Established multi-asset WA Lithium company, Global Lithium Resources [ASX:GL1] has posted an update for its new exploration drilling program.

GL1 has gained 16% so far in the calendar year and leading the wider market by 9% over the last 12 months:

Source: TradingView

Global Lithium tucks into 20,000 meters exploration drilling at MBLP

Today, Global Lithium announced it has officially commenced its 2023 exploration activities across its 100% owned Marble Bar Lithium Project (MBLP).

This year’s exploration programs are based on findings from the CY2022 program with up to 20,000 meters of drilling to be used to explore the lithium and gold targets across MBLP.

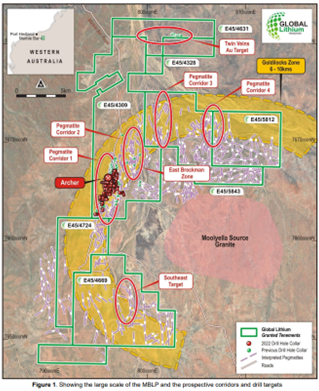

The lithium group reiterated that MBLP has already demonstrated multiple prospective lithium-bearing corridors. This could be just as large as the current Archer resource area, which is still yet to be explored.

The drilling program consists of a two-stage exploration strategy.

One, Global intends to continue exploration drilling to test and expand known lithium mineralised areas and prospective lithium corridors identified in the CY2022 exploration program.

These lithium corridors are spread out along a strike length of approximately 25 kilometres. A maximum of 16,000 meters Reverse Circulation (RC) drilling is planned to explore the area more thoroughly.

Stage two will consist of an RC drilling program of up to 4,000 meters that will be completed on the Twin Veins Gold project — 13 kilometres to the north of the Archer Lithium Deposit.

Global Lithium’s General Manager of Exploration, Stuart Peterson commented:

‘I am pleased GL1 has commenced the CY2023 exploration program at the 100% owned Marble Bar Lithium Project. We have only explored about 6km of the projected 25 kilometres lithium prospective strike length, so I believe that MBLP could hold additional lithium discoveries as we progress exploration further.

‘Also, being able to explore the potential of the Twin Veins gold and base metal anomaly in this year’s program is very exciting and I look forward to providing regular updates as results become available.’

Source: GL1

Towards the end of last month, the lithium and gold explorer also reported its Manna ore sorting trial had delivered a 90% increase in lithium grading.

The Manna Lithium initial ore sorting trials had all been successfully completed. The test run had shown an elevated head grade from 0.88% Li2O to 1.67% Li2O.

The group also said preliminary test work showed an equally impressive 93% reduction in iron from the mixed waste and pegmatite sample.

Initial ore sorting test work showed a significant improvement. It suggests the benefits of incorporating an ore sorting process at Manna, with further trials to come and results to be shared at the end of the year.

The red draught and what you can do about it

Stopping climate change will require trillions and a global supply of critical minerals — one special metal is copper.

This means that we’re going to need a lot of the red metal, and more exploration will be required to restock supplies.

If you subscribe to Fat Tail Commodities, you will have access to the most recent insider report on the subject from resources expert, James Cooper — all for free.

James will give you instant tips on stock picks for the copper industry. He’ll also explain the copper supply crisis and how you can position yourself to take advantage of incoming changes in the industry.

Find out more about making money from the red draught and click here today.

Regards,

Fat Tail Commodities

Comments