Global Energy Ventures Ltd’s [ASX:GEV] share price spiked today after successfully receiving a renewable hydrogen grant worth $300,000.

GEV shares are currently going for 8.5 per share, up 18%.

Over the course of 12 months, the GEV stock gained nearly 70%.

Global Energy Ventures used to operate as a shipbuilder for compressed gas solutions — building, owning, and operating ships storing compressed gas.

But last year, the company pivoted, sensing the changing winds.

GEV switched from running shipbuilding services from compressed gas to compressed hydrogen.

GEV is going green.

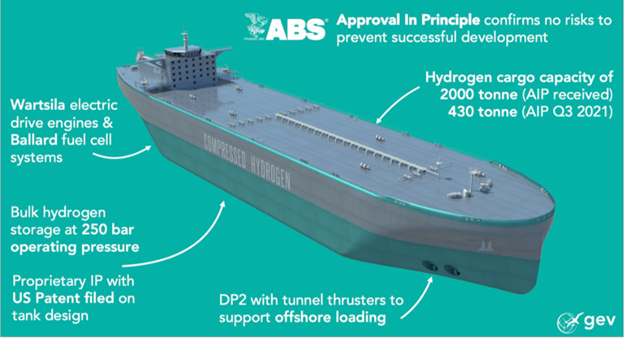

Announcing the company’s new strategy, GEV CEO Maurice Brand said Global Energy would seek to develop ‘a new class of ship for marine transportation of hydrogen.’

With today’s grant announcement, GEV is getting closer to realising its ambition.

GEV secures grant

GEV announced today its application for funding with the WA government and the WA Renewable Hydrogen Fund Round 2 was successful.

The grant of $300,000 will be exclusive of GST.

As a part of the Memorandum of Understanding with the HyEnergy Project partners, including Province Resources Ltd [ASX:PRL], GEV is conducting a feasibility study on the export of green hydrogen from the HyEnergy Project.

This project resides in the Gascoyne region of Western Australia.

The early preparation work backed by a site assessment has been completed by the company and will lead to the appointment of key technical and environmental advisors.

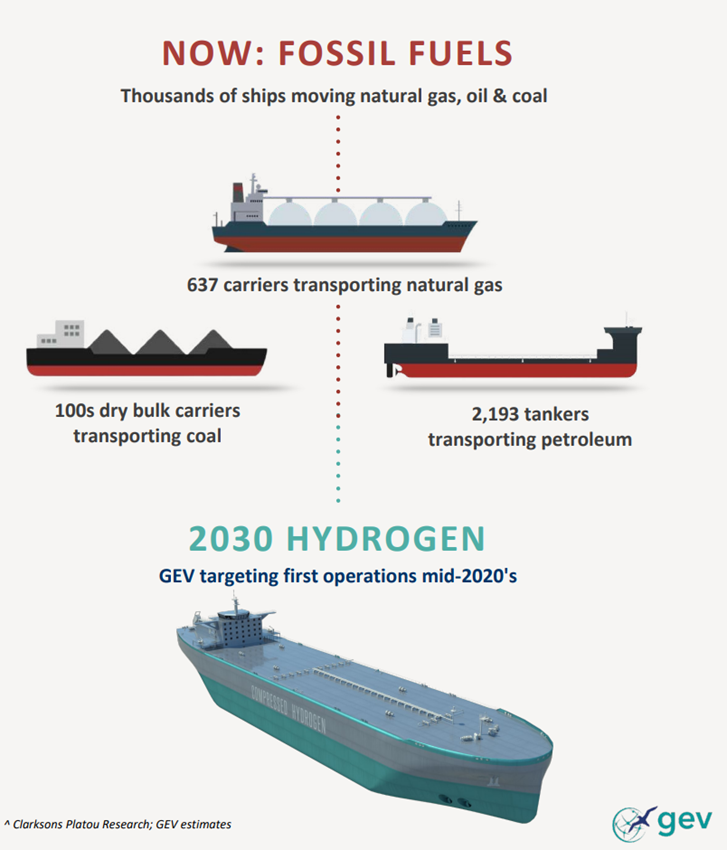

The project will spread out from the transport of hydrogen within the onshore compression facilities to an offshore ship loading buoy and then on to ‘nominated’ Asia-Pacific markets.

This will be done via GEV’s compressed hydrogen ships.

Further updates on the developments will be provided to the shareholders through the next two quarters.

The expected target for completion by the company is the first half of 2022.

Martin Carolan, Managing Director and CEO said:

‘GEV is delighted to be one of three applicants chosen for feasibility funding from the WA Renewable Hydrogen Fund and would like to thank and acknowledge the Western Australian Government for their support and recognition of our plans to export green hydrogen from the Gascoyne region.

‘One of the strategic focus areas for the WA Government’s Hydrogen Strategy is Export.

‘GEV, together with the HyEnergy Project partners, aims to harness WA’s world class renewable energy resources and proud history of exporting energy to international markets, to develop the first green hydrogen export project using our compressed shipping supply chain.’

If executed properly, this will be the world’s first compressed hydrogen ship and zero carbon marine transport.

The ship designed by GEV can store hydrogen in a high-purity gaseous form which avoids the energy and capital-intensive processes used for converting hydrogen to a liquid/chemical state.

Lastly, the compressed hydrogen shipping will aim for developing a ‘zero-emission supply chain’ using electric drive engines powered by onboard fuel cells.

GEV share price outlook

The $300,000 grant may not sound much when you look at GEV’s FY21 cash pile of $6.6 million.

But the grant can come in handy funding GEV’s project development, with the company spending $456,000 in project development fees in FY21.

But I believe the more important thing here could be the signal the grant sends to the market.

The Western Australia state government just yesterday announced it will set up a $50 million fund to drive renewable hydrogen industry development.

This fund will ‘stimulate local demand for renewable hydrogen in transport and industrial settings and drive investment into renewable hydrogen.’

So, can the grant be construed as validation? Does the WA government think GEV is onto something? And could its new $50 million fund throw more money GEV’s way?

GEV thinks its supply chain is ‘simple, energy efficient and cost competitive to regional markets up to 4,500 nautical miles.’

If this proves accurate and the powers that be in WA agree, GEV could benefit from the state’s strong interest in scaling its hydrogen sector.

But GEV isn’t only looking local.

In a presentation two days ago, Global Energy Ventures said over 30 countries have hydrogen strategies with US$70 billion in public funding committed.

The company thinks it has an opportunity to become a market leader in an emerging sector.

Only time will tell.

Now, if you want to know more about the growing renewable energy boom, then a great place to start is by reading the thoughts of our resident clean energy expert Selva Freigedo.

The link is to a briefing she put together that goes through a few things.

One, the winners and losers of the renewables revolution. Two, the basics of investing in renewables. And finally, the three Aussie stocks to watch during the green energy switchover.

Recommended reading.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here