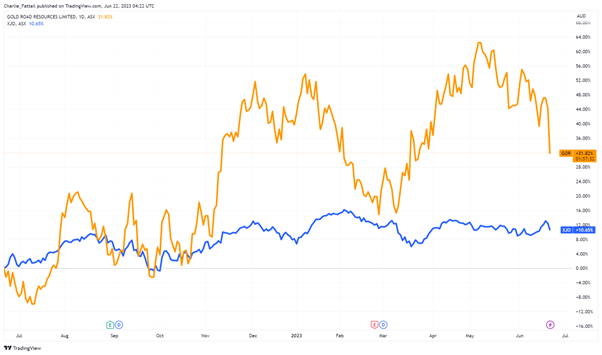

Shares of Gold Road Resources [ASX:GOR] tanked by 8.45% today, trading at $1.59, after lowering production guidance from the WA Gruyere Gold Mine project.

The mid-tier Australian gold producer has seen incredible growth in the past year, remaining buoyant despite depressed gold prices — with shares up by 32.23% in the last 12 months.

With commodity prices and interest rates up, Gold Road has managed to stay ahead of the competition, performing 17% above the sector this year.

But with disappointing news today, what’s next for the company?

Source: TradingView

Rain on Gold Road Resources parade

Gold Road is projecting its annual production from Gruyere mine to be between 320,000–350,000 ounces — down from 340,000–370,000 ounces.

The company’s statement today sought to explain the shortfall, commenting:

‘Reliability and utilisation of the production drills and availability of blasting resources were below expectations for the quarter.

‘These factors, together with a recent significant rain event, have negatively impacted ore and waste mining at Gruyere.’

Gruyere mine is a 50:50 joint venture between Gold Fields and Gold Road Resources. The project began in 2016 when Gold Road sold 50% to Gold Fields for $350 million — plus a 1.5% Net Smelter Return Royalty.

Under the agreement, Gold Fields managed the operation at Gruyere while Gold Road retained responsibility for the exploration of the joint venture tenements.

The Gruyere mine sits approximately 1,200 kilometres from Perth in WA and has been producing for three and a half years — totalling approximately 918,500 ounces.

With an MRE of 6.69 million ounces, it stands as Australia’s seventh largest gold mine with a project mine life of 10 years.

Gold Road Resources’ outlook

While the short-term share price has tanked after the latest news, the outlook for Gold Road is still positive long-term.

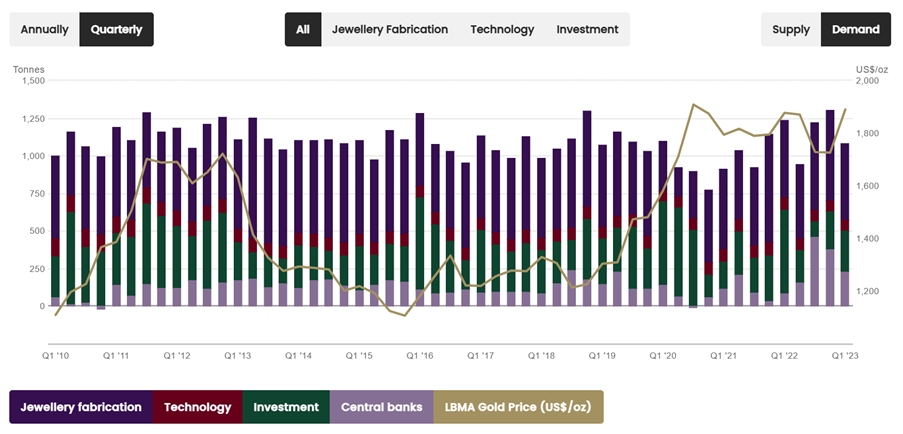

Gold is currently around values seen in March last year. Little momentum has been found since the top spot it hit in early May this year — at $2,015 per ounce.

But with market instability on the horizon, many experts are bullish on gold long-term as central banks ramp up their purchasing to shore up reserves and hedge against inflation.

Source: ICE Benchmark, World Gold Council

With a longer outlook, Gold Road may appear as a good buying opportunity for some investors for a company that has provided value in the past.

On paper, the production requires minimal growth capital, offering good margins at the current gold prices.

The life-of-mine has also been reaffirmed to 2032, and it appears Gruyere is on track to deliver two million ounces during 2025.

However, past performance is no indicator of future performance.

So, what could trip Gold Road moving forward?

On 13 June, Gold Road announced the extension of its open-pit mining contract with MACA to continue its mining services for the next five years — covering drill and blast, load and haul, crushing and screening. If further issues arise on the site, the relationship could sour and a lengthy disentanglement could occur.

A recovery plan is currently being developed with contractor MACA that will include bringing in additional equipment to boost production. However, until that is developed, the likelihood of costs rising is high.

Gold Road has said they will review AISC per ounce for their next quarterly report.

The ball may have been dropped by Gold Road, but what is stopping you from getting into gold?

How to buy and store gold in Australia in 2023

In a world where people are feeling more pressure in their finances than ever, this makes it even more important to find ways to build and protect your wealth.

How are you meant to do this with the increasing interest rates, sky-high energy bills and general dismal high cost-of-living environment?

Everyone is in the same boat right now.

It’s those emotions that are holding a lot of budding investors back from some real potential – and that’s often the best time to get into a market.

Fat Tail Investment Research’s gold bug Brian Chu, editor of Gold Stock Pro and host of The Bullion and Bordeaux Hour, has some ideas for you to explore.

Click here for Brian’s latest gold report.

Regards,

Fat Tail Commodities

Comments