FYI Resources Ltd [ASX:FYI] and EcoGraf Ltd [ASX:EGR] share price is up after a MOU to explore the potential of HPA carbon coating for the lithium-ion battery market.

At time of writing, the FYI share price was up 4% and the EGR share price was up 1%.

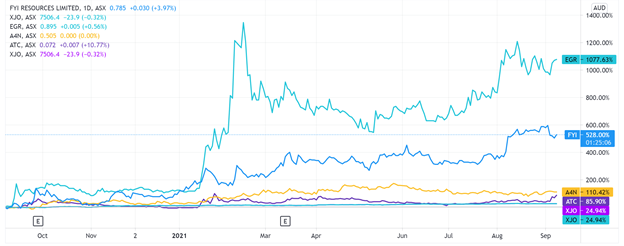

Like other stocks aiming to serve the anticipated boom in the lithium-ion battery market, FYI posted strong results of late.

Over the last 12 months, FYI gained 525%.

Will the touted collaboration with a stock seeking to serve the lithium-ion battery supply chain with graphite see those gains continue?

To analyse that, we must first appraise today’s announcement. So, let’s do that now.

How to Find Promising Energy Stocks — Discover why the energy market is ripe for massive disruption and how to identify innovative energy stocks. Click here to learn more.

FYI and EGR partner up

FYI Resources and EcoGraf entered a non-binding Memorandum of Understanding (MOU) today.

The primary target of this partnership will be to develop carbon coating material covered with high purity alumina (HPA) with the burgeoning Li-ion market in mind.

The most common use for HPA in battery technologies is hidden in a ceramic form as a coating on the separator membrane within the battery cell.

FYI and EGR think HPA-coated separators improve battery chargeability, performance, and overall service and durability.

But there are new applications emerging.

Ones directed at anodes in lithium-ion batteries by improving battery life and performance using HPA coating applied to the anode’s graphite particles.

So, while others may rush to become a junior lithium explorer, FYI and EGR are thinking of more indirect means to serve — and benefit from — the demand for lithium-ion batteries.

FYI cited research suggesting ‘HPA-doped carbon coatings enhance battery anode performance, by minimising first cycle losses during battery charging cycles.’

HPA is used as a ‘nano thickness’ — thin coating on the separator sheets used within a lithium-ion battery.

This is mainly done because alumina coated separators improve the ability to withstand a high rate of discharge, battery performance durability, and overall safety.

Now that we’re done with the technical stuff, let’s switch to the details of the MOU.

The FYI and EGR partnership will combine FYI’s HPA resources with EcoGraf’s purified spherical graphite (SPG).

An initial technical program will see the firms produce and evaluate the performance of HPA-doped carbon coated SPG.

Funding will be shared equally, and the research collaboration will also include the evaluation of alumina and graphite composites for new battery technologies and materials in clean energy applications.

Next steps for FYI and EGR

Once the test-work programs are successfully completed, both companies will look to hash out key commercial principles for further collaboration.

So, plenty will rest on the results of the upcoming testing and evaluation.

Of course, even if the tests are promising, there will be the issue of negotiation and securing firm commercial terms between the pair.

FYI shareholders will be aware this is not always easy.

After all, a final decision on FYI’s flagged joint venture with Alcoa of Australia continues to be delayed.

For reference, the potential joint venture with Alcoa centres on HPA development and commercialisation opportunities targeting electric vehicle, static power, LED, and other niche HPA market segments.

The success — or otherwise — of these collaborations will likely go a long way in determining the medium-term trajectory of FYI’s share price.

Now, if you are interested in the lithium industry and looking for interesting investment ideas in the sector, I suggest reading Money Morning‘s free 2021 lithium stock report.

The report also profiles three unique lithium companies: a European lithium developer, an established Aussie producer, and a speculative WA miner.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here