The FYI Resources Ltd [ASX:FYI] is entering a binding term sheet with Alcoa of Australia to develop FYI’s high quality alumina (HPA) project.

Both parties were in talks regarding a binding agreement and a potential joint venture for almost a year.

Today’s announcement comes after two extensions to a 90-day exclusivity period Alcoa and FYI entered in May as both parties felt they needed more time to deliberate.

Shareholders did not respond well.

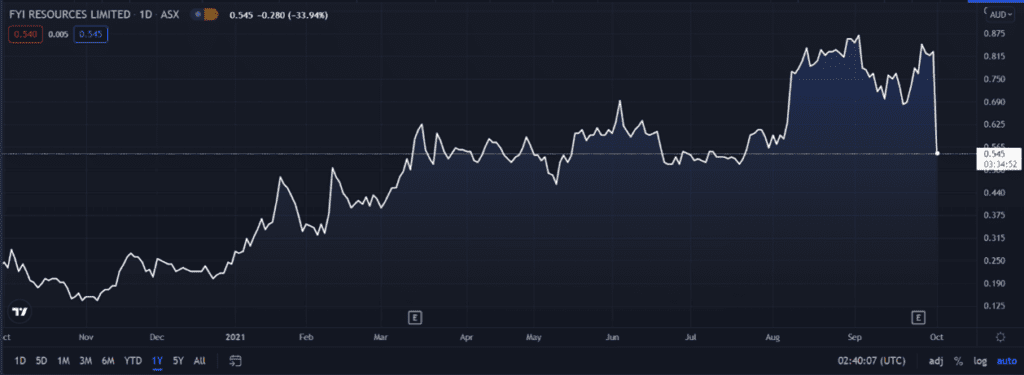

FYI Resources Ltd [ASX:FYI] share price is currently down 33.9%, exchanging hands for 54 cents per share.

Despite today’s massive drop, FYI is still up 120% over the last 12 months.

But how will today’s announced JV impact FYI long term?

Let’s dig into the details to find out.

FYI & Alcoa finally sign binding agreement

After much delay, FYI and Alcoa were finally able to report they entered a binding term sheet for the joint development of FYI’s HPA project.

That said, the term sheet does not guarantee the establishment of a joint venture.

As FYI said today, the signed term sheet ‘sets out the pathway to a future joint venture, subject to final investment decisions by both parties.’

But the likely culprit for the steep sell-off is this:

The term sheet lays out a path for Alcoa to own 65% of the joint venture. FYI Resources would hold the other 35%.

Investors may have found this distribution unappealing.

However, FYI believes that a joint development with Alcoa on the proposed terms is the ‘surest pathway to de-risk and progress the development of the project.’

FYI believes that with Alcoa on board, the HPA project has the potential to ‘transform the HPA project from the current R&D and design stage to reality.’

The term sheet outlines three phases of project development:

‘Phase one: Detailed design of an estimated 1,000 tpa demonstration facility and additional production trials over 2021 and 2022. Estimated cost at phase 1 is US$7m. On completion of Phase one each party would make a decision whether or not to proceed to Phase two.

‘Phase two: Subject to a positive investment decision planned for 2022, the parties would enter into an unincorporated joint venture and the demonstration facility would be constructed, and detailed engineering undertaken for a full-scale HPA plant that would produce 8,000 tpa. The estimated total cost of stage 2 is approximately US$50m.

‘Upon entering phase two, Alcoa would contribute the first US$5m of FYI’s funding requirement in relation to Phase 2 construction costs by sole funding the first US$14m of costs associated with the construction of the demonstration facility.

‘On completion of Phase two each party will make a decision whether or not to proceed with Phase three.

‘Phase three: Subject to a positive investment decision planned for 2023 the parties could establish an incorporated joint venture company and construction for the full-scale plant would commence. The full-scale facility (engineering and construction) is currently projected to cost approximately $200m, subject to further engineering studies. Upon entering phase three, Alcoa would contribute the first US$68m of FYI’s funding requirement in relation to Phase 3 construction costs by sole funding the first US$194m of costs associated with the construction of the full-scale facility.’

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

What does the future hold for the FYI Share Price?

After more than a year of deliberation, Alcoa and FYI finally edge closer to entering a joint venture.

Alcoa and FYI are now targeting to commence the development and construction of a demonstration plant and primary facility as soon as possible.

And while the involvement of Alcoa will bring much needed capital, investors will likely spend the next few weeks reassessing FYI’s prospects given FYI’s reduced stake in the project if a joint venture goes ahead.

Bottom line is that the companies will aim towards exploring new HPA products and downstream opportunities to enhance market prospects.

FYI Resources Managing Director Roland Hill tried to make a positive case:

‘Coming to joint development terms on our HPA project is a transformational event for FYI. The strong alignment between the parties and resulting HPA business case is outstanding.

‘FYI considers that a future JV forms a robust structure capable of delivering the high quality HPA strategy, as outlined in the DFS, at a time when the international HPA market is forecast to grow in line with the world’s e-mobility uptake and emerging HPA applications.’

HPA, LEDs, lithium-ion batteries, new-age tech.

If you’re interested in these things and want to know how you could possibly profit, then I recommend reading our free lithium report.

It outlines three stocks that could surge on the back of renewed demand for lithium in 2021.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here