At time of writing, the share price of Galaxy Resources Ltd [ASX:GXY] is down 1.59%, to trade at $1.24 apiece.

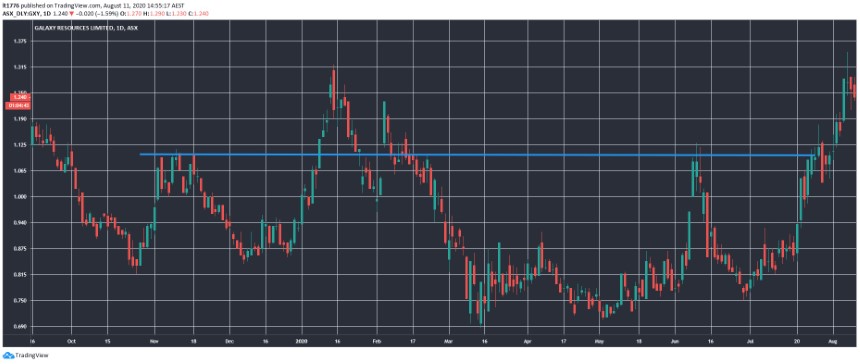

You can see the GXY share price spiked strongly starting in July:

Source: tradingview.com

The GXY share price then punched through resistance at around $1.10.

This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2020. Click here to get your copy now.

GXY share price tracking other ASX-listed lithium companies higher

It’s an emerging theme from the second half of the year.

The pandemic was thought to be putting a brake on the EV revolution, but just recently Germany announced increased EV subsidies as part of a green recovery plan.

A lot could hinge on what China does with its subsidy schemes for GXY, but if the long-term bottom is in, then the next few years promise to be exciting for GXY.

I previously discussed the waiting for Godot-like nature of investing in lithium, speculating that many lithium investors could be younger or at least have a longer investment horizon.

While there is no immediate news out at the moment, a strong run up could be seeing those who accumulated during the sideways trading in March and June take some profits off the table.

Outlook for the GXY share price

The Sal de Vida project advanced to the design phase in early July and GXY is targeting 2022 to see the first lithium carbonate from there.

In the short term the retracement in the GXY share price may continue.

As always, it’s a waiting game.

It may prove to be the European EV market that picks up first, and there are some interesting signals coming out of companies with exposure there.

For our updated lithium report, and three picks in this space, go here.

Regards,

Lachlann Tierney,

For Money Morning