Today, WA-based lithium junior Global Lithium Resources [ASX:GL1] has revealed its latest assay results for the 2022 Manna drilling program, which point to an extension of the miner’s initial mineralisation expectations.

Shares for the lithium junior’s stock were pulled up 1% since yesterday’s closing price, trading for $1.58 on Friday at the time of writing.

So far in 2023, GL1 has bumped down 14% in share value, while peers Argosy Minerals [ASX:AGY] and Anson Resources [ASX:ASN] have increased 18% and 15%, respectively.

Meanwhile, Piedmont Lithium [ASX:PLL] and Atlantic Lithium [ASX:A11] have been pumelled off the back of a less than glowing report from short-seller Blue Orca released yesterday, alledging secret promises and payments to Ghana politicians:

Source: TradingView

Global Lithium’s drilling and Manna expansion

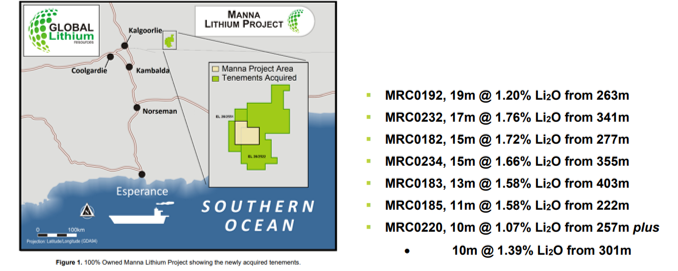

GL1 says its latest assay results for its Manna Lithium Project have shown a large-scale lithium-bearing pegmatite system, which has ultimately extended beyond expectations.

Global admitted the northeast spodumene extension was brought to its attention by the exploration team late last year, however; due to its preoccupation with the Manna Resource upgrade, the area was not explored properly until much later.

GL1 now highlights an 800-metre-long zone with high-grade intercepts of spodumene-bearing pegmatites, extending all along strike and down dip in all directions, which it believes is a direct extension of the existing Manna deposit.

An interim resource upgrade has been launched using the remaining assay results from the 2022 program.

GL1’s General Exploration Manager Stuart Peterson commented:

‘I am very pleased with these exceptional assay results within the new North-eastern extension of the Manna Lithium deposit. These results have increased our confidence that this new area could potentially hold significant tonnes and the company will continue to build on the existing Manna Resource.

‘The exploration team have planned a large scale, 35,000m drilling program that is targeted to drill out and define new prospective areas within Manna. Our team continues to work hard to understand the extent of the possible strike length of the deposit outside of our current resource estimate.’

Source: GL1

GL1’s next steps and the lithium plight

Global’s 2023 drilling campaign will be focused on expanding its exploration program at the Manna Lithium Project. In doing so, it hopes to increase its understanding of the lithium mineralogy within the pegmatite system.

New regional targets will also be drill tested to depth in search of possible additional spodumene pegmatites.

The project already hosts a mineral resource of 32.7Mt @ 1.0% LiO, and Global will extend the drilling program into 2023 for further growth and expansion.

Lithium has been a strong theme over 2022, even with its price corrections and as the world makes massive economic and financial changes.

China saw its lithium carbonate equivalent price falling to ¥346,500 yesterday, its lowest level in more than a year — likely due to the mass ending of EV subsidies this year.

As we step closer to a world where everyone is driving EVs, we’re likely to see many changes, which could throw expectations out of balance…

Drill baby drill

Lithium is only one part of a universe that is chock-full of potential.

It’s part of a broader industry making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

This can be described as an alternate universe, the universe of booming drillers.

It’s been described as a ‘new golden age’ for junior explorers — and for investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Yes, it’s very possible. Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to the top of the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia