Governments around the world are spending trillions of dollars on infrastructure.

There’s the US’ $1-trillion infrastructure push, China’s enormous Belt and Road Initiative spanning continents, the UK’s promise of £650 billion in infrastructure schemes over the next decade…the list goes on.

It’s the biggest global build-out of physical assets in human history.

Think roads, bridges, airports, seaports, energy facilities, 5G towers, schools, hospitals, rail, and even hyperloops.

You name it; they’ve been planned…and funded.

It’s fuelling a global land price boom.

But it also requires an almost un-suppliable amount of building materials, skills, and new technology.

This will open the door to many investment opportunities over the next year or so. Opportunities my subscribers over at Cycles, Trends & Forecasts will learn about.

Regardless, this is highly likely to further heighten global trade disputes.

All of it fits in with everything we expect to see on the upswing of the Kondratieff Wave.

It will also add fuel to the property boom over the ‘Winner’s Curse’ phase of the cycle, starting around now and due to peak in 2026.

The COVID panic was the trigger for the flush of spending, of course.

However, blowing an infrastructure bubble — inevitably blowing a land market bubble — is a well-worn strategy to dig economies out of recessions.

It was how the US got out of the Great Depression.

In 1933, British economist JM Keynes wrote an open letter to US President Franklin D Roosevelt supporting an expansive public works program that government borrowing could finance.

He got what he wanted.

40,000 new and 85,000 improved buildings and thousands of new roads and bridges were constructed US-wide.

Most are still in use today.

You may not know the impact this had on land values due to the depth of the downturn.

After all, everybody knows how bad the Great Depression was — it’s hard to conceive of land prices increasing through the 1930s.

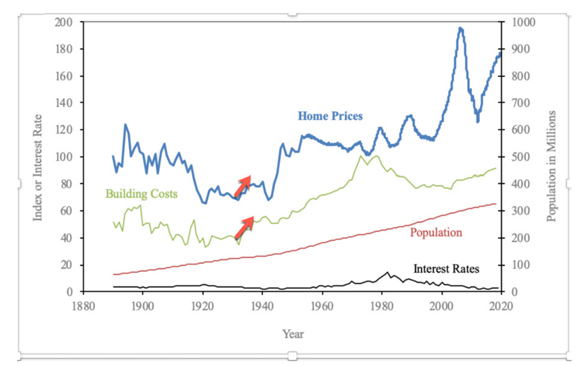

But, renowned US economist Robert Shiller evidenced a substantial recovery in US home prices prior to the Second World War (and increases in building costs) in response to the massive infrastructure spending.

Check it out…

|

|

| Source: Robert Shiller |

Those who study the Law of Rent would not be surprised.

This is exactly as we would expect.

Land prices absorb the economic gains from these types of developments.

We saw the spirit of Keynes resurrected again during the 2008 Financial crisis.

Headlines around the world called for infrastructure initiatives ‘The Revenge of Keynes’ (Le Monde), ‘Thee Undeniable Shift to Keynes ’ (Financial Times), ‘What Would Keynes Have Done?’ (The New York Times).

It was Keynes’ moment again after decades of neglect.

The Obama administration spent $150 billion on infrastructure.

China pledged $585 billion, India $500 billion, the European Union $252 billion, Japan $129 billion, Canada $12 billion, Australia $4.7 billion, Singapore $13.8 billion, Germany $42 billion; the list goes on.

That took the world out of the 2008 disaster and into the current cycle.

Therefore, what we’re seeing now — the spending fuelling the second half of this cycle — is nothing new…but it is infinitely bigger!

I’ll make the call now that the next two years will see residential land prices in most major cities increase substantially!

The seeds of the turn are already in motion.

From Pete Wargent’s daily blog:

‘Barring a surprising turn of events, interest rates are now on pause for an extended period.

‘Markets are pricing a 98 per cent implied chance of rates being on hold next month.

‘And the implied terminal cash rate for the cycle has also been revised lower after today’s interest rate decision and data.

|

|

| Source: ASX |

‘This should give consumers and housing market participants a bit more certainty about the road ahead, after a wild year.’

The property market is showing solid month-on-month gains.

Clearance rates are holding steady in Sydney and Melbourne.

And, despite an increase in stock expected to hit the market in spring, there’s going to be enough on the demand side of the coin to maintain upward pressure on prices — with strong immigration fuelling population growth into the major capital cities.

We also need to remember that the government spending in response to the stimulus put Australians in the midst of a cash boom.

Governments flooded billions into the economy.

While some people suffered big income hits, in aggregate, government transfers pumpedmore cash into household bank balances than the crisis leaking out in lost wages.

Rate hikes have eroded it away for many, of course…but not all.

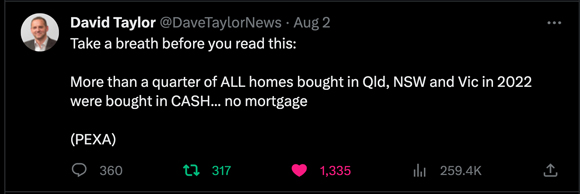

And it does contextualise some recent research showing the level of cash purchases during 2022.

|

|

| Source: Twitter |

I still have buyers on the books who buy in cash.

Interestingly enough, I also know those who are selling and thinking of banking the cash in term deposits rather than having to deal with potential legislative changes that will freeze rents and increase land taxes.

All in all, the cycle will continue as forecasted. It’s playing out before your eyes.

If you know the trends, you’ll have insight into how to take advantage of the money-making opportunities.

The spending doesn’t mean that every area is going to see massive gains.

The focus needs to be on the locations where the spending occurs and stocks that benefit — building companies, construction materials, etc.

Best wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments