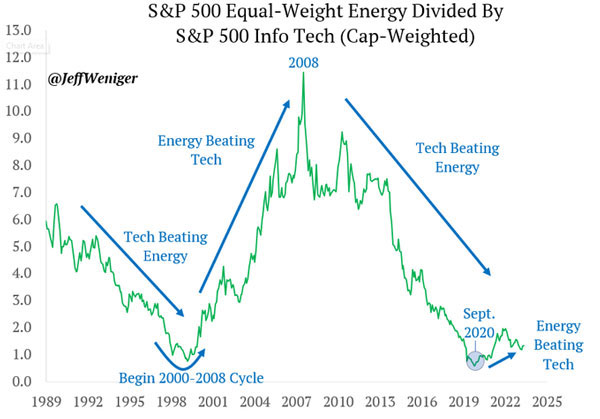

Six weeks ago I shared this chart with you:

| |

| Source: Jeff Weniger @ Wisdom Tree |

With it, I asked the question: Could it be this simple?

What I meant was, are the cycles between energy and tech stock so predictable that to make money, it’s simply a matter of rotating from one to the other at the right time?

This is clearly an idea that’s gathering pace.

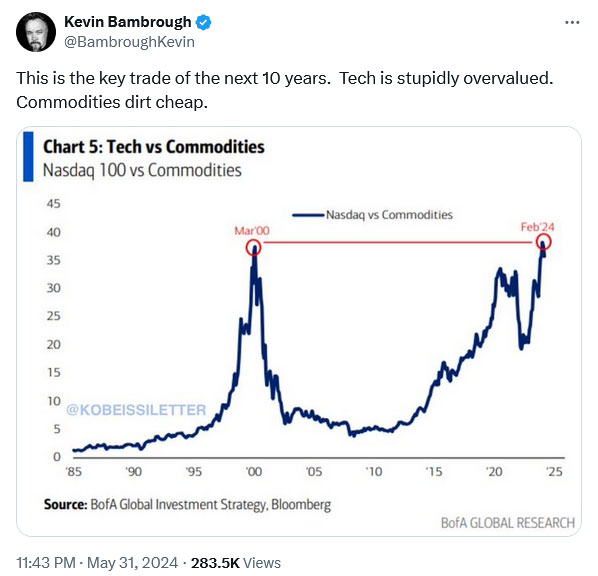

I came across this tweet the other day that made much the same point, except this time for the commodities space as a whole:

| |

| Source: X.com |

As a tech investor, this prediction doesn’t fill me with glee.

And for the record, I don’t think it’s an either-or situation.

Indeed, energy and AI are two industries joined at the hip these days due to the intense energy demands of AI applications.

As Blackrock CEO Larry Fink said recently:

‘The world is short power.’

In my opinion, the AI revolution will be a major factor in driving energy demands in the future.

But you certainly could make a case that commodities and energy are undervalued compared to tech this year.

And for Aussie investors with a smorgasbord of mineral, energy, and commodity opportunities at our finger tips, this is an enticing thesis to consider.

Anyway, I bring this idea up again today, because my colleague and professional geologist James Cooper has one stock in the energy sector, he thinks is poised to ride this wave.

Specifically speaking, it’s an oil stock listed on the ASX.

Let me explain more…

The last supercycle

Overnight, the OPEC coalition of oil producing nations – which includes Saudi Arabia and Russia – agreed on extending production cuts.

As reported:

‘The Organization of the Petroleum Exporting Countries (OPEC+) on Sunday agreed to extend output cuts through next year, likely keeping prices high through the November presidential election.

‘The alliance said after a meeting Sunday that the move was aimed at boosting slack prices that have lulled despite the ongoing war in Gaza and attacks on shipping vessels in the Red Sea.’

Looking at the charts, you can see why they’re trying to prop up the oil price, which is hovering around U$81 per barrel as I type.

| |

| Source: Trading View |

After rising from December through to April, the price of oil has reversed course in May and seems poised to test yearly lows.

It could be a sign the underlying economy is weakening right now.

But my colleague, James Cooper, thinks he’s seeing a signal that the oil market is poised for a new up-cycle sooner than most think.

Indeed, he thinks it could be the last Supercycle we see in the oil sector before we finally transition away to using more renewable sources of energy (and nuclear too, in my opinion).

And yet that fact only makes this oil pick even more lucrative potentially.

He recently wrote:

‘If you believe, like I do, that we’re embarking on broad commodity price inflation over the coming years…oil should not be ignored.

‘In fact, its last hurrah could be quite a sight to behold…

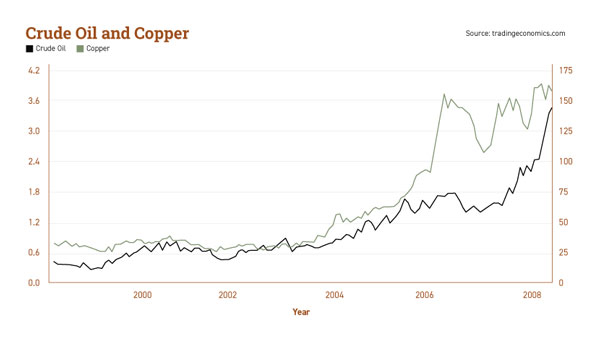

‘As the early 2000s China-led boom demonstrated, oil tends to rise in partnership with other commodities.

‘To show you what I mean…

‘At the beginning of the resource boom in 2001, crude traded as low as US$19.70/ barrel.

‘As I mentioned, crude almost reached US$150/barrel at its 2008 peak.

‘People forget this…

‘But in the last resources boom, oil’s performance was actually on a par with copper. The commodity most associated with those boom years.

‘Just take a look at the chart below from 2000 to 2008, showing the stellar rise of these two commodities:

| |

| Source: TradingEconomics |

‘Of course, past performance is not a reliable guide to future results.

‘But history shows energy prices rise alongside metals in major commodity booms.

‘Despite poor public opinion and government opposition…there’s no reason to believe oil can’t repeat this stellar performance in the years to come.

‘In fact, terrible sentiment against oil and gas companies will likely push prices even higher…as development projects face opposition.

‘That’s why you should be open to opportunities in this sector, right now.’

Want to find out more?

Read this special report

James has laid out his entire rationale.

I think, at the very least, you’ll find it intriguing.

And if you’re interested in investing, he’ll show you how to access the name of his favourite oil play (as well as four other resources stocks poised to benefit from a potential commodity boom).

Click here now to get this special report.

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments