If you could hitch a lift with Marty McFly and travel back in time, what stock would you buy?

The surprising answer to this hypothetical (unfortunately!) question is a US company called Monster Beverage Corp.

It makes energy drinks and was first listed on the stock market in 1995.

Since then, this little-known stock has returned early investors a whopping 260,061%, turning a $10,000 stake into $26 million today.

And all for punting on the growth of caffeinated water!

That’s the interesting thing about the top 10 stocks.

Sure, you’ve your Amazons, NVIDIAs, Apples, and other well-known tech highflyers in there.

But you’ve also companies like Pool Corp [NASDAQ:POOL] — a wholesale distributor of swimming pools — sneaking in too.

Get this…

A $10,000 investment in POOL in 1993 would be worth $6.9 million today. You’d literally be swimming in cash.

And even in the last five years, POOL has generated a return of 207% — three times the return of the S&P 500 over the same time frame.

My point is…

The stock market can be an unbelievable place for wealth creation.

And you don’t need to ride the latest fad, guess the next set of economics numbers, or even front run the Fed’s next moves to do it.

I mean, areas as mundane as fizzy drinks and swimming pools have minted fortunes for some.

But whether you prefer the mundane or the high-tech, the process of finding such gems is pretty much the same.

You think about where the future is heading and then find the best companies best placed to follow it.

Easier said than done, maybe.

But here’s the kicker…

Sale now on!

The best time to start taking calculated positions in the future is when the market thinks said future is bleak.

When everyone is running for the hills, the shrewd operator does the opposite.

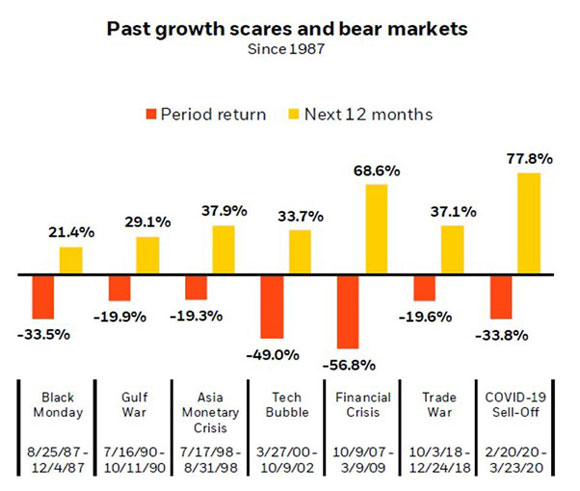

As this graphic shows, it’s usually the smart thing to do:

|

|

| Source: Forbes |

Now markets have been falling all year.

The Nasdaq is down 28%, the S&P 500 is down 16%, but our own ASX 200 is only down 4%.

Which isn’t half bad, all things considered.

But some think there’s more pain in store.

That we’re in for one last leg down as the Fed tightens interest rates too far into a slowing economy in an effort to bring down inflation.

Make no mistake, if the real economy does slow down, our market will eventually take a hit.

[Editor’s note: Three of my more experienced colleagues, Greg Canavan, Murray Dawes, and Vern Gowdie, are holding a LIVE event this Thursday to discuss this possibility in more detail. It’s called ‘The Fat Tail Crisis Action Summit’, and you can find out more about it here.]

But others think the bottom is in already.

That there are early signs inflation is cooling off in the US, which could mean a pivot soon from central banks.

My take?

Who knows…

But you probably don’t want to get too excited about stocks that are low on cash flow or high in debt right now.

On the other hand, stable businesses that continue to churn out cash flow…or even high-growth stocks in tech or biotech with ample cash in the bank?

They’re probably the kind of stocks that should at least be on your radar, ready to pounce on if things do get worse.

Of course, you’re never going to time the absolute bottom.

No one does.

But if you have a two-year-plus time horizon and a good ‘hit list’ of future-orientated stocks that can survive any economic shock, then any dip over the next few months will be a big buying opportunity, in my opinion.

As the old market saying goes…

Bull market profits are made in bear markets.

So where should you be looking?

Here’s one idea to consider…

Buying lithium on the dip

There’s been a lot of chatter about lithium in recent years.

It wasn’t always so, but the idea of an electric car-driven future seems almost inevitable these days.

And that means demand for lithium batteries is set to soar with it.

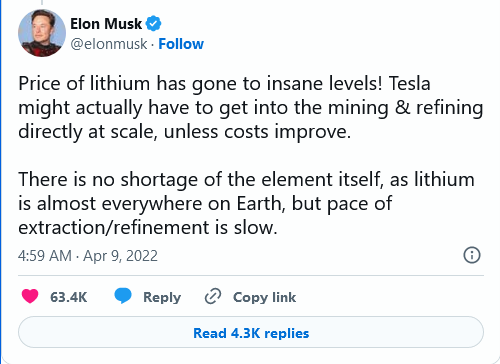

Such is the importance of lithium to electric cars, Elon Musk said earlier this year that he might need to get into the lithium mining business!

|

|

| Source: Twitter |

Naturally enough, lithium stocks have been standout performers over the past year.

But if we do get a broad economic downturn, that could change fast.

Indeed, Goldman Sachs (GS) and Credit Suisse (CS) both just put out bearish reports on lithium.

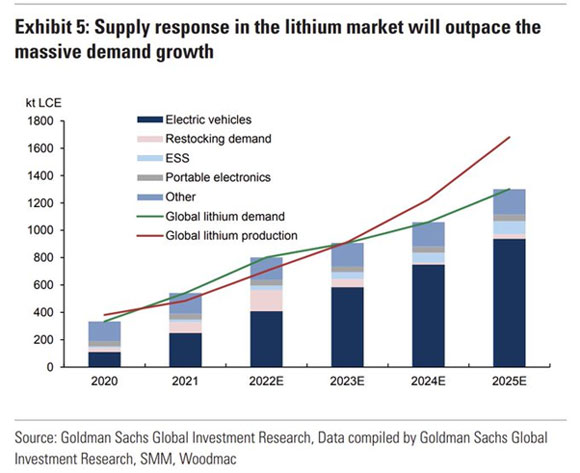

GS forecast that lithium supply will outpace demand starting next year, running all the way to 2025.

And CS said a major cathode producer ‘might’ slash production in China given softening demand.

Here’s the chart:

|

|

| Source: Goldman Sachs |

Something to bear in mind here is that GS put out a similarly bearish report back in June this year.

And since then, the price of lithium carbonate has soared by 24%.

But they’re doubling down on this view, and I wouldn’t be surprised if they’re right this time.

Here’s the point I want to make, though…

If we do get a downturn in lithium stocks, in my opinion, it will be a huge buying opportunity.

The economics of long-term demand aren’t changing fast, and electric vehicles are set to play a huge role in our future economy.

Allan Ray, an analyst at Bloomberg, wrote:

‘The slowdown in demand, if any, will likely be relatively tame given that demand outlook still points to accelerated growth.’

But there’s a caveat here…

If we get sector-wide falls, only certain types of lithium stock will be buying opportunities.

In an early-stage trend, you can buy almost any stock in a sector and make money — duds and superstars alike.

But when a trend starts to mature, the cream rises to the top.

That’s the stage we’re at in lithium, I feel.

Which makes buying any potential dip a double-edged sword here.

In wobbly markets, you need to get your stock picks right now more than ever.

On that note…

My co-editor at Exponential Stock Investor, Ryan Clarkson Ledward, and I just put out a cracking report for subscribers on our favourite lithium play.

And surprisingly, our basis for picking it had nothing to do with electric cars.

If we’re right about it, the electric car revolution is only a stepping stone to an even bigger energy story for this company.

You can find out more about Exponential Stock Investor here, and if you decide to sign up, you’ll be able to access that report straight away.

Or if you’re really into mining stocks only, I highly recommend checking out my new colleague James Cooper’s brand-new service, Diggers and Drillers.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.