In today’s Money Morning…’Big Shots’ don’t lose…a Berlin Wall moment…check out our ‘New Money’ masterclass…and more…

I came across a great saying the other day.

It went:

‘Capitalism without bankruptcy is like Catholicism without hell.’

Meaning without the possibility of adverse consequences, a lot of people won’t do the right thing.

Unfortunately, that’s the state of our financial system right now.

It’s rotten to the core because people are shielded from the consequences in the name of ‘financial stability’.

But, in reality, this financial stability is a mirage of monetary meddling.

Even worse, a lot of this meddling is done to protect the people at the top of the tree. It’s like a game of Monopoly, where a select few players have unlimited access to the bank (and Get Out of Jail Free cards) while the majority don’t.

There are heaps of examples I could give you on this.

From Federal Reserve bankers getting caught out front-running policy decisions on their personal trading accounts to the monumental bank bailouts of the GFC.

Plus, a lot more in between…

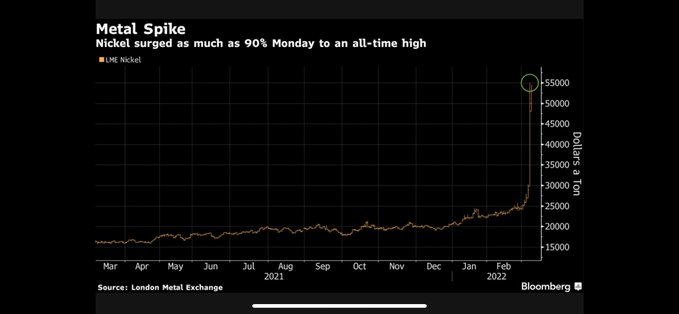

The latest example of this financial moral decay came from the relatively obscure nickel market.

Let me explain what happened last week and why it’s the latest sign of a financial system in its death throes…

‘Big Shots’ don’t lose

If you or I make a bad trade, we wear the loss and move on.

Not so for Chinese billionaire metal magnet Xiang Guangda.

The tycoon, known in China as ‘Big Shot’, managed to freeze the 145-year-old London Metals Exchange (LME) after he was caught in a huge short squeeze that saw nickel prices soar.

See the price spike here:

|

|

| Source: Bloomberg |

Mr Guangda had a very big trade betting on prices going down, so this extreme move threatened to lose him and some associates more than

US$12 billion.

Like I said before, if you or I are caught on the wrong side of a trade, it’s tough luck. Even if the trade would bankrupt us.

The prospect of that outcome is what hopefully allows us to invest wisely, do our research, and put in place risk management measures in case we’re wrong.

Not so for ‘Big Shot’.

He simply had the LME close down trading and reverse the trades that went against him!

US$3.5 billion worth of trades ‘disappeared’. That’s money lost by people who thought they were operating in a free market and had made winning trades.

Amazingly, despite that concession, the Big Shot refused to close his short position!

And why should he?

He’d just proven that if he lost too much money, the LME would protect him. And his short position might now be back in the money as nickel prices fell sharply upon the LME opening up trading again.

Why was he given such concessions in the first place?

Well, you see, his bankers are JPMorgan. So, in reality, it would be them who were on part of the hook for these losses should they eventuate.

We saw this same scenario play out last year in the GameStop saga.

Like now, trading was suspended after some big traders were caught on the wrong side of a short squeeze.

An interesting consequence was that it saved one of Robinhood’s backers — Citadel — from copping the losses that time around.

See a pattern here?

As billionaire J Paul Getty once quipped:

‘If you owe the bank $100 that’s your problem. If you owe the bank $100 million that’s the banks problem.’

I suppose these days you could add to that ‘and if a bank owes billions, it’s society’s problem’.

Of course, give it a few weeks, and we’ll forget all about this story.

Just as we did with GameStop, just as we did with the ‘too big to fail’ bailouts of the GFC, just as we did with the Fed traders, and just as we did with every other ignored misdemeanour since.

The sad truth is the establishment knows how to play this game, and public attention will move on to other things.

Funnily enough, wars and pandemics are good distractions too!

But, unfortunately, free lunches don’t last forever. Ask Marie Antionette. And all these actions are building on top of each other into a crescendo of financial consequence.

The telltale signs are apparent in soaring inflation and unsustainable debt markets.

The old edifices of power are crumbling.

One day, perhaps soon, they will fall…

A Berlin Wall moment

I remember when the Berlin Wall fell in 1989.

Although I was only 10, you could feel it was a big deal at the time.

It felt like the Cold War — the background to my childhood in Scotland — literally ended that day. And within a couple of years, the Soviet Union had crumbled altogether.

As Lenin once remarked:

‘There are decades where nothing happens and there are weeks where decades happen.’

To me, it feels we are approaching such a moment for the old financial order.

Things will just change in the blink of an eye, and you’ll either be prepared for it or you won’t.

The moral decay of a world without bankruptcy — a world that accelerated with the GFC bailouts and endless money printing ever since — has corroded free market capitalism.

We’re at the absurd point now where all eyes watch a group of unelected private bankers every month or two to literally decide how to invest trillions of dollars.

The Fed is the market.

Old alliances are changing too.

The debt-laden US has weaponised its reserve currency status and control over financial networks to the point other countries are taking action.

As the SWF Institute reported recently:

‘The catalysts of de-dollarization are more impactful as Washington utilizes economic sanctions as weapons against countries, including larger economies, stoking back-up plans for nations like China, India, Saudi Arabia, and Russia.

‘The United States’ traditional allies in Europe, Russia, and China are irritated at the U.S. dollar’s dominance in international finance markets. Even global financial crises benefit the U.S. dollar.

‘For example, the global financial crisis of 2008, which started in the U.S. (remember subprime mortgages) paradoxically strengthened the U.S. dollar’s dominance as a global safe haven.’

Are we seeing the end of US dollar dominance?

And, if so, what comes next?

Check out our ‘New Money’ masterclass

My colleague Greg Canavan and I have been following this story for a while, and we started a service called New Money Investor early last year to track the twists and turns.

Even though we both have different ideas on what might come next, there’s no question in either of our minds that we’re witnessing a once-in-a-lifetime shift in what defines money.

And that’ll have huge ramifications for every investor.

Personally, I see a huge role for Bitcoin [BTC] and other leading cryptocurrencies.

Not only as investable assets, but as the new rails of the 21st century financial network.

That’s why I’m currently running a new money masterclass tomorrow that focuses on this side of things.

In it, you’ll get an expert view on the crypto markets and the role they’re going to play in this new monetary world order.

I’ll also reveal my top crypto play for 2022.

It’s a unique way for a beginner to get exposure to a number of leading projects in the crypto space in just one move.

Importantly, I’ll explain why it’s not too late to claim your stake in the world of new money.

You can watch that here now for a limited time.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.