At time of writing, the gold price in AUD terms is holding its ground at $2,460 after pushing beyond support at $2,475.

You can see the recent selling is registering in a downtrend for its 20- and 50-day moving averages below:

Source: tradingview.com

We take a quick look at what’s happening with the US dollar and whether the Federal Reserve will move to negative rates.

Dollar Index losing ground quickly, could signal a return to form for gold

The Dollar Index or [DXY] is a measure of the strength of the US dollar against a basket of major currencies.

This is what’s happening with the DXY in the last year:

Source: tradingview.com

A strong spike in the aftermath of the March market low as the USD is often seen as a safe haven.

But it is sliding quickly at the moment, a sign that all might not be well across the Pacific.

After all, the US is experiencing significant civil unrest and the speed of their recovery could hinge on more aggressive asset purchases by the Fed.

Kitco quotes Scott Minerd of Guggenheim Investments as saying the following:

‘The first and most likely policy option will be to announce a lengthy period of forward guidance … Given the current situation, forward guidance will have to be aggressive…The minimum period of time for keeping rates at the zero bound would be something like five years, but a longer time period may be necessary.’

And:

‘The current pace of Fed purchases ($6 billion per day, or roughly $125 billion per month) is insufficient to absorb the $170 billion in net monthly Treasury coupon issuance we forecast for the rest of the year, let alone the hundreds of billions of monthly net T-bill issuance we expect … It will likely take at least $2 trillion in asset purchases per year just to fund the Treasury.’

This is an immense amount of money.

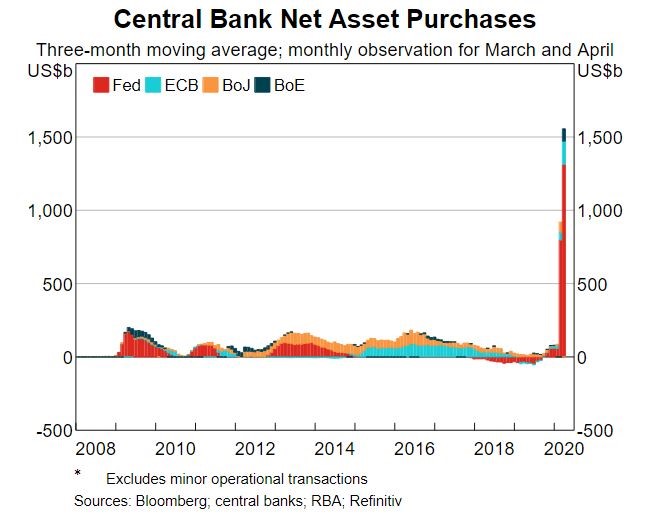

You can see what this looks like below:

Source: RBA

Off the charts.

While it’s no guarantee, gold you would think, will eventual be awoken from its recent stupor and react positively to this tsunami of cheap money.

Will the Fed go below zero?

With the Federal Reserve to meet in the next 24 hours, the recent move for gold could be hinting at some expectation that the comments that emerge from the meeting will be geared towards more of the same.

I’d be shocked if they went to negative rates this early in the game though.

So, we will see what they say.

However, another market downturn could force their hand in the coming months.

Regards,

Lachlann Tierney,

For The Daily Reckoning Australia

PS: According to Jim Rickards, the recent market crash we’ve witnessed is just the beginning. A total financial collapse might be next. Learn how to protect your savings and investments before it’s too late. Download your free report now.

Comments