Do you remember what I told you last Tuesday? Well done if so.

Personally, I can barely recall what I had for breakfast this morning!

Here’s a refresher…

I said watch cannabis stocks — the other ‘green’ revolution happening now.

A week can be a long time in the market.

ASX ‘Pot’ stocks are suddenly roaring.

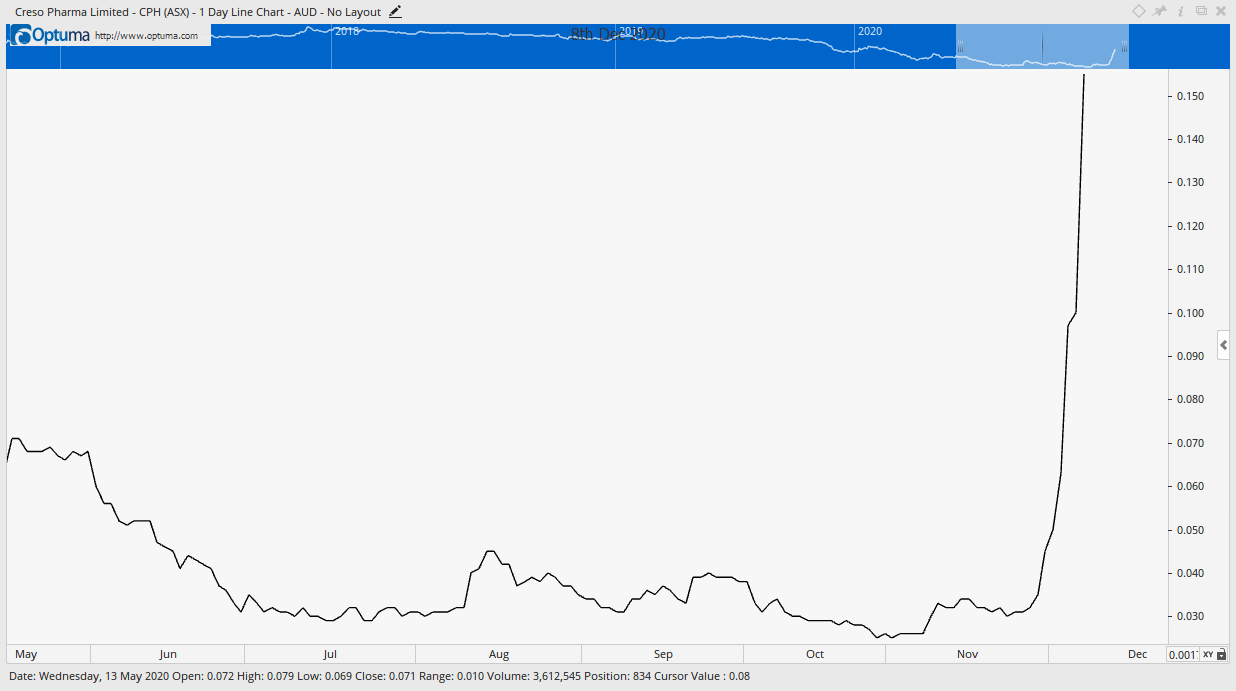

Check out the rise in Creso Pharma Ltd [ASX:CPH], for example.

It’s up 200% in a week!

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Creso Pharma goes…BOOM!

|

|

| Source: Optuma |

Now that’s a ride!

Unfortunately for me, I wasn’t on that one.

But subscribers to Ryan Dinse’s Small-Cap Momentum Alert were.

Ryan got them on the stock around 3.5 cents. Today, it’s around 16 cents…all in less than a month.

That’s the potential of the small-cap space, though it does come with added volatility risk.

I’m not saying to chase this stock.

A rally like that can usually only go so far.

However, I do think the opportunities in cannabis will keep coming.

The cannabis stocks moving powerfully now were the stocks heavily beaten up in the previous 12–18 months.

They are not necessarily the ones I am looking to hold for the long term.

What’s Behind the ASX Pot Stocks Rally?

But what caused this rally in the first place?

There’s been some nice news flow, lately, for the ‘big picture’.

Last week the UN said it was reclassifying cannabis away from being a Schedule IV drug (equivalent to heroin) to a Schedule I.

This opens up the possibility of further research and medicinal use.

Several of the cannabis names also released different news yesterday.

It was this…

The US House of Representatives just passed a bill called the ‘MORE’ Act.

It’s to decriminalise cannabis at the national level in the US.

It sounds a lot more exciting than it is.

This legislation has to pass through the Senate as well.

The odds of that happening aren’t great.

Certainly, decriminalisation at the US federal level — whenever it comes — would be massive for the cannabis industry.

But it’s powering along here in Australia even without it.

By the way, if you’re not familiar with this space, the US is operating a strange dynamic currently.

Individual states are legislating rules for cannabis while the federal government maintains it’s all illegal — but doesn’t do anything to stop it.

The goods news for Aussie firms is that the US isn’t the only one playing the field (though it is the biggest).

The other lucrative market is Europe, especially Germany. The UK isn’t too far away from being an important importer, either.

Why do you and I care?

It gives Aussie cannabis companies a global growth profile and lots of potential customers.

One man who has followed cannabis since the industry began in 2017 is Ryan Clarkson-Ledward over at Australian Small-Cap Investigator.

I checked in with him for his latest views on what’s happening.

He says…

‘There is also the possibility of more good news on the horizon.

‘The Therapeutic Goods Administration (TGA) has spent much of 2020 debating the future of CBD — one of the two key ingredients in cannabis that isn’t responsible for the psychoactive effects.

‘A substance that has shown great promise for its therapeutic benefits with few side effects.

‘That’s why back in April, the TGA began consulting about proposed changes to access for CBD.

‘Potentially even making it possible to get access to certain formulations without a prescription. Effectively making it an “over-the-counter” drug that anyone can purchase from a pharmacy.

‘Keep in mind, this is purely for CBD products — not cannabis as a whole.

‘These drugs can’t and won’t cause any psychoactive high. They’re purely for medicinal use.

‘A decision on this matter was set to be made on 25 November. But, in the report released on that date, the TGA confirmed the final ruling wouldn’t be made until “late December”.

‘So, we will have to wait a few more weeks for the ultimate decision.

‘But if it passes, it will be a huge outcome for some of our local pot stocks. Making it far easier to market and sell their medicinal products to consumers. With a favourable ruling set to be implemented by 1 June 2021.

‘For these reasons, the pot stock boom may be about to kick off once more.’

If you’re keen to follow Ryan and have a chance to profit from this potential new marijuana move, I suggest you jump on board with him before pot stocks really start moving.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments