Global Lithium Resources Ord [ASX:GL1] share price, a Pilbara-focused lithium explorer, commenced trading today after IPO raises $10 million.

The ASX lithium boom is well and truly here.

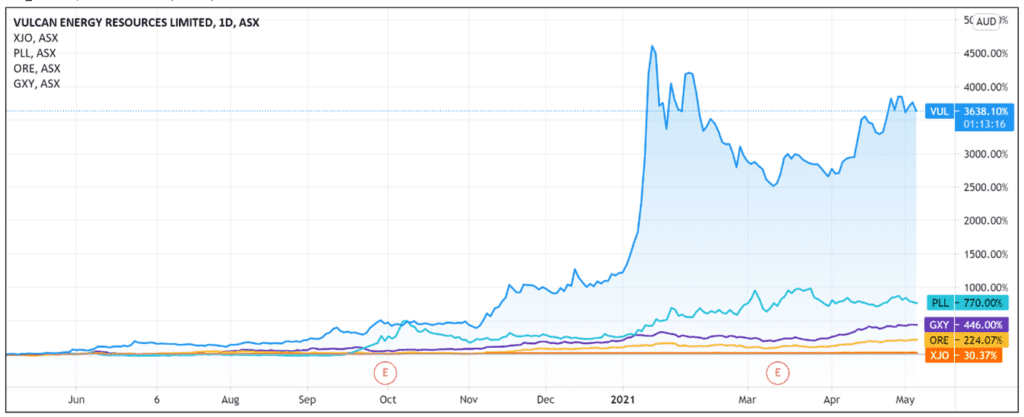

Take Vulcan Energy Resources Ltd [ASX:VUL]. At one point last year, VUL shares were trading for 23 cents before reaching a high of $9.95 this January.

And stocks like Piedmont Lithium Ltd [ASX:PLL] have gone up 700% over the last 12 months.

The market’s expectations for the sector in the coming years also saw a massive merger between Galaxy Resources Ltd [ASX:GXY] and Orocobre Ltd [ASX:ORE], creating a $4 billion lithium firm.

And today the sector widens by welcoming another player — Global Lithium.

The market responded positively to the debut, with GL1’s share price soaring 32% higher at the time of writing.

Global Lithium overview

Established in 2018, GL1 is an emerging lithium explorer who owns 100% of the Marble Bar Lithium Project (MBLP) in Western Australia’s Pilbara region.

It seeks to become a leading Australian lithium company by focusing on MBLP.

GL1 reported that MBLP’s Archer deposit has a declared JORC inferred mineral resource of 10.5Mt at 1.0% Li2O1, following three RC drilling programs.

The company announced today that further drilling has commenced at MBLP.

The launched RC drilling program of about 4,000 metres aims to identify opportunities to grow GL1’s existing JORC inferred mineral resource.

The drilling will take approximately one month, with a further 800 metres of diamond core drilling planned.

Global Lithium’s $10 million IPO

The company stated it completed a heavily oversubscribed IPO, raising $10 million before costs.

GL1 issued 50 million shares at an issue price of 20 cents per share.

At the time of writing, shares in Global Lithium were exchanging hands for 26.5 cents.

The IPO was supported by a ‘strong mix’ of institutional investors, resource-focused funds, sophisticated, and retail investors.

Next steps for the Global Lithium Share Price

GL1 identified its primary focus is to explore MBLP and grow its Archer deposit.

The company’s directors stated they were confident that further exploration will result in an ‘increase in the size of the Archer deposit and that the remaining MBLP project area is also highly prospective for additional discoveries.’

Global Lithium also flagged it will consider acquisition opportunities or additional tenement applications.

Global Lithium’s oversubscribed IPO and 30% share price jump shows the strong interest in lithium stocks at the moment.

But with so many news items coming out almost daily and so many lithium stocks to keep aware of, it’s hard to keep up and know where to look for lithium investment ideas.

Therefore, I think our free report on ASX lithium stocks is a great place for anyone who wants further information and ideas.

Additionally, if you’re looking for something not tied specifically to lithium but still related to green energy theme, then I also recommend reading our free report on the renewable’s revolution.

There, our energy expert Selva Freigedo reveals three ways you can capitalise on the $95 trillion renewable energy boom.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report