Australian junior and dual-asset miner Global Lithium Resources [ASX:GL1] has appointed leading development consultant Wave International as the lead engineer for the group’s Manna Lithium Project Definitive Feasibility Study (DFS).

Global Lithium says the DFS will generate a capital and operating cost estimate to an accuracy of more or less 10% to 15% and expects completion by the fourth quarter.

Investors upped the GL1’s worth by 6% by the early afternoon, trading around $1.10 at the time of writing.

Yet Gl1 has taken a 51% fall over the last 52-week cycle as many lithium stocks have surpassed their initial corrections:

Source: tradingview.com

Global names Wave International as choice engineers

The lithium miner has decided on Perth-based Wave International as the lead engineer for the company’s DFS of its 100% owned Manna Lithium Project.

Global says part of its reasoning for choosing Wave is because it is known as a leading resource development consultancy with more than 100 years of collective lithium experience.

Wave has also already undertaken the metallurgical test work needed to support the DFS at the group’s Manna Project, which is located in the Goldfields region of WA.

Said test work was completed in January, leaving Global to request the next steps and task the engineers to define and test the metallurgical upgrade process to produce spodumene concentrate at Manna.

It will be up to Wave to compile various mining and engineering activities into one comprehensive and consolidated DFS report as part of upcoming scope work.

The miners are expecting the DFS late in the fourth quarter, at which point Global hopes to reach a Final Investment Decision in readiness for the next calendar year.

Dr Tony Chamberlain, Global Lithium’s Project Director, stated:

‘We have been working with Wave closely for the last couple of months as we proceed with the commencement of the Manna DFS. With their team’s collective experience within the lithium space, they offer an unrivalled advantage within our industry to assist us with progressing Manna and we are pleased to widen their appointment to include lead engineer for the DFS.’

Wave’s International Director and COO, Robin Macaskill also wished to comment:

‘We are thrilled to announce that our collaboration with Global Lithium will continue, after the recent release of their Scoping Study that confirms the possibility of a highly competitive lithium project in Western Australia.

‘The board and management team possess impressive expertise, and they are dedicated to deliver the Manna Project. By combining Global Lithium’s clear vision with Wave’s industry-leading experience and innovative approach to project delivery, we are embarking on a truly exciting venture in an equally exciting market sector.’

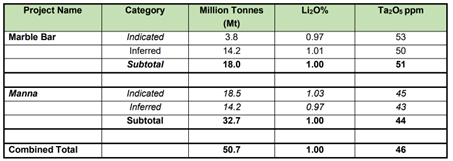

Global Lithium has now defined a total Inferred and Indicated Mineral Resource of 50.7Mt at 1% Li2O at its Marble Bar Lithium Project in the Pilbara region and for its Manna Lithium projects combined.

The group believes this confirms it as a significant global lithium player and aims to fast-track into the development stage.

Source: GL1

‘Drill Baby Drill’

Lithium is only one aspect of a sector that is chock-full of potential.

It’s part of a wider industry making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

This can be described as an alternate universe, the universe of booming drillers.

More of these booms are marked to happen for every single metal that can be found on the period table.

It’s been described as a ‘new golden age’ for junior explorers…and investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Yes, it’s possible. Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning