Three things I’m thinking about today…

1) On Friday, Murray Dawes and I released the latest episode of our Closing Bell podcast.

Here’s me banging away…

| |

You can check it out below if you like.

I bring it up for another reason. Every Monday I’ll check how many views each episode got.

We can guarantee you of something. The episode will get a higher number if ‘gold’ is in the title than any other topic.

Australians are drawn to gold in the same way Americans are drawn to oil. Big money can come from a big find, or bull run in the sector.

And now gold stocks are hot. They have plenty of fuel to keep going. It’s natural there’s high interest around gold.

However, it’s always fruitful to check out ideas that most people aren’t paying the slightest attention too.

There’s always likely to be better value when no one is even thinking, let alone bidding strongly on an idea – yet.

I have one for you today…

2) It begins with a heads up from the Closing Bell…

In last week’s episode I pointed out that I believe the RBA wants higher house prices to support the domestic economy and consumer confidence.

Michele Bullock says that house prices are a matter of supply and demand, and therefore out of her remit.

Piffle!

The strongest explanatory factor for house price growth is bank lending. Bullock pretends this isn’t the case for a reason.

The only one that makes sense to me is that higher property values give middle Australia a kick into gear. The RBA can offset international weakness this way.

That puts cyclical companies exposed to consumer spending on a stronger footing.

One of those is Myer ($MYR).

I’m one of those men who hates shopping. I find the whole thing a ball ache.

However, if I go anywhere, it’s probably going to be Myer. I’m 43, with zero interest in fashion. I’m not alone. Myer’s loyalty program has 4.6 million active members.

More importantly, Myer just gave us a trading update too. What did they tell us?

It was by no means a great update, in terms of industry trends.

Myer’s sales are ok, but said consumer are still hunting for value and under cost of living pressure. Retailers in general are discounting to maintain sales and market share.

However, it’s the market reaction that matters to me. Nothing Myer said is going to be a surprise anyone at this point.

And so it proved.

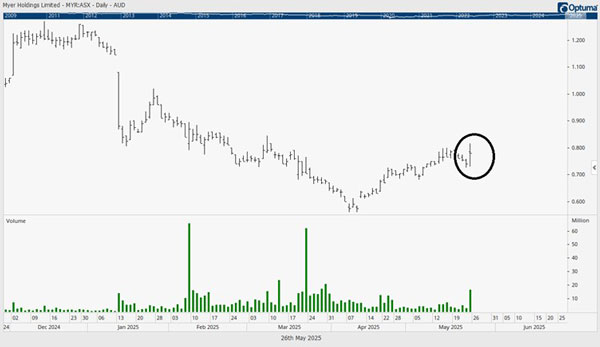

The stock initial sold off when that update came out. But support came in for it. I’ve marked that on the chart below…

| |

| Source: Optuma |

Myer only has a market cap of $652 million. At under 80 cents a share, that’s a long way off its former highs. It has $280 million in cash at last accounts.

It’s hard to see that as anything but cheap.

That said, it’s hard see the stock taking off rapidly. It’s been a few decades since department stores were a “thing”.

However, Myer’s broad network of stores and active members will provide useful clues to track the potential recovery of the Aussie consumer discretionary sector.

I’d be surprised to see it break the recent April low at any point in the next few years, assuming the cyclical upswing happens, as I expect.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Murray’s Chart of the Day –

Australian Dollar

| |

| Source: Tradingview |

With the US Dollar Index struggling to hold above major support at 98.00, the Australian dollar is getting stronger.

That is despite the first interest rate cut in two years occurring last week in Australia.

The recovery in the Australian dollar has been rapid since the sharp sell-off in April that took it below 60 cents.

The collapse in the Australian dollar last month took the price down into a major buy zone between 58-62 cents (see chart above).

Confirmation of a monthly buy pivot this month will firm up the positive vibes for the Aussie dollar, giving targets back to the middle of the major range at 68 cents (currently 65 cents).

The long-term trend based on the monthly moving averages remains down, so I will be quick to shift back to a bearish footing if the rally doesn’t continue. But for now the Australian dollar looks constructive for more upside in coming months.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments