In today’s Money Morning… first up, don’t keep your crypto on an exchange… gold price in the doldrums, could pick up quickly… if you like gold or crypto don’t buy the banks… and more…

I woke up this morning to an enquiry from a self-professed gold bug who subscribes to The Gowdie Advisory.

He was asking about setting up a ‘digital wallet’.

Like many people who have a penchant for gold, he can see the wave of monetary antics coming from a mile off.

He was thinking about things like Modern Monetary Theory (MMT), the abolition of the Reserve Banking Act, runs on the banks, or even the advent of CBDCs, which I talked about yesterday.

But while these ‘gold to crypto’ neophytes are certainly coming from the right place, there’s a bit of a knowledge gap to close.

So, a quick bit of crypto 101 is in order.

Bitcoin vs Gold: Which Should You Buy in 2021?

First up, don’t keep your crypto on an exchange

This is the simplest and most basic bit of knowledge you need about investing in cryptocurrency.

Repeat after me, ‘not your keys not your crypto’.

This means that you should look at using a hardware wallet.

For example, a Ledger device.

Case in point, is the Mt Gox fiasco.

Taking a trip down bad memory lane (via thenextweb.com):

‘Mt. Gox was one of the first Bitcoin exchanges on the web, but it wasn’t always related to cryptocurrency. Back in 2007, programmer Jed McCaleb purchased the mtgox.com domain for an online trading platform for virtual cards used in the game Magic: The Gathering.

‘Fast forward a few years to 2010, and McCaleb saw an opportunity to create a place for people to exchange their fiat currency to and from Bitcoin. On July 18, 2010, McCaleb launched mtgox.com in the form that most came to know it, as a Bitcoin exchange.

‘McCaleb’s involvement in Mt. Gox as a Bitcoin exchange was short-lived, he sold the platform to French born developer Mark Karpelès about a year after he got his idea off the ground…

‘It was under the control of Karpelès that Mt. Gox would witness a series of hacks and scandals that would lead to the platform’s eventual demise. But it wasn’t without becoming the world’s leading Bitcoin exchanges by 2013. At one point, Mt. Gox was handling around 70 percent of the world’s Bitcoin trades (by volume).’

But:

‘On February 7, 2014, Mt. Gox cancelled all Bitcoin trading, froze accounts, and took a step back to take stock of what was actually going on. Ten days later, the exchanged published a statement. It claimed it had rectified the situation, and that it was now on course to correct customer losses and resume trade.

‘But by the end of the month Mark Karpelès had stepped down from his role at the Bitcoin Foundation, and the firm’s fate was sealed. It disclosed over 740,000 of users’ BTC [now US$37 billion] had been stolen in a hack that it claimed had been ongoing for years. At the time, that amount was valued at around half a billion dollars.

‘On February 28, 2014, the exchange accepted its fate and filed for bankruptcy in Tokyo. It would also file for bankruptcy in the US later in March.’

And this is why you don’t keep your crypto on an exchange.

Do. Not. Do. It.

It doesn’t help that the number of ransomware attacks around the world is on the rise either.

As you can see below:

|

|

| Source: Thesslstore.com |

A ransomware attack is where a malicious attacker holds your devices or data in exchange for money, usually crypto.

Avoid exchange storage — they are there to facilitate transactions but not to store the actual currency.

It’s like if you went to a bustling market to buy an expensive rug with cash and then decided to take a nap on it, with a few notes sticking out from your jacket pocket.

Silly.

That being said, the gold/crypto nexus is growing — something I called the ‘Trust Quotient’.

Gold price in the doldrums, could pick up quickly

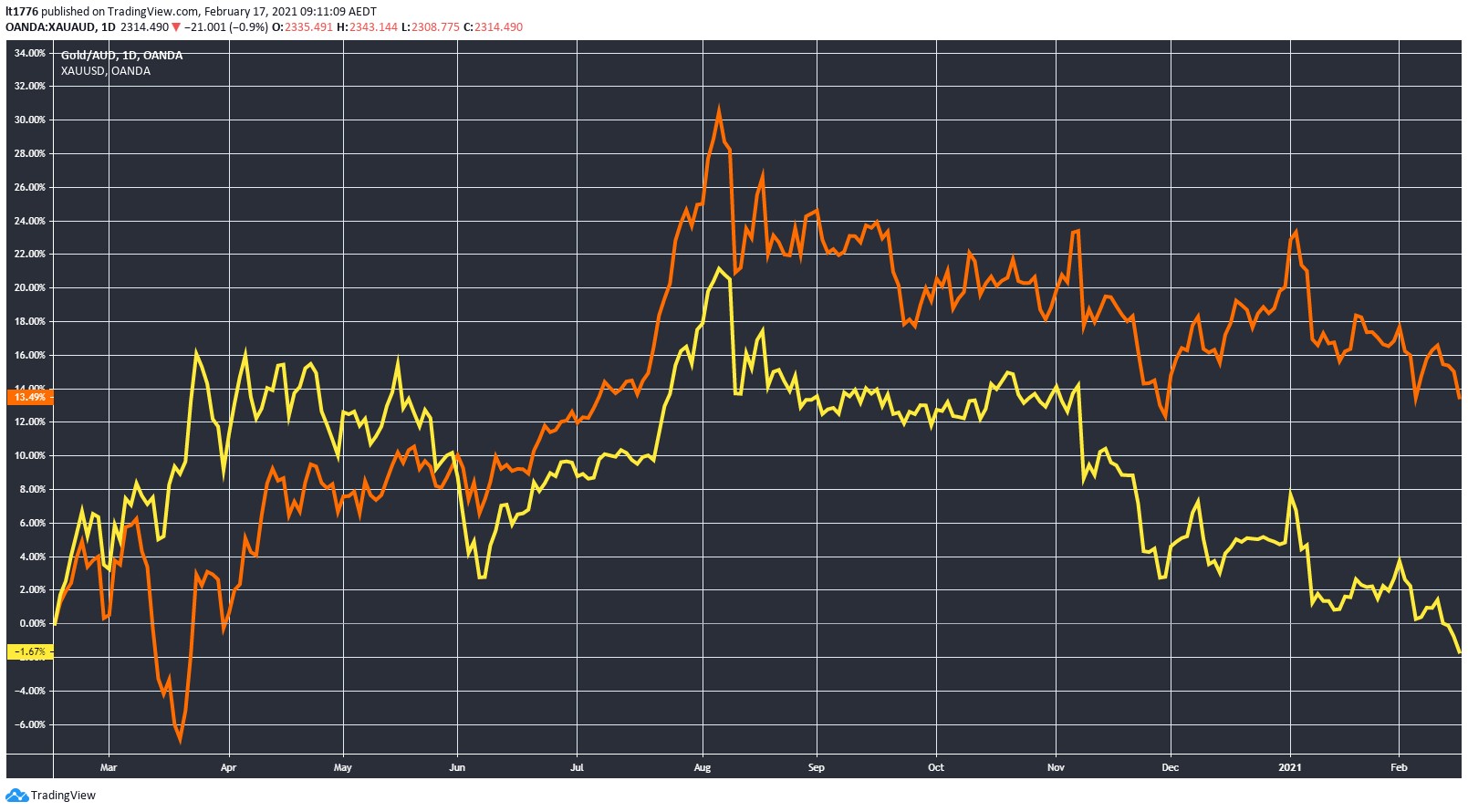

The gold price chart in AUD (yellow) looks worse than the gold price in USD (orange):

|

|

| Source: tradingview.com |

That’s because the AUD is running hot while the USD looks soft.

But gold’s downtrend could change in quick order should the Biden + Yellen + Powell trifecta do what they say they will do.

And year to date, gold is massively underperforming BTC — which I tipped to be 2021’s best-performing asset class.

However, gold’s traditional status is as a safe hedge — not a speculative play.

Different investment strategies are necessary for different risk appetites.

Dare I say it, you also need to actually believe in the underlying reasons for an investment to be comfortable with it, ie: if you like gold or crypto don’t buy the banks.

Further down the track we may see investment demographics change too.

These two groups of investors may allocate a portion to gold and a portion to crypto.

So for the gold bugs out there interested in joining the crypto bandwagon, there’s a great starting point to be found in Ryan Dinse’s Crypto Flip Trader service.

And if you want to stick in gold, I get that too.

The compelling case for holding gold is laid out in Jim Rickards’ new book — which you can get early access to here.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: If you’re interested in learning more about what Bitcoin is, and how Bitcoin works we have a comprehensive guide. To check out tell-all BTC guide click here.

Comments