost.

Gold stocks might enjoy another lift in their operating margins. Should that happen, you’ve got a perfect setup for gold stocks to break out above the 2020 highs.

Your choice — watch from the sidelines

or get on the field

As I wrap up this article, I’m at the Australian Gold Conference presenting on these points.

If you’d like to go deeper into the opportunity here, consider signing up to The Australian Gold Report here.

Right now looks to be an opportunity to begin building a precious metals portfolio and accumulating some gold stocks just as they are primed to break out in a powerful way.

You can watch it unfold, or get into the action now!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments